What do you mean by CREST?

The Certificates Registry for Electronic Share Transfer, or CREST, is the electronic framework for holding financial instruments. They settle exchanges in the UK and handle Irish stocks. Crest permits offer and bondholders to store resources in electronic structure, rather than holding paper testaments, and it additionally offers same-day clearance for exchanges.

Copyright © 2021 Kalkine Media

Understanding CREST

The CREST is the central vault for business sectors in the UK and Irish stocks. The CREST is named after the CrestCo partnership, which Euroclear has worked on since 2002. It is the administrator of an electronic settlement framework utilised to settle a wide range of worldwide securities and can likewise hold stock testaments for the sake of its clients.

Euroclear was set up during the 1960s in light of the arising Eurobond market. The organisation went through many years of development and extension, just as a few consolidations incorporated some central securities depositaries (CSD) like Sicovam SA, the CSD of France. The CREST project was dispatched in 1993. After three years, the resulting guardian organisation, CrestCo, was established. Euroclear converged with CrestCo in 2002 and assumed working responsibility for the organisation. The new name for the merged entity was Euroclear UK and Ireland.

The CREST allows retail financial backers to hold securities electronically. It makes it feasible for bondholders and investors to keep resources in an electronic structure instead of holding actual offer authentications. The framework also helps make profit instalments to investors and executes other significant capacities and corporate activities like rights issues.

Crest additionally goes about as an electronic exchange affirmation (ETC) framework using Trax. When at least two gatherings in an exchange concur upon an arrangement, they affirm their sides of the exchange through an electronic exchange. All parties included are needed to submit affirmation of all exchange subtleties to CREST. If subtleties of the exchange are not the equivalent for each gathering, CREST demonstrates all issues and advises gatherings of inconsistencies. This part of the CREST framework considers a quick goal and quicker preparation of the exchange. Since CREST keeps a clearing framework and holds securities, same-day clearance for securities exchanges is possible. The organisation's most significant contribution to financial backers is the quick exchange of the financial instruments that it handles.

There are two classes of individuals on CREST: members and sponsored individuals. Individuals are generally significant pension funds, vendor agents, or other substantial monetary organisations with huge assets. Sponsored individuals have similar rights and duties as individuals. Nonetheless, given that they do not have the financial or specialised holdings of the individuals, they depend on their sponsoring party to interface with CREST.

For global stocks, CREST holds all of them in the local depository, for example, Clearstream for German stocks and CDS for Canadian stocks. Crest, at that point, gives a CDI to every holder of the security, which can be moved in CREST very much like a UK value. This is like the depositary receipts give in different nations. Some limitations apply to CDIs. They are not withdrawable or depositable in or out of CREST. This is because a CDI is an electronic impression of the fundamental security held in the local/domestic market. The security provided by CDI is "worldwide protections" indeed survey, which incorporates security through value shares, Eurobonds, depository receipts, and securities. Foreign securities should be qualified to be held inside or through a CSD, which contains Euroclear, DTC, SIS SegaIntersettle (the Swiss clearing framework), and other public or global depository occasionally determined in the CREST International Manual. The utilisation of the CDIs does not influence monetary and economic rights.

Crest interfaces markets in the UK and Ireland with others universally. Retail and private financial backers can open records in their names and are offered admittance to CREST indirectly through their intermediary or bank.

Crest Operations

- Keep up subtleties of individuals and their record structures

- Accounting

- Validating and trying to coordinate with electronic settlement guidelines from members

- Settling transactions, keeping up the commitments

- Giving data to enlistment centres and instalments banks

- Providing data to LCH and its clearing individuals for SETS exchanges

- Backing SLB, CA, claims estimation, and settlements

- Sharing data to framework controllers

- Estimation and assortment of tax charges for the inland income and Irish income

- Reconciliation of accounts and transaction

- Offering help for settlement of financial securities

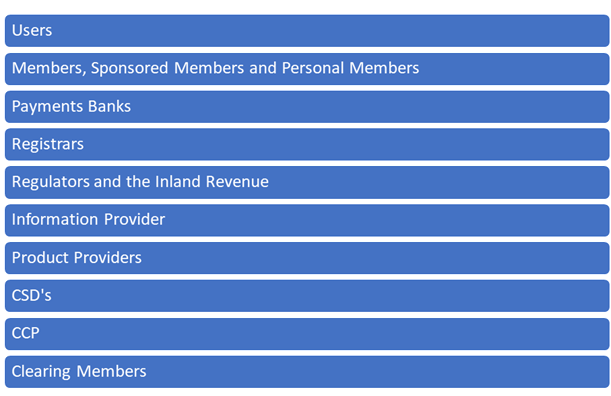

Crest Participants

Copyright © 2021 Kalkine Media

Frequently Asked Questions

- What is a crest depository interest (CDI)?

A CREST Depository Interest (CDI) is a UK security that addresses a stock exchanged outside the UK. They offer a straightforward, practical approach to exchange various international securities and are the primary methods for foreign managing given by different UK worldwide stockbrokers. From multiple points of view, CDIs take after American depository receipts (ADRs) and global depository receipts (GDRs). The fundamental lawful procedure is different, yet little of this will straightforwardly influence the financial backer.

Under the UK law, global securities can't be taken care of directly in CREST, so CDIs were made to allow trades in foreign stocks to be settled similarly. Basically, for each store accessible as a CDI, CREST has the necessary number of offers in shares held in its name or an intermediary at the central depository in the organisation's nation of origin. For instance, DTCC in the US, Euroclear in Europe, Clearstream in Germany, SIS in Switzerland.

CREST issues CDIs addressing these offers – one CDI for each portion of the essential stock. These CDIs are English law instruments and exchanges that can be settled through CREST, like regular trade. The fundamental offers depend on trust for the proprietors of the CDI, who have full financial rights over them. Giving a CDI doesn't imply that the stock is recorded on the London Stock Exchange. When CDIs are exchanged in London, they are done through OTC markets or market makers. They can be purchased and sold through most UK stockbrokers regularly. But not for the same exchange charge as any share.

- What are the pros and cons of CDI?

The real benefit of the CDI is to make the settlement of exchanges and guardianship of stocks simpler for foreign financial instruments. The intermediary doesn't have to make any plans for this in the stock's nation of origin. It can depend on the CREST framework similarly they would pay for a UK stock. Settlement of exchanges should be possible in reality, and profits are likewise paid in real, so you and your merchant don't have to stress over unfamiliar monetary forms. The CREST framework similarly offers alternative making and accepting instalments in euros and US dollars, albeit not all intermediaries will offer this.

The only drawback is that a few predetermined numbers of global stocks are accessible. The CDI is equipped towards more enormous stocks in significant Western economies, and even where a market is covered, not all organisations recorded there will be accessible. Markets covered by the framework are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Italy, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the US. It is significant to note that since CDIs of a foreign stock will, as a rule, be exchanged through a UK market creator, the value that the market producer statements won't be equivalent to is accessible on the abroad trade since they need to procure a benefit on the exchange. This is not a loophole but a fact of the market.

Please wait processing your request...

Please wait processing your request...