What are Accrued Expenses?

An accrued expense is an obligation for which liability is recognized but has not yet been invoiced. For accrued expenses in place of booking an invoice, a journal entry is made to record an accrual. With this, an offsetting liability is also registered as a current liability in the balance sheet. Journal entry is based on the accrual concept. If a journal entry is not recorded, the expense remains unidentified in the period incurred. It results in reporting of inflated profits, not a conservative one. Accrued expense booking increases the precision of the financial reports. The expenses become closely aligned with associated revenues of the period.

Summary

- Expenses of a company recorded on incurrence, as opposed to receipt of invoice, are accrued expense.

- Using the accrual method of accounting, when accrued expenses are booked, the balance sheet and income statement show the actual state of profits.

- Expenses such as outstanding salaries, rent etc., are examples of accrued expenses. They are recognized when incurred and not on their payment.

Frequently Asked Questions (FAQ)-

How are Accrued Expenses Recorded in Accounting?

- Accrued expenses are logged as current liabilities in a company’s balance sheetsince current liabilities usually are paid within a year from the transaction date.

- Suppose a firm uses goods or services but their bills are yet to be received. The liability for payment of the goods has thus incurred through invoice has not been booked.

- Therefore, at the end of each reporting period, a business must properly evaluate the amount payable for each of its accrued expenditures.

- Company must log itin an expense account with a corresponding liability. An accrued expense is merely an estimation; therefore, it is different from the actual invoice amount in the supplier’s invoice.

- Generally, it is a small addition to the accrued expense booked. A reversal journal entry with the amount of invoice is booked to the Accrued expense account. This means the actual invoice is netted against the expense accrual.

Immaterial expenses are often not recorded as accrued as documenting them requires repeated efforts that is not worth their value. It will just add to the number of journal entries recorded in a month and will make the year-end closing process slower.

Example

Suppose a company Delicious Ltd. manufactures chocolates in Sydney. It uses the best cocoa and organic ingredients to manufacture premium chocolates.

In June, one of Delicious Ltd.’s mixing machines breaks down. Since the machine is an imported one, for repairing it, parts are ordered and received within a few days from known suppliers. A local worker fixes the device using these parts. He submits his bill on the spot and goes away. But the final tab for the parts is not yet received by Delicious Ltd.

The amount for these parts used should be recorded as payment is due but not booked due to lack of proper bill. It becomes an accrued repairing expense. The amount for parts used needs to be added as accrual and shown under “Accrued Expenses” as a current liability on the face of the balance sheet.

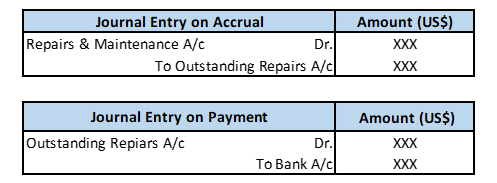

By mid-July, Delicious Ltd receives the bill from the supplier. Now Delicious Ltd. will make the payment, and the accrued expense will be reversed. The Journal entries in the books of Delicious Ltd. will be as follows-

Source: Copyright © 2021 Kalkine Media

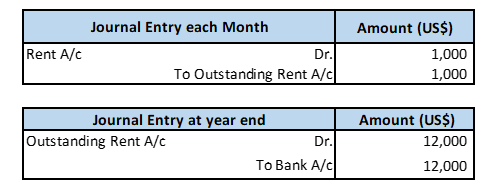

Now in a different scenario, Delicious Ltd., also operates on rented premises, and the rent agreement is such that rent is payable at year-end. While preparing the financial statements for each month, if rent is not recorded since it is not paid, it will be wrong. It will not match the utilization of resources with the liability for payments towards it. So, Delicious Ltd. will record Outstanding rent in the books of account against rent for each month. Then at the year-end, when the bill is received from the owner of premises, payment is made, and outstanding rent for 12 months is reversed. Let us consider monthly rent as US$1,000. Then accounting entries will be as follows-

Source: Copyright © 2021 Kalkine Media

Other Common examples of expenses that may accrue to a company are-

Services received without Invoice, Wages outstanding for workers, Taxes payable, Commission charges, etc.

Why is recording Accrued Expenses Important?

Not like cash accounting, recording accrued expenses can have a huge effect on revenue reporting. Accrual Accounting helps to identify the true income of a firm. If a company does not account for expenses payable in the future, Company may report inflated profits. It is essential for all the stakeholders of a business to know the actual picture of its earnings.

If all financial transactions are recorded in the books of account as per the accrual concept, it leaves zero chance of errors in reporting. In addition, the auditors will also be able to certify that financial statements are free from any mistakes. Regularly recording accrued expenses as and when liability materializes, the credibility of a firm is strengthened in front of auditors and shareholders.

Booking of Accrued expenditure is based on the double-entry system of accounting. Anyone looking at the books will see the dual effect of the transaction. Generally Accepted Accounting Principles (GAAP) recognize a double-entry system; therefore, accounting accrued expenses makes a firm compliant with globally accepted standards.

How are Accrued Expenses different from Accounts Payable?

- Accrued expensesare related to the regular operating expenses of a business. Firms need to pay them but cannot do so as there is no bill for recording them. Thus, the company accounts for such confirmed future outflows to give a better depiction of expenses, revenues, and liabilities. It will freeze the money available to companies for expenditure. They are short term liabilities, mostly for a year.

- Accounts payable, on the other hand, are obligations against invoices already received but not yet paid. They can be short-term or medium term, depending on credit terms decided between creditor and firm.

If an invoice is received for an accrued expense, but payment is not paid, it can be booked as accounts payable. It will be removed from books only when payment is cleared.

Please wait processing your request...

Please wait processing your request...