What is Factor Investing?

Factor investing stands for an investment approach in securities that includes targeting specific characteristics, proven to provide a higher return in the equity market.

Chiefly, investment decisions are based upon the exploitation of factor premiums, which have shown robust behaviour for a long time and are applicable across different markets.

In 1970s, factor investing marked its presence in the equity markets as an investment approach after the testing of the Capital Asset Pricing Model (CAPM).

What is the Significance of Factor Investing?

Source: Copyright © 2021 Kalkine Media Pty Ltd

With more than three million individual securities and multiple asset classes in the global market, it is a challenge to create the right mix for an investor’s portfolio. However, few factors have been explored by academicians which help in determining the adjusted risk-return profile of security.

These factors are persistent and broad, allowing investors to critically examine the security as per their diversification goals.

Emerging technologies are giving an edge to investors by expanding their data source and assessing the factors in real-time.

Ascertaining the factors that affect the return on securities can help in creating an optimum portfolio as per the need and risk profile of an investor. Extensive research indicates that these factors drive returns because of risk-taking character and non-rationality of investors at the same time across the globe and structural impediments.

Risk-bearing behaviour results in additional returns or underperformance in few markets. Structural impediments stand for the restrictions in some countries to access certain securities, simultaneously creating investment opportunities for another investor. The behavioral biases create a pool of opportunities with different investors having different views about a security.

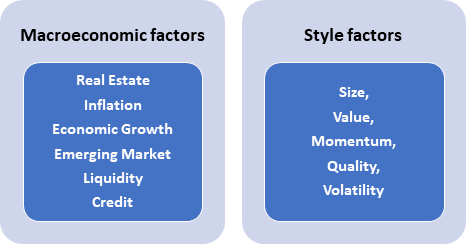

What are the types of factors?

Macroeconomic and style factors are the two types of factors that drive return.

Source: Copyright © 2021 Kalkine Media Pty Ltd

Macroeconomic factors explain the broad risks, whereas style factors define the risk and return of an asset class. Macro factors include real estate, inflation, economic growth, emerging market, liquidity and credit.

Style factors actually work in comparison to the macro factors. Types of Style factors are:-

- Size – As demonstrated by the Fama and French model, the premium is received for wheel investing in small companies. This phenomenon takes place because the small companies are riskier in nature and are prone to the risk of bankruptcy. Furthermore, stocks of small companies are highly volatile. Therefore, investors are compensated for making investments in riskier but growing stocks. For harvesting premium at lower cost, small-cap stocks are seen as an efficient way, however, the riskier nature should not be ignored.

- Value – Fama and French model projected that discounted stocks outperform expensive stocks. The stocks discounted in relation to their intrinsic value have the potential to beat the market expectations and create an upside for the investors. With the lower expectations and pessimistic attitude of investors, in few cases, the stock aims at outperforming the market expectations. In effect, higher earnings are reported over time.

- Momentum – It has the essence of technical analysis, that is, making the investment decision based on past trends. The future returns are predicted after examining the past movement of the stock price. The momentum phenomenon is created because of the behavioral element. The past performance impacts the future price until a new element is introduced in the system.

- Quality – Quality firms are targeted by investors for decades because of the promising return nature. The concept of quality emerged recently as the earlier quality was not explained. Empirical studies indicate that high quality firms generally outperform the expectations in the market. Components like a stable income, positive cash flow, growing profitability and low leverage in the open market project the company’s quality. Furthermore, if a firm has a competitive advantage, then the stocks provide higher returns and therefore, competitive advantage stocks are sticky. A single quality factor may extend higher profits in the future.

- Volatility – Historical data reported that low-volatile stocks may outperform in the market and garner higher returns. Chiefly, investing in low volatile stocks also means that stocks have stable revenue, stable return, and least impacted by macro events like a recession. The best time to invest is when the market is highly volatile as it promises stable returns in long term.

How to access the factors?

Technology advancements like artificial intelligence, cloud computing, data mining, to name a few, empower the investor to retrieve and examine time-tested ideas and enhance strategies.

Advanced methodologies are utilised under enhanced strategies which includes multiple class of assets along with short- and long-term investment. It strengthens the portfolio and increases return along with minimising the risk.

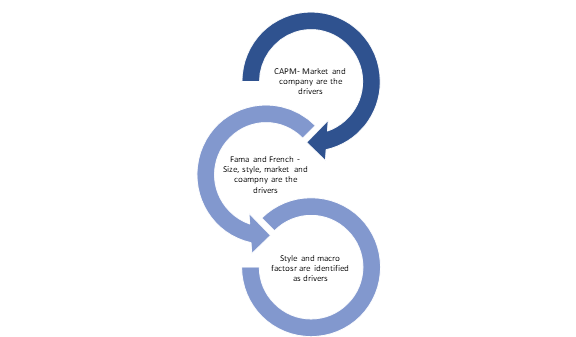

What are factor investing models?

Factor investing was first noticed when CAPM was introduced in the 1970s. The model stated that stocks to a certain extent are affected by bet (broader market). It was a single factor model which included the market and the company’s profile as the factors which affect the market.

Fama-French model is a multiple factor model which stated that factors like style and size of the company also act as drivers.

The recent studies deduced that stock price drivers are not limited to CAPM and Fama- French model but also includes factors like volatility, quality, momentum, value, size to name a few.

Source: Copyright © 2021 Kalkine Media Pty Ltd

What is the Difference between factor investing, quantitative investing and smart beta?

The concepts of factor investing, quantitative investing and smart beta are seen as almost similar terms in the equity market. However, these terms are used differently by different investors or portfolio managers.

- Factor investing: It is part of quantitative investing which involves exploiting the factor premiums that are efficient, both theoretically and pragmatically. It can be employed across country and asset classes. It specifies certain characteristics which impact the expected risk and return of a security.

- Quantitative investing: By utilising rule-based models and quantitative data, a portfolio is constructed under quant investing. Unlike fundamental investing, the security selection is dependent upon the quant strategies and models.

- Smart beta: Factor premiums are targeted in smart beta. In theory, smart beta is seen as a factor-based strategy. The smart beta-related information (indices) is transmitted publicly through exchange-traded funds.

Please wait processing your request...

Please wait processing your request...