What is Default risk premium?

Default risk premium refers to the additional return received by the lender from the borrower by assuming default risk. Default risk premium defines the difference between the interest rate of a debt instrument and the risk-free rate. The concept of default risk premium was introduced to compensate investors for the possibility of defaulting on their debt.

© 2022 Kalkine Media®

Understanding Default risk premium

Default risk premium (DRP) refers to the extra amount paid by the borrower to the lender for the likelihood of a default risk. This happens mostly in the bond market, where companies have more chances of default paying more interest on bonds in comparison to more stable companies. It is similar to a mortgage loan, in which banks charge high interest to customers who have a worse credit history.

Default risk premium (DRP) compensates lenders and investors in case of defaults by borrowers on their debt. It is a premium amount paid by the borrower to compensate the investor and lender for assuming default risk. Companies and borrowers indirectly pay a default premium through the rates at which they repay the obligation.

© 2022 Kalkine Media®

In the bond market, agencies like S&P, Fitch, and Moody’s give ratings to the corporate bonds based on their revenues generated to make the payments of the principal and interest amount together with any assets they undertake to secure bonds. Companies default premium is basically dependent on the credit rating, the higher the rating, the lower the default premium of a company.

Frequently Asked Questions (FAQs)

How to determine Default Risk Premium?

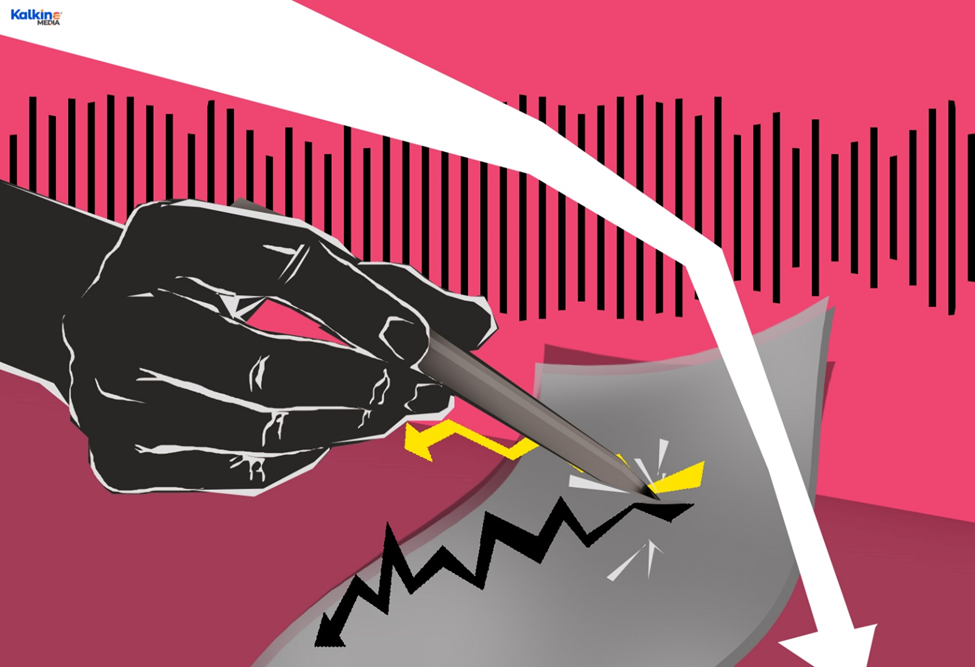

Default risk premium basically depend on creditworthiness of an individual or a company, it can be determined by considering the following points:

Source: Copyright © 2021 Kalkine Media

- Credit history

The default risk premium is depending on the credit history of an individual or a company. If an individual or a company’s past obligations are completed by making all their interest payment on time, it shows that the company or individual is trustworthy. It is a good signal for an entity that it is able to manage its interest payments even with the increasing debt obligations. A good credit history represents that an individual or a company can be trusted by lenders or investors for borrowing more money at the low-interest rate as the probability of default risk is very low, and the default risk premium is relatively low. On the other hand, if an individual or a company has a poor credit history, the default risk premium will be higher.

- Liquidity and profitability

The financial position of an entity is one of the most important factors while determining the default risk premium. Lenders prefer to examine and analyze the financial statements of an entity that gives insight into the liquidity and profitability; and the ability to meet the interest payment obligations of an entity. If an entity generates good revenue monthly with effective managing cost, lender or investor will be ready to charge low default risk premium and vice versa.

- Asset ownership

Assets of a company will attract banks more as the loans may collateralize against them because in any case of default banks use the collateral as the payment of the loan. Asset ownership of a company may affect the default premium risk. For instance, if a company owns premises of £5 million and wants to take a loan worth £5 million to finance its project, a bank can use the premises as collateral and in case of default, the bank will claim ownership of the premises as its payment of the loan.

What is the significance of the Default Risk Premium?

Default risk premium compensates the investor or lender from the borrower for assuming default risk. If the borrower has a poor credit record and would like to borrow money, the lender will charge a high default premium as the chances of default of interest payments are relatively high.

We can say default risk premiums provide a greater incentive to borrowers for not defaulting on their debts. Without default risk premium, an Investor prefers not to invest in any company that has a high chance of default risk. One can say that the DRP gives borrowers a greater incentive not to default on the debt. The default risk premium of an individual or a company determines by considering their creditworthiness, credit history of their past obligation, and asset ownership. Apparently, a country’s government does not pay a default risk premium. Though, in unfavorable circumstances, the government chose to pay higher yields to tempt investors.

How to calculate Default Risk premium?

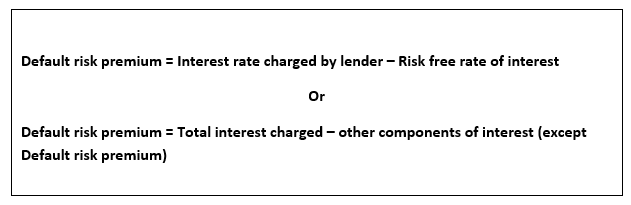

Default risk premium can be calculated through two ways. Default risk premium can calculate by taking the difference between the risk-free rate and the interest rate. And the second one way is more comprehensive as interest rate includes various components and Default risk premium is one of those components.

So, we can calculate Default risk premium by deducting all the other components from interest rate except DRP. An interest rate includes inflation premium, maturity premium, Default risk premium and risk-free rate.

Default risk premium can be calculated by using given equations:

Source: Copyright © 2021 Kalkine Media

Please wait processing your request...

Please wait processing your request...