What Is Face Value?

Face value is the nominal value, i.e. the initial price at the time of issuance of share, bond or stocks. For example, for stocks, it is the original cost, and for bonds, it is the amount paid at the time of maturity. Face value, also known as par value, refers to the company's value as recorded in its share or bond certificates. It's the number that appears on the physical stock or bond certificate. This amount remains constant regardless of market conditions as long as the securities is traded on the open market. The share / bond certificate clearly states the face value of the shares and bonds. It's an essential parameter for calculating stock market value, premiums, and returns, among other things. Face value is also called par value.

Summary

- Face value is the number that appears on the physical stock or bond certificate.

- If a bond trades above its face value and is sold at a premium. On the other hand, if a bond trades below its par value, it trades on discount, and thus prices are lower.

- The distribution of dividends cannot reduce the total value of the capital at face value.

Frequently Asked Questions (FAQs)

What is the difference between face value and issue price?

When a publicly traded firm offers shares to raise capital through an Initial Public Offering (IPO), the face value is fixed. The procedure by which a corporation acquires funds for development and expansion is known as an initial public offering (IPO). It is the price at which various stakeholders can buy a company's shares. Meanwhile, the stock's face value should not be mistaken with the stock's issue price. The issue price includes the additional premium a corporation charges potential subscribers over and above the face value. Simply put, the issue price equals the face value plus the premium. Premium is determined by the company's numerous performance criteria, such as sales, profit, and volume growth.

On the other hand, there may be cases where the company may have to issue shares at a discount to its face value. In such cases, the issue price will be lower than the face value, and the gap between the two values will be the discount.

Share certificate © Fireflyphoto | Megapixl.com

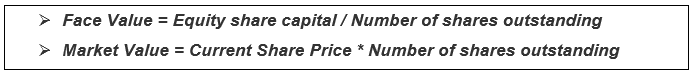

What is the difference between face value and market value?

There is a difference between a stock's face value and its market value. The current price at which a share is traded or bought on the capital markets is known as market value. A share's face value is usually less than its market value. A company's market value fluctuates depending on its performance and the demand and supply of its stock. Suppose a firm goes public at a face value of US$6 per share. A decade later, It could be worth US$60 per share on the market. However, in some cases, the face value of a stock may be higher than the market value. When a share's market value exceeds its face value, as in the example above, it is said to be at a premium or above par. In this case, the premium is US$44. If the share price in the market falls below the face value, then it is called selling at discount or below par.

© Ragsac19 | Megapixl.com

Where is the concept of face value useful in the case of share price?

When companies decide to split their stock, the face value of the stock is of essence. Therefore, it is useful to comprehend the change in a share's face value in the event of a stock split. A stock split is the division of the face value, so shares with a face value of AU$10 would be reduced to AU$5 in the event of a 1:2 split. The price of the shares, on the other hand, would fall correspondingly. As a result, the total value of the holdings of the investors will remain status quo. But in the event of a stock split, there will be more shares accessible to investors.

The face value of the company's total outstanding shares is the default minimum reserve that must be maintained. In other words, the face value of the share capital cannot be reduced by the distribution of dividends- that has to be mandatorily paid out of the accumulated earnings, which also forms a part of the total capital of a company.

What is the relevance of face value in case of bonds?

Since par value denotes a contractual agreement between the issuing body and the lender, in the case of fixed-income instruments like bonds and debentures, par value has a vital role to play. The face value of a bond is the dollar amount mentioned on the certificate, which is used to calculate interest and the amount to be paid to lenders at maturity. For example, if a firm issues bonds with a par value of US$100 per bond and a lender owns tens of them, the firm must repay US$1000 to the lender at maturity.

Whether a bond trades above face value or below face value depends on the interest rate levels in the market and credit ratings. A bond trades above its face value and is sold at a premium. In such cases, the coupon rate on the bonds lies above the prevailing market interest rate. On the other hand, if a bond trades below its par value, it trades on discount and thus, prices are lower. The interest rate in such cases is below the prevailing market rates. In other words, the premium or discount to the face value of the bond reflects the adjustment in valuation for the higher or lower coupon rate vis-à-vis the prevailing market rate. For example, there is a five year government bond with a coupon rate of 5% (at par with the central bank rate) issued with a face value of US$100 in 2020, if in 2022 the central bank revises its rate downwards, the market will reflect the attractiveness of the bond by pricing it at a premium to its face value in the secondary market. However, it must be noted that the bondholder will only receive the face value of US$100 at the time of maturity in 2025.

Please wait processing your request...

Please wait processing your request...