Elliott waves are price patterns, first discovered by R.N. Elliott in 1930s, who described the pattern’s characteristics on wave principle. The theory was an inspiration drawn from the Dow Theory, which, coupled with some natural observation, emerged as one of the most prominent tools used in technical analysis.

Basic Attributes of Elliott Waves

Ralph Nelson used wave principles to describe the price movements of the financial market, which later turned into what today is studied as wave principle of Elliott waves.

- Every wave has a starting point and an ending point in price and time.

- The basic pattern consists of five individual waves that are linked through time and move together to achieve a direction or a trend.

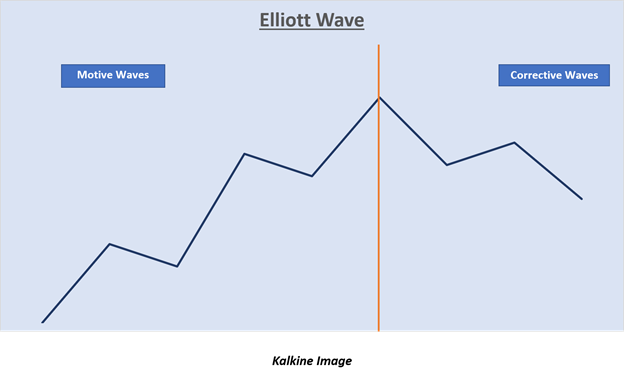

- There are two types of waves w.r.t its behaviour, i.e., motive waves and corrective waves.

- Motive waves propel the market prices up or down, and corrective waves interrupt the main trend and travel in the opposite direction.

- The Elliott waves are a 5-3 structure, in which, the first five waves are motive with two corrective sub waves and, the last three waves are corrective in nature.

Motive Waves and Governing Rules

There are two types of motive waves, i.e., impulse waves and diagonal waves.

Impulse Waves

Impulse waves are the strongest types of motive waves that follow some observational rules and could be identified by a 5-3-5-3-5 structure.

- Wave 2 never moves beyond the starting point of wave 1, or it could be said that wave 2 never retraces 100 per cent of wave 1; and,

- Wave 3 is never the shortest; however, it is not mandatory that it should be the longest.

- Wave 4 never enters the price territory of wave 1, i.e., it neither reaches the starting point nor the endpoint of Wave 1.

In an impulse wave, the Wave 1 and Wave 5 are always motive waves (could be impulse or diagonal), Wave 3 is always impulse, and Wave 2 and Wave 4 (sub waves) are always corrective.

Some Features of Impulse Waves

Extensions

In an impulse wave, usually, one of the motive waves, i.e., Wave 1, Wave 3, and Wave 5 is extended. An extended impulse wave is just an elongated wave, and the basic principle underlying wave extension is that, if one motive wave is extended, the other two motive waves should be approximately of the same length.

The Elliott theorist usually uses this rule for forecasting the length and time of the future movement or the wave, that would enfold.

Truncation

Truncation is defined as the process when one motive wave (current) fails to breach the high of the previous motive wave and starts correcting after roughly reaching the high of the previous motive wave.

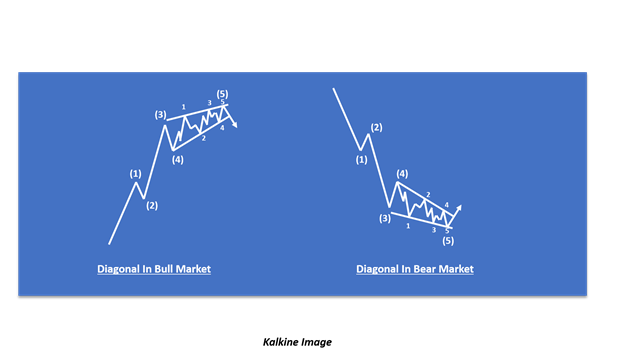

Diagonal Waves

Diagonal waves are another type of motive wave, which usually follow the rules governing impulse wave, except one, i.e., Wave 4 never reaches the price territory of Wave 1 – through the starting point to the ending point.

Diagonal waves are often contracting in nature, though it could rarely be expanding as well, and there are two types of diagonal, i.e., ending diagonal and leading diagonal.

Ending Diagonal

In an ending diagonal, sub waves 1,2,3,4 and 5 always take corrective-wave form and is only formed as fifth wave of impulse waves.

In an ending diagonal one line connects the termination point of sub waves 1 and 3 of Wave 5, and the other trendline connects sub waves 2 and 4 of Wave 5.

The formation of ending diagonal normally indicates trend reversal and a swift or a sharp reversal usually brings the price back to the starting point of the diagonal (which is often the starting point of Wave 5), and sometimes it can correct further deeper.

Leading Diagonal

On the other hand, a leading diagonal occurs at the beginning of the motive wave and is usually an extension formation of Wave 1. Moreover, the structure of Wave 1 in the leading diagonal is the same as the formation structure of the ending diagonal.

The only difference between both the diagonal waves is that leading diagonal forms at the beginning of the motive wave and it often indicates trend momentum (as in after consolidation) while on the other hand, the ending diagonal forms at the end of the motive wave and is often related to a trend reversal.

Corrective Waves and Governing Rules

As the name suggests, corrective waves are normally retracements of motive waves which are either sharp or sideways. All corrective waves achieve partial or full retracement of the preceding motive waves.

While motive waves are relatively easy to spot and act on, identifying, corrective waves could become really daunting, especially for novice traders due to its vast variations.

There are basically three types of corrective waves, which could be identified from there structure;

- Zigzag

Zigzag is a sharp, three-wave corrective wave, that follows the 5-3-5 structure. For identification purposes, Elliott theorists label corrective waves in alphabets and motive waves in numeric.

In a zigzag, the wave A (which contains 5 sub waves) is always a leading diagonal and Wave C (which also contains 5 sub waves) is always an ending diagonal.

- Flat

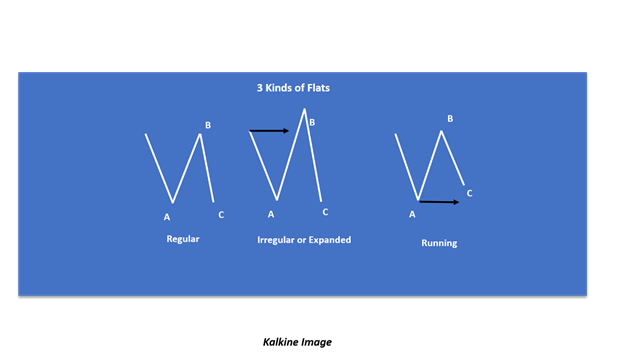

A flat is a sideways form of correction that follows a basic 3-3-5 structure. In flat, Wave A and B are always corrective, and Wave C is always a motive wave.

Wave B usually retraces more than 90 per cent of Wave A.

There are three types of flat that are classified w.r.t the ending and starting point of Wave A, B, and C.

- Regular

- Expanded (most common)

- Running (rare)

- Triangle

Triangle is typically a sideway corrective wave with 5 waves that follow the 3-3-3-3-3 structure. There are three types of triangle w.r.t the relative steepness of its high and lows connecting triangle.

(Triangle Diagram)

- Contracting

- Barrier

- Expanding

Apart from the three-common structure, corrective waves can also take a series of combination, i.e.; it could show two or more structure simultaneously.

Please wait processing your request...

Please wait processing your request...