What is Dividend Yield?

Dividend yield is a financial proportion, showing the number of dividends paid each year in relation to share price. It is generally expressed as a percentage and depicts the dividend-only return on investment. For investors, who are dependent on dividends as their major source of income, this ratio means a lot. The dividend yield of their portfolio directly impacts their personal finances.

Summary

- The dividend yield is in essence the return on investment in a share devoid of any capital gains.

- It is a financial proportion, showing the number of dividends paid each year in relation to share price.

- The dividend yield is a financial proportion, showing the number of dividends paid each year in relation to share price.

Frequently Asked Questions (FAQ)-

How is Dividend Yield Computed?

The dividend yield can be computed from the annual financial statement. Otherwise, investors can use trailing dividends and add last quarter dividends each time they compute the ratio. This way one can capture the trailing dividend data post annual result announcement.

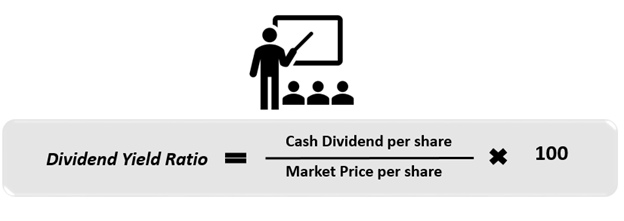

The formula for computing the dividend yield is –

Source: Copyright © 2021 Kalkine Media

Using annual dividends gives accurate yield numbers only during the first few months after the annual report is released. However, after some time the data becomes less relevant for investors. Using trailing dividend numbers then is a better way to assess dividend yield.

As dividends are paid quarterly by many companies, some investors use last paid quarterly dividendsand multiply them by four. They use this number as the annual dividend for yield calculation. This approach is not for companies that pay dividends more frequently or pay one large dividend followed by a small dividend later. Therefore, when deciding on the dividend yield computation method, analysts and investors need to have track of the dividend payment history.

if a dividend is not raised or dropped, the yield will only be impacted by the share price. In such cases, often investors will see unusually high or low dividend yields for stocks.

Example

A Company Alpha’s shares trade at USD100 and it pays an annual dividend of USD10 per share to its shareholders. Now consider another Company Beta whose stock trades at USD50 and it also distributes an annual dividend of USD10 per share.

When the dividend yield of Company Alpha & Beta is computed, we get Company Alpha’s dividend yield as 10% (USD10 / USD100), & Beta’s dividend yield as 20% (USD10 / USD50). Considering all factors as constant any intelligent investor would prefer to invest in Company Beta’s shares for the dividend yield is very high at a lower price.

Now consider Beta only pays USD2 in the next year as dividend then the dividend yield drops to 4%. At this time is company Alpha maintains its dividends at USD10 then it takeover Beta’s position in the eyes of dividend-hungry investors. This is because given everything remains the same, Alpha can generate a constant dividend yield compared to Beta.

Though it is one of the important factors, dividend yield cannot be the only factor used to determine any share’s utility to an investor.

What are the Pros and Cons of using Dividend Yield?

Benefits of using Dividend Yield Ratio-

- The dividend yield ratio helps investors gauge an understanding of the alignment of stocks with their investment strategy.

- Investors who focus on dividends usually stably magnify returns on their portfolios.

- Most Investors do not withdraw dividends and it is reinvested, which then compounds to earn higher future dividends

- The dividend yield is in essence the return on investment in a share devoid of any capital gains.

Detriments of Dividend Yield Ratio-

- A high dividend yield is attractive but at the expense of budding growth opportunities.

- Shareholders can earn higher returns even if the value of shares increases based on growth & not dividends paid.

- Investors must not evaluate shares based on their dividend yield alone and consider other factors.

- Investors should not invest in distressed companies having higher dividend yields as dividends may be eating up the company’s reserves or assets.

- The dividend is also highly impacted by volatility in the denominator i.e. share price which can give a false representation of the actual picture.

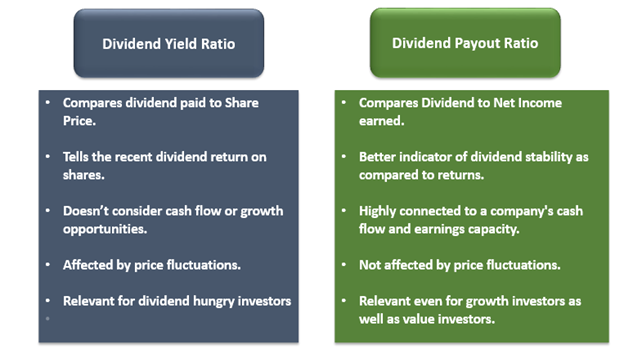

How is Dividend Yield different from Dividend Payout Ratio?

Source: Copyright © 2021 Kalkine Media

Should a high dividend yield be enough for investors?

Investors who are return-oriented often search for companies offering higher dividend yields. However, it's vital to know the settings that make dividend yield high. Investors got to search for companies that have a track record of sustaining or increasing dividends, backed by strong underlying financials. This ensures continued dividends within the future.

Sometimes an elevation in dividend yield is the outcome of falling share prices. The yield will mathematically rise because the denominator is reducing, this is known as "value trap”. Investors need to thus determine the reason for the fall in stock price. If the corporate is suffering financial despairs, the investor must steer away from such an investment.

Macro influencers like a poorly managed economy can also be a vital factor for investors. There are numerous examples of stocks plummeting during recessionary periods. The causes of such declines and their impact on the present and future of individual shares need to be studied.

Even the type of company like its’ business model, functional strategies also affect dividend yields and can sometimes make them peculiarly high. Other than this, some companies even lose out on growth opportunities, to lure investors by paying dividends instead of reinvesting them for business expansion.

High dividend yields are the best resort for investors during times of volatility. These shares offer good payoff opportunities and are best for risk-averse investors. The caution however is, investors must essentially study share valuation and dividend track record before investing.

Dividends are tax-free for investors in most countries hence, investing in these stocks provides tax savings but the benefit of current taxation should not be on account of future losses.

Due to the reasons mentioned above very often investors go and buy dividend-paying stocks just before the dividend date. They gain on the dividends paid and later sell the stocks to do away with the other influencing factors and their effects on the investment.

Thus, not only the dividend yield but various other factors like time of entry & exit, share fundamentals.

Please wait processing your request...

Please wait processing your request...