How can we define cash advance?

Cash advance denotes a quick and short-term loan borrowed from a bank or other money lenders. The term cash advance can be defined as the feature that is provided by credit cards to the cardholders allowing them to borrow a short-term loan. This feature is considered very useful, especially when it’s an immediate need for cash.

These short-term loans also give you a specific deadline to repay the amount with a certain amount of interest. Although the interest rate for credit cards is steep, it attracts borrowers for its speedy approval feature.

Image source: © Roberto1977 | Megapixl.com

Summary

- Cash advance refers to the quick and short-term loans given to people from banks or other alternative moneylenders.

- There are three types of cash advances: credit card cash advances, merchant cash advances, and payday loans.

- Cash advances can be taken through credit cards using three methods: ATM, bank, and cheques.

Frequently Asked Questions (FAQ)

What are the different categories of a cash advance?

- Credit Card Cash Advance

The most common type of cash advance is the credit card cash advance method. Money can be readily withdrawn from an ATM, depending on your credit card company. It can also be withdrawn through a check mailed to the credit card issuer.

When compared to conventional transactions, credit cards normally have a higher interest rate. The users are bound to pay 24 percent on an average, i.e. nine percent higher than the Annual Percentage Rate for all your purchases. Moreover, the interest begins to add up at the very exact moment when you make your purchase. There is no such grace period for the calculation of interest in case of the credit cards.

The credit card cash advance has a different rate of interest for different ways of purchase. If you directly withdraw money from the ATM, you might have to pay a lesser amount of interest. Credit Card Cash Advance may also have an upper limit of withdrawal attached i.e the credit limit allowed on your card and there is no grace period for interest to be charged in case of such loan.

- Merchant Cash Advance (MCA)

The term merchant cash advance denotes the loan received by various merchants and companies from banks or moneylenders. These merchants typically have a low credit point, and they might utilise the money to support their funding and business activities.

MCA are cash advances made against future sales. This is generally available for businesses that have a steady volume of business sales. The loan received is like a lumpsum payment and is paid back as the business makes sales to the customers.

- Payday Loans

Payday loans are very short-term loans, usually single instalment loan, that is given at a very high-interest rate based on the receiver’s income. They are typically valid or have a time limit till the borrower's next payday. People take payday loans to sustain the days of their lives until their next salary gets credited.

In which situation should you take cash advances?

A cash advance is an excellent way of borrowing money in the situation of a financial crisis or emergency. However, a cash advance is not considered a healthy practice and should only be regarded as the last option in case of an emergency.

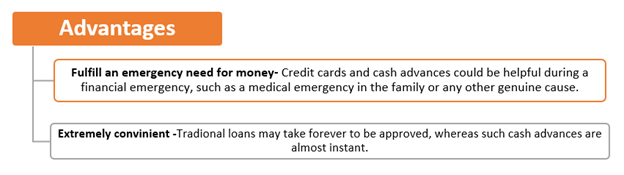

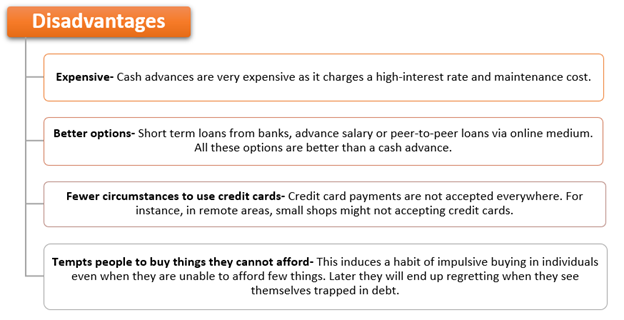

What are the advantages & disadvantages of a cash advance?

Image source: Copyright © 2021 Kalkine Media

Image source: Copyright © 2021 Kalkine Media

How does cash advance affect your credit score?

A cash advance has no direct impact on your credit score. However, a cash advance has got an indirect effect on the credit score in various ways.

First of all, if you plan to take cash advance through credit cards, in that case, your outstanding balance will rise, which will also give rise to the credit utilisation ratio. It will have an impact on your credit scores. Your credit scores might have an adverse effect when the credit utilisation ratio exceeds 40 percent. A higher rate of credit utilisation ratio indicates a credit risk.

As stated above, cash advance charges a very high interest rate, which could stop you from paying back the credits promptly. That can again affect your credit score. If you reach the maximum limit of your cash credit, then it could be alarming for your credit score. Even if you repay the credits, your credit report will reflect the maximum credit amount and put a wrong impression of you in the moneylender's mind. They might feel a bit skeptical about lending money to someone with high credit scores.

How to take cash advance from credit cards?

- Through ATM

One can take cash advance through ATM from your credit cards by using an ATM pin. All you need to do is visit an ATM booth along with your credit card. If you do not have an ATM pin, you need to request a pin from your credit card issuing company.

- Through Bank

One can request a cash advance through credit cards by physically visiting a bank.

- Through checks

Some of the banks and credit card issuer directly mail convenience checks to their clients. These checks can be utilised as regular checks. People can use these convenience checks to pay bills, deposit into a bank account, or transfer a balance.

Please wait processing your request...

Please wait processing your request...