Capital budgeting is typically defined as the process used by companies for decision making on capital projects with a life of a year or more. The process takes centre stage in corporate finance as capital projects make up the long-term assets portion of the balance sheet.

Sometimes, capital projects for a company could be so large that a sound capital budgeting process could ultimately decide the future, and capital decisions cannot be easily reversed at low cost, so committing a mistake could be proven very costly.

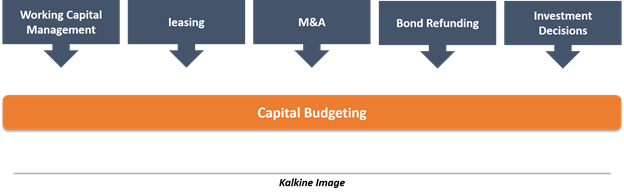

The principles of capital budgeting have been adapted for many corporate decisions, including working capital management, leasing, mergers & acquisitions (or M&A), bond refunding, and investment decisions.

Moreover, the valuation techniques or principles used in capital budgeting are tantamount to valuation principles used in security analysis and portfolio management and mainly focus on increasing the shareholders’ wealth.

The Process of Capital Budgeting

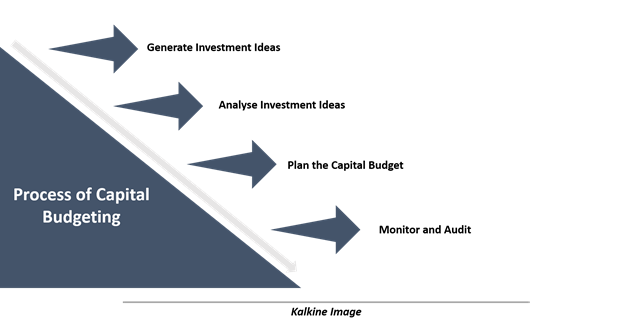

The primary stage of the capital budgeting process is to generate investment ideas, which could practically come from any level within an organisation, and it makes it the very first and the most important process or step of capital budgeting.

Step two or the second process in typical capital budgeting is to analyse those investment ideas via gathering information to forecast the future cash flows for each investment idea and then evaluating their profitability.

The tertiary step or the third process of capital budgeting is to plan the capital budget via fitting the profitable investment idea into the overall business strategy.

The last but one of the most important steps of capital budgeting is monitoring and post-auditing once the idea generated has been successfully completed into a capital project.

Types of Capital Budget Projects

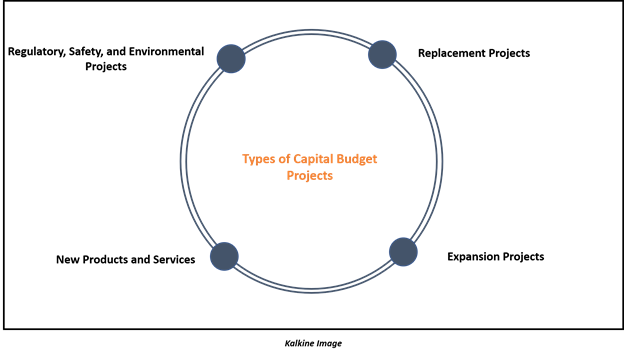

- Replacement Projects

Replacement projects are one of the easiest capital budgeting decisions, which generally deals with the replacement of worn-out machinery, projects, inventory, and so on. In replacement projects, if the expenditure is modest and the equipment has significant implications, the finance department or capital budget analysts typically ignore overanalysing the project.

- Expansion Projects

Expansion projects are those projects which increase the size of the business instead of maintaining the existing business of the company like replacement projects.

- New Products and Services

These types of investment projects bring more uncertainty than expansion projects and are mainly for increasing customer experience or tapping a new market.

- Regulatory, Safety, and Environmental Projects

These are types of projects frequently required by government or local authorities. Such types of projects generate no revenue and are generally in place to benefit local communities, government, or society. However, such projects could be very costly for companies at times, and decision around such projects could be very crucial.

Underlying Principle of Capital Budgeting

Capital budgeting mainly relies on just a few principles and use some assumptions.

- Decisions are based on cash flows.

In capital budgeting decisions are purely based on cash flows of an individual or a group of projects, and they do not consider the accounting concepts such as net income, EBIDTA, and so on. Also, this assumption or principle ignores intangible costs and benefits.

- Timing of the cash flow is of paramount importance.

- Cash flows are based on opportunity costs, i.e., the opportunity foregone in the next best alternative.

- Cash flows are analysed on an post-tax basis.

- Financing costs are ignored.

This assumption or the principle may seem unrealistic, but all capital budgeting methods plainly assume that the required rate of return or the discount rate used to reach capital budgeting decision, considers the financial cost.

Thus, incorporating the finance cost twice could lead to unnecessary complications.

Investment Decision Criteria Under Capital Budgeting

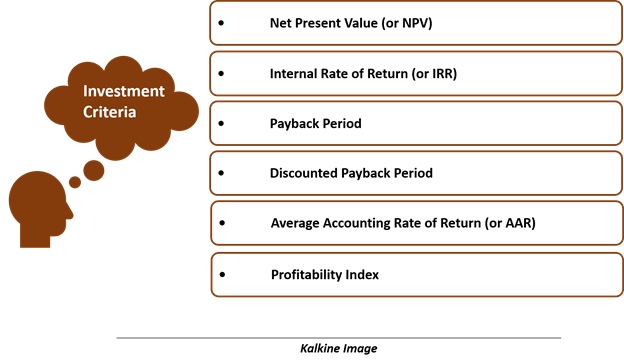

There are several methods for reaching an investment decision in capital budgeting, including Net Present Value (or NPV), Internal rate of return (or IRR), payback period, discounted payback period, average accounting rate of return, and profitability index (or PI). However, the most prominent is only the NPV and IRR.

- Net Present Value (or NPV)

Net present value (or NPV) is ideally defined as the sum of all discounted cash inflows for a project netted against the initial cash outflow or initial outlay.

The investment decision with NPV is relatively simple, i.e., investment if NPV > 0, and do not investment if the NPV < 0.

- Internal Rate of Return (or IRR)

Internal rate of return (or IRR) is defined as the discount rate, which makes the present value of all projected cash inflows equal to the initial cash outflow.

The investment decision with IRR is;

Invest if IRR > required rate of return

Do not invest if IRR > required rate of return

- Payback Period

The payback period is defined as the number of periods required to cover the initial outlay of cash into a project. Suppose a project calls for an initial cash outflow of $10,000 with cash inflows of five annual equal cash inflows of $2,000. The payback period for the investment would be 5 years.

While this investment decision contains many drawbacks, the payback period gives an idea about the liquidity of a project.

- Discounted Payback Period

The discounted payback period is almost similar to the payback period; however, it uses the discount rate to find the time required to cover the initial outlay by calculating the PV of the cash inflows.

Thus, the discounted payback period could be defined as the number of periods it takes for the cumulative discounted cash flow to become equal to the initial outlay.

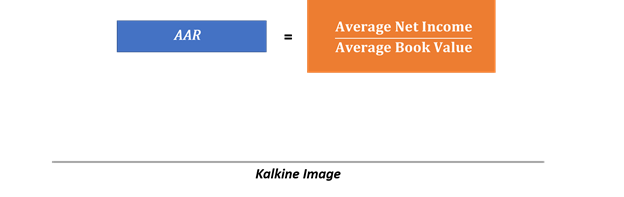

- Average Accounting Rate of Return (or AAR)

The average accounting rate of return could be defined as

However, AAR is seldom used in capital budgeting as unlike other methods, it considers accounting numbers for calculation and ignores the cash flows.

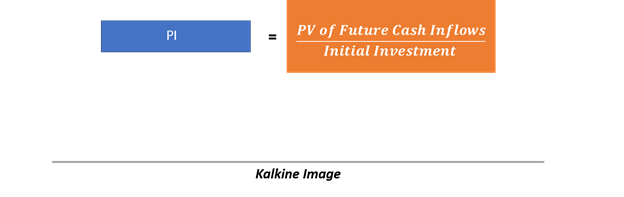

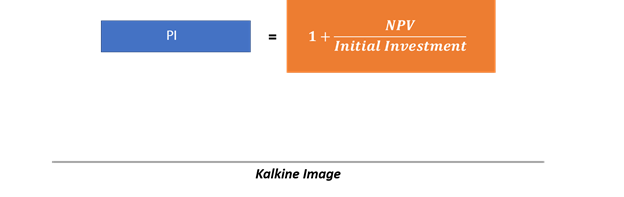

- Profitability Index

The profitability index could be defined as the present value of all future cash inflows divided by the initial outlay.

The above equation could also be rearranged as below:

The decision criteria form PI under capital budgeting is as below:

Invest if PI > 1.0

Do not invest, if PI < 0

Please wait processing your request...

Please wait processing your request...