What is enterprise value?

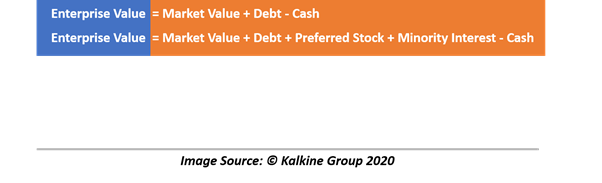

Enterprise value is an important concept in corporate finance. It is a measure of a company’s value based on market capitalisaion, debt, and cash. Therefore, enterprise value includes ownership interest and asset claims from debt, excluding cash.

Enterprise value essentially represents the cost of buying a business before considering any premium on the acquisition. For an operating and profitable business, the value of the enterprise is equal to the value of its productive operations.

The value of productive operations must represent the value of all net claims against the company’s assets, which are being applied to produce cash for the shareholders, claimants, or stakeholders.

Market Value: Full diluted shares outstanding is multiplied with the current stock price to calculate the market value of the company. Apart from basic shares outstanding, fully diluted shares include convertible securities, warrants, employee stock options etc.

Debt: Debt is a source of financing for a company that is favoured by the management since taking on debt does not dilute the ownership of equity shareholders. However, debt holders of the company are preferred over equity shareholders.

Moreover, debt holders have a claim on the company’s assets before equity shareholders and are paid before the equity shareholders.

Cash: Cash is the money with the company sitting idle on the balance sheet. But cash is not a static figure and continues to fluctuate consistent with cash needs of the business.

In case when cash is not used to fund operation, it can be used to pay off debtholders or suppliers. Cash is subtracted from the market value when calculating enterprise value.

Minority interest: Minority interest is the ownership interest of less than 50% in a company. It represents holding in stock by other company than the parent company.

Since minority interest represents partial ownership of others in an enterprise, it is kind of an obligation and is added to arrive at the enterprise value.

Preferred equity: Although the name suggests equity, it is much like debt. Preferred shareholders are ranked above common equity shareholders of the company and ranked below the debtholders of the company.

In most cases, preferred equity is converted to common equity shares. However, preferred shareholders receive interest before the common equity shareholders because they are ranked above common equity shareholders in the capital structure.

Since preferred equity is a type of debt until converted to common equity shares, it is added to the market value of the company to get enterprise value.

Use of enterprise value

Enterprise value is used as a valuation metric for the valuation of companies. It can be used regardless of the company or industry. It is often used in multiples like EV/EBITDA, EV/FCF, or EV/Sales. Enterprise value is also one of the go-to metrics in merger and acquisition valuations.

Enterprise value includes the debt of the company and is useful for comparing companies with distinct capital structures. Since it covers the equity and debt of the company, it is a kind of holistic metric.

EV/EBITDA ratio is used extensively in the valuation of companies, especially for mergers and acquisitions. For growing companies and new-age sectors, EV/EBITDA is a better method of valuation compared to the P/E ratio.

Limitations of enterprise value

Finding the market value of unlisted companies could be difficult. Shares of unlisted companies are quoted at face value, which ignores the potential premium the market is ready to pay for the business.

Companies with low free-float market capitalisation could have a volatile market capitalisation since a little change in demand for the shares could result in a large change in the price of a stock, thus market capitalisation or market value.

Enterprise value also assumes that the cash is effectively used to pay off the debt of the company. This assumption may not be true since companies are required to fund daily business operations through cash or debt. It does not consider debt servicing costs.

Free cash flow vs enterprise value

Free cash flow of a company is the residual cash left after deducting capital expenditure from operating cash. It basically represents the amount of cash left with the company to honour its obligations like paying off debt or paying dividends.

Enterprise value is the value of the company. It could change as the market value of the company changes consistently with the changes in the share price. Compared to free cash flow, it represents a takeover value without any premium.

EBITDA vs Enterprise value

EBITDA represents earnings of the company during a period of time, which excludes interest, taxes, depreciation and amortisation. It is a metric that shows the earning capability of a firm. Enterprise value, as noted earlier, is a takeover value of firm without any premium.

Both are completely different metrics in corporate finance. Enterprise value considers debt of the company while EBITDA does not include debt or debt servicing costs/interest payments.

Please wait processing your request...

Please wait processing your request...