What is Fixed Cost?

Fixed cost refers to the cost which does not fluctuate with the change in the units of goods and services sold and produced, it is the expenses of an enterprise which have to be paid on particular time.

Source: Copyright © 2021 Kalkine Media

Understanding Fixed Cost

Fixed cost is the expenses of a company which do not change with the generated volume of goods and services. These expenses are fixed which has to be paid by a company over a specific time period. Every company has different fixed cost depending on its scale and nature of business such as manufacturing companies have to pay high fixed cost as they need more space for operation and equipment’s.

Total cost for any company can have two components: fixed cost and variable cost. The proportion of these costs directly depends on the nature of a company’s business. Usually, fixed costs are decided with an agreement and contract with a specific time period. During that time period, fixed cost will not change. On the same side, variable costs directly relate with the volume of goods and services generated by the company.

Frequently Asked Questions (FAQs)

What is the role of fixed cost in financial analysis?

Companies need to keep both fixed and variable cost in the consideration at the time of the analysing cost per unit. Fixed cost is treated as the indirect cost of production of a company as it is not incurred directly by the production process. Fixed cost is needed in financial statement analysis to measure Cost Structure Management of a company in many ways including:

- Ratios

There are various ratios which are used to analyse financial statement of a company where we need fixed cost to calculate these ratios such as:

- Fixed cost ratio: This ratio is used to know the proportion of fixed costs in production. It is calculated by dividing the fixed costs with net sales.

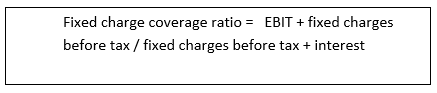

- Fixed charge coverage ratio: This ratio shows the ability of a company to pay its fixed-charge obligations. It is calculated by using the formula :

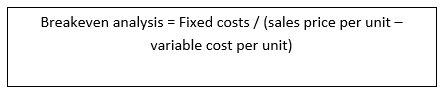

- Breakeven analysis

Breakeven analysis helps to know the production level to produce to gain profit; it is helping in taking decision related to fixed and variable cost of a company. It also helps a company to take decision of selling price of its goods. It can be calculated as:

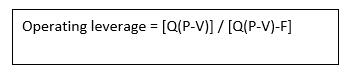

- Operating leverage

High operating leverage means a company can produce high profit with per additional unit. Operating leverage can be calculated by using the given formula:

Where, Q stand for numbers of unit produced, P stands for price per unit, V stand for variable cost per unit produced, and F stands for Fixed costs.

How does Fixed cost calculated?

Fixed cost is calculated by using the given formula to calculate the fixed cost of a company.

Fixed costs = Total production costs — (Variable cost per unit * Number of units produced)

For total production, you have to add all the production costs of a company. For instance, there is a food truck, the owner of the food truck calculates its one-month expenses and it will equals to £6000 in total cost. The he sold 800 units in that month, and each unit costs £4 including all vegetable, meat and other expenses. In this 4000-(5*1200), 800 is the fixed cost.

What is the difference between fixed cost and variable cost?

Variable cost refers to the cost which varies with the change in the production of the company. If a company increases its production of goods and services, the variable cost will increase too. On the same side if a company decided to produce less, its variable cost will reduce too. If output is zero, variable cost will be zero.

While fixed cost is a cost that will not fluctuate with the change in the production of a company, it will not affected by the output generated by a company. A company has to pay its fixed cost even it doesn’t produce a single unit for a month. In this case a company’s variable cost will be zero but fixed cost will be the same.

What is Average Fixed cost?

Average fixed cost refers to the fixed cost of the production that is divided by the total units produced by a company. Average fixed cost shows the level of fixed cost which a company has to pay for each unit. It also refers to the fixed cost per unit of output produced by a company. It can be calculated by using given formula:

Average fixed cost = Total fixed cost / Total number of units produced

What are the examples of Fixed cost?

Fixed cost may include the fixed expenditures of a company which incurred over a specific period of time such as salaries of employee, monthly rent etc.

Property rent: A company’s property rent will be fixed over a specific time period such as for a year. It will be fixed until and unless contract will over.

Payroll: A company’s payroll is treated as fixed cost as the salaries of employee is fixed and stable over a given period of time.

Insurance & Interest on loans: A company’s insurance cost will be stable over a specific time, it includes health insurance of employees, property insurance etc. Interest on business loans is also constant unless company decides to take more loans.

Licenses and permits & Property taxes: The company needs to pay a fixed amount as its licenses and permits fee. Companies have to pay various property taxes including buildings, equipment, machineries and vehicles.

Manufacturing equipment: Companies need various equipment and machineries to do business and production have fixed monthly payments.

Please wait processing your request...

Please wait processing your request...