What is Aggregate Market Value?

The Aggregate Market Value (AMV) of a company is used to quantify the size of the company. It fundamentally measures the total value of all outstanding equity shares, according to the market's evaluation. The AMV of a company is solely the combined market value of its’ entire outstanding stock. The AMV of a business’s equity is, therefore, the total value given by the investors to a business. ‘Market Capitalisation’, or ‘Market Cap’, are also exchangeable terms to describe Aggregate market value. Here price of share plays a very important role and is the most relevant reason for the change in AMV. This means that the demand and supply behaviour of stocks can change the AMV of a company from time to time. This is the reason why Aggregate Market value (AMV) plunges during the bear market, which accompanies recessions and rises during the bull market that usually happen during economic expansions.

How is AMV calculated?

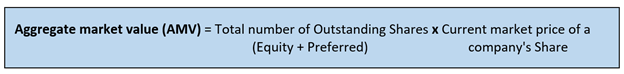

To calculate AMV, one needs to multiply the current market price of a company's stock by the total number of shares outstanding at any point in time. This calculation should be applied to all classifications of stock that are outstanding, i.e. common stock and all classes of preferred stock. The outstanding number of shares are mentioned under the equity section or owner’s funds section of a company's balance sheet.

Copyright © 2021 Kalkine Media Pty Ltd

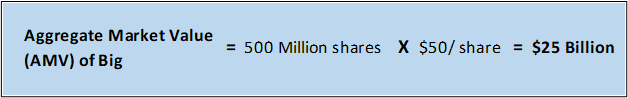

Example: Suppose a company, ‘Big’ has a total of 500 million shares of stock outstanding which is currently trading at $50 per share. Then Aggregate Market Value (AMV) of ‘Big’ would be $25 billion, which is equal to $50 per share multiplied by 500 million shares.

Copyright © 2021 Kalkine Media Pty Ltd

The price here of $50 per share is driven by the demand and supply of shares in the stock market.

What is the Importance of AMV?

The concept of AMV is a determining criterion on many occasions, and a few are listed below -

- Stock Exchange Listings - almost all of the stock market exchanges worldwide want the companies listed on their exchange to be of a certain size. Companies that do not meet these limits may have to come across other qualifications or experience delisting from the market. Therefore, they usually place lower limits on the AMV for these companies.

- Debt-to-Equity Ratio- The AMV of any company is useful in measuring the comparative contributions of debt and equity to an organisation's finances. The debt Equity ratio is computed by dividing total debt on a company’s Balance Sheet by the AMV of its equity. Generally, higher the ratio, riskier is the company to potential investors.

- Determining Market Capitalisation- The investing community regularly uses market capitalisation to rank companies and compare their sizes in a specific industry or sector. AMV helps investors classify companies as Large Cap, Mid Cap & Small Cap.

- Indicative of Investor’s Perception- AMV is a decent pointer of an investors’ perceptions of business prospects. Generally, companies in the large-cap category have more capital and assets than those in the small-cap category, so investors perceive them as lower-risk investments.

- Computation of valuation ratios- AMV can also be utilised to compute the valuation of companies in cases of Mergers and Acquisition decisions though it may not always reflect the best price as highlighted before as it totally ignores the debt holders of a Company.

Why is AMV not a conclusive valuation metric?

AMV cannot be used to get a conclusive value of any business since AMV as an equity value metric doesn’t include valuation of the Debt component. The AMV of a company is solely the combined market value of its’ entire outstanding stock. This is why investors prefer to look at the Enterprise Value (EV). This is reflective of the entire value of the business. It is the total value attributable to Equity & Debt holders. In case a business has a minority interest, it is included in the EV computation as well. Thus making EV a better choice for the investment community to value a business. Other than EV, investors may also use Forecasted Free Cash Flows to determine the potential value of a Business.

While the calculation of AMV is really simple, there are several factors that can cause it to reflect a below-par "real" value of a business. These influencers are:

- Illiquid markets - Without a company is being publicly held and having a robust market for its shares, and it is fairly likely that its shares will be sparingly traded. This means that even an insignificant trade size can alter the share price considerably. As few shares are being traded, when multiplied by the total number of shares outstanding, this minor trade can result in a large change in the market value of equity. It may be very difficult to determine a market value for shares when a company is privately held since shares are not being traded.

- Sectoral impact - Investors may be bearish on a certain industry or vice versa, resulting in sudden changes in the share prices of all companies in that industry. These changes may be for a short-term duration, resulting in drops and spikes in share prices that have nothing to do with a specific company's performance.

- Control premium - An acquirer in the case of Corporate Acquisitions shouldn’t rely on the market value of equity while deciding upon the bid price for a prospect company. Usually, the current shareholders want a premium to do away with their control over the business. This control premium is usually worth at least an additional 20% of the market price of the stock. This is why usually Acquirer’s do a valuation based on enterprise value (EV) or a valuation based on Forecasted free cash flows.

Thus, like any other financial metric Aggregate Market Value (AMV) also cannot be termed as a foolproof determining value of a company’s actual value for an Investor.

Please wait processing your request...

Please wait processing your request...