0R15 8539.0 2.1534% 0R1E 8600.0 3.3654% 0M69 None None% 0R2V 190.25 -0.1312% 0QYR 1345.5 2.0871% 0QYP 424.0 0.5931% 0LCV 146.6464 -1.3147% 0RUK None None% 0RYA 1631.0 -0.6094% 0RIH 171.3 0.9131% 0RIH 174.9 2.1016% 0R1O 186.0 9820.0% 0R1O None None% 0QFP None None% 0M2Z 298.3 -0.6495% 0VSO None None% 0R1I None None% 0QZI 474.5 0.6363% 0QZ0 220.0 0.0% 0NZF None None%

Company Overview: Moonpig Group PLC (LSE: MOON) is a FTSE 250 listed company operating an online platform for greeting cards and gifting. The company encompasses several brands, including Moonpig, Buyagift, and Red Letter Days in the UK, as well as the Greetz brand in the Netherlands. Moonpig Group provides a wide range of cards for various occasions, along with personalized features and next-day delivery services. Its product offerings also include a curated selection of gifts such as flowers, chocolates, alcohol, balloons, personalized mugs, beauty products, candles, books, novelty items, games, and soft toys. The company is segmented into Moonpig, Greetz, and Experiences to manage its various offerings and operations effectively. This Report covers the Price Action, Technical Indicators Analysis along with the Support Levels, Resistance Levels, and Recommendations on this stock.

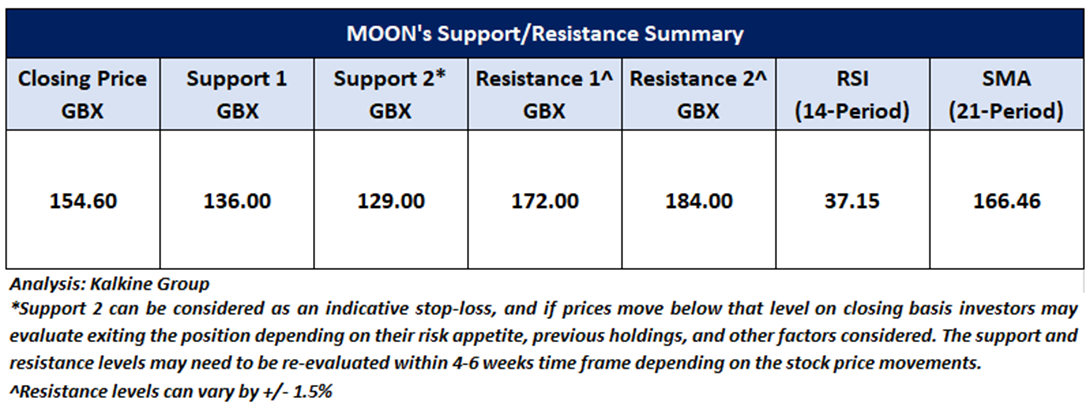

MOON’s Technical Observation

MOON’s prices are currently trading near a lower trendline support level. There is an anticipation of a reversal in the Closing Price of GBX 154.60, supported by a volume buildup and stochastic data indicating an oversold market condition. The leading indicator RSI (14-period) is at 37.15, suggesting a potential reversal in the price trend. However, it's worth noting that the stock price is presently trading below both the trending indicators, the 21-period SMA and the 50-period SMA, which could potentially act as resistance levels in the near term. The important support levels for the stock are situated at GBX 136.00 and GBX 129.00, while key resistance is positioned at GBX 172.00 and GBX 184.00 levels.

Xxxxxx Xxxxxx Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx Xxxxxx Xxxxxx Xxxxxx & Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Enter your details below and our team will help you to decide if this product is best for you.