What is capital improvement?

The concept of capital improvement applies to personal, business or government property. A capital improvement is a modification or addition to a property that enhances its value, extends its useful life, or makes it suitable for new uses. Improving or renovating, or updating an asset implies capital improvement. A capital improvement is changes made to the property such that they are permanent, and their removal leads to a decline in the value of the property.

Summary

- A capital improvement is a modification or addition to a property that enhances its value, extends its useful life, or makes it suitable for new uses.

- Frequent repairs, obsoletion, growth and expansion are all reasons why companies need capital improvement.

- Capital expenditures extend the useful life of an asset and are recorded by increasing the asset's net book value.

Capital improvement includes renovation, © Audiences | Megapixl.com

Frequently Asked Questions

What is capital?

Capital is frequently connected with money that is put to productive or investing use. Capital for business can come from the company's operations, or the company can raise it through loans or equity. When we evaluate the amount of capital, we estimate the wealth and the value of equipment used to create the wealth.

Why do companies need capital improvement?

Capital assets are critical contributors to the performance of a company. Over a period of time, there is depreciation on the asset, and it also gets outdated. Obsolescence is a significant reason that calls for capital improvement. Obsolescence may be physical or functional. For example, for a 100-year-old company that has never been renovated, the building would be in a near dilapidated state- this is physical obsolescence.

When a start-up begins operations, it may be functioning out of a small two-storey building, but once it becomes a listed company, it would have employed more employees and would need a larger space. In this case, the existing two-storey structure would be functionally obsolete. Again, this will call for capital improvement.

As time passes, the repair and maintenance costs on capital assets may start escalating. There may also be inefficiencies in the production process and output quality. If not addressed promptly, such concerns will lead to a loss of competitive advantage for the business. As a result, it may be beneficial to incur a higher one-time cost and invest in capital improvement. Else, the opportunity costs may keep escalating.

Growth and expansion of the business also call for capital improvement to meet the increasing need for physical and human capital- this could be in addition to the need for attracting new business. A good and updated infrastructure helps build confidence among prospective buyers, debtors, suppliers, creditors, and investors.

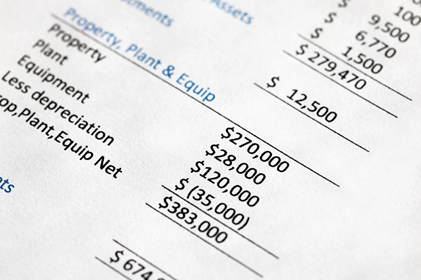

How is capital improvement recorded in the books?

Expenses related to depreciable assets are divided into two categories: regular/ ordinary and capital expenditures. Repairs and maintenance are examples of ordinary expenses. These expenses are considered operational expenses and are documented by debiting the profit and loss account and crediting the cash/ bank account.

Capital assets (less depreciation) recorded in the balance sheet © Bjeayes | Megapixl.com

Capital expenditures extend the useful life of an asset and are recorded by increasing the asset's net book value. For example, adding a new storey to a building increases the gross book value of the asset recorded in the books, thereby increasing the net value of the buildings on the balance sheet. On the other hand, at times, the useful life of an asset can also be extended using capital improvement, thereby reducing the depreciation. For instance, let us assume a computer is operated by a business for almost ten years and has been wholly depreciated as it has become outdated in relation to the latest systems available. The company can buy new software and update the computer making it useful for five more years. As a result, an item of small capital expenditure has resulted in reduction or reversal of depreciation earlier recorded. The depreciation reduction/reversal also contributes to the increase in the asset's net value on the asset side of the balance sheet- this happens without a change in the gross book value of the computer.

How can capital improvement be made efficiently?

Capital improvement must be a well-planned decision- this promotes better planning and installation or construction. There must be clarity about when the company should do it and how much it will cost. While making such a plan, the asset owner must also keep in mind the incremental value-added that will improve. The capital improvements budget is a financial strategy and programme for purchasing or contracting capital improvements, such as land, buildings, and other items with a longer life expectancy. It is also essential to decide the mode of financing the capital improvement. Before taking a final decision on matters, multiple options must be explored to ensure feasibility and maximum efficiency.

Copyright © 2021 Kalkine Media

What are the advantages of capital improvement?

For any asset that a person or business, or government owns, the money spent for capital improvement increases the asset's life. As a result, the owner benefits in the future because it reflects when the valuation is done for the asset. When companies or governments improve their infrastructure, it improves their image in the public eye. An asset whose value has improved will be usable for an extended period and will help generate revenues. When the value of an asset increases, the depreciation figures will also be higher, year on year. Hence, the depreciation claims can contribute to tax savings for the company. When a company makes capital improvement, it improves efficiency in production because the asset may not need multiple repairs and maintenance. This contributes to the enhancement of the firm's revenues. Better capital asset operations ensure more efficiency from human resources because assets work better, and thus, the overall working environment is better.

Please wait processing your request...

Please wait processing your request...