What is Bad Debt?

Bad debt refers to the expense incurred when the financial amount owed to a business entity/creditor is not likely to be paid by the customer. The situation arises when the one to whom the credit has been extended fails to fulfil his/her obligation to pay back the outstanding debt. Bad debt simply means the receivables which cannot be recovered.

In most of the business activities, credits are often extended to the customers and thus there is always a risk associated with the collection of this payment.

Businesses that mostly depend on credit to conduct sales are more likely to encounter bad debts.

Source: © Icefields | Megapixl.com

Summary

- A company faces bad debt when the customers fail to pay back their bills.

- Bad debts occur when a business entity gives too much credit to its customers who are incapable of paying back the debt.

- The allowance method is more preferred over the other to record the bad debt because even if we have no idea as to which accounts receivable will remain uncollectible, it has an advantage of matching expected bad debts to revenues.

How to Record a Bad Debt?

Bad debt can be calculated in two ways:

- Write-off method: Here, the creditor very well knows that the customer is unlikely to pay the debt, and hence, the invoice amount is charged directly to bad debt expense and removed from the account receivable. In this method, small businesses not only debit the bad debt expense account, but they also credit the accounts receivable.

- Allowance method: Under this method, the bad debts are predicted beforehand or at an early phase. Based on a reckoned figure, the allowance for doubtful accounts is prepared and set aside. This is the financial burden which a business is likely to bear on a yearly basis. The accountant keeps track of revenue transactions as well as the amount of bad debt expense incurred. In this method the Bad Debt expense is debited by the creditor for the estimated write-off. Also, one must remember that this method helps the business entities take into consideration the anticipated or predicted losses in their financial statements.

Why is direct write-off method not the best way to recognize Bad Debts?

It is worth noting that the allowance form is preferable to the write-off method. This is due to the fact that the latter is incompatible with the matching concept enshrined in commonly accepted accounting principles (GAAP). As a result, if you follow GAAP for accounting, you'll be required to use the bad debt provision form. It's also worth noting that the way you report bad debt expenditures varies depending on where you are in the world.

As per the norm, an expense must be acknowledged at the time a transaction takes place but not when the payment is made. Due to this direct write-off method is not considered the most appropriate way to recognize bad debt.

Which Methods Are Used for Estimating Bad Debt?

According to GAAP, the most popular methods for calculating bad debts are the following. The two ways include: first, the sales approach -which uses a percentage of the total sales of a business for the period. The second technique is percentage of accounts receivable form. The third approach, which is though less common but is used many a times is the accounts receivable aging approach.

1. % Of Accounts Receivable Method

In this approach, businesses get the approx. value of bad debts by calculating the allowance for doubtful accounts via the percentage of the accounts that are receivable after the accounting period.

Bad debt expense is also the gap between the estimated allowance for doubtful accounts after the accounting period and the current allowance for doubtful accounts before adjustment. Here, allowance for doubtful accounts balance is equal to accounts receivable at the end of the accounting period multiplied by the estimated percentage uncollectible.

2. Percentage Of Sales Method

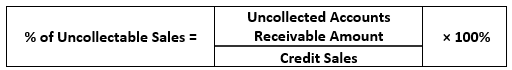

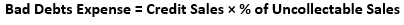

The percentage of sales method involves determining the percentage of overall credit sales that cannot be collected. This approach lays stress on the income statement and the interrelation of uncollectible accounts to sales. To obtain this, we must rely on the historical records of the business to get the percentage of credit sales that result in unreceivable amounts.

Here, the experience with the customer and the anticipated credit policy helps a great deal in determining the percentage.

Formula:

The method is also used to develop a budgeted set of financial statements.

- Ageing Method

The accounts receivable aging approach is also sometimes used by businesses to estimate the Bad Debts. This method divides accounts receivable into different age groups. Receivable accounts are grouped based on their age, and accordingly, a conclusion on the probability of their collection is drawn in percentage.

The method is also based on the concept that the longer the time spent collecting the receivables, the lesser the chances of its collection.

Why is it crucial to understand Bad Debts?

It is essential to record the Bad Debt expenses each time a business entity prepares its financial statements. Usually, companies prepare financial statements for every fiscal year or quarter. This is because the calculation of Bad Debts expense helps the business entities identify customers who default on payments more often than others. It allows them to differentiate between creditworthy customers and defaulters.

Furthermore, financial statements of a company or business entity are of immense importance as they are often taken into consideration by investors when they are thinking to invest their money. As a result, investors evaluate companies based on their financial statements. It is said that a bad debt could portray a business in bad light, reflecting that it isn’t performing well in the market. Therefore, it's important to identify bad debts as bad debts so that investors can rest assured that all accounts are in good standing.

Source: © Revenant_hm| Megapixl.com

What is the difference between Good and Bad debt?

It is widely believed that no debt is good debt. However, a debt that can increase your total worth and add value to your life is regarded as good debt. Good debts are investments for your future. Example- Student loan debt, small business expenses, mortgage loans and real estate investments. On the other hand, bad debt is when you borrow money to buy a depreciating asset such as cars, clothes, consumables etc.

Nonetheless, not all debt can be classified as good or bad debts. This is because what can be good debt for one person can be a bad debt for the other person, depending on the financial situation and other factors. Simply put, bad debt is an irrecoverable receivable.

Please wait processing your request...

Please wait processing your request...