What is the free-rider problem?

The free-rider problem exists when some entities enjoy the benefit of something either free of cost or by paying something minimal in relation to the overall benefit. The free-rider problem brings about market inefficiency in the form of overproduction or underproduction of a good. The free-rider problem is prevalent in the case of public goods. For example, the government invests in infrastructure like building roads and bridges- taxpayers, tax evaders, and people from the non-taxable category all enjoy the benefits.

Summary

- The free-rider problem exists when some entities enjoy the benefit without paying for it proportionately.

- The free rider problem happens in the case of public goods, which are non-excludable and non-rival in consumption.

- Pareto efficient production is complex when there is a free-rider problem associated with the commodity.

Frequently Asked Questions

Why does the free-rider problem occur?

Free rider problems exist because it is not possible to exclude the free riders from consuming the product. Mancur Olson analysed the free-rider situation. He found that rational people try to maximise the outcomes they want. Thus in the case of public goods where they know that they can benefit even without paying for it, rational beings will choose not to pay and instead free ride. However, when people do not reflect their actual preferences by indicating the prices they would be willing to pay for it, there is a free-rider problem.

What are public goods?

Goods characterised by nonrivalry and non-excludability in consumption are called public goods. The nature of these goods is such that efficient production is tough. Thus, private sector players in business do not produce public goods.

Private goods are rival goods- this means that when a person X consumes more of a commodity, there is lesser available for the others to consume. Rivalry is true of seats on an aircraft. As more and more people continue to book seats on a flight, the seats available for the others are lesser and lesser. However, in the case of public goods, there is non-rivalry in consumption. Public goods include roads, bridges, public parks, national defence etc. If X is a taxpayer of a country and is safe at home while soldiers are in the war zone, equally safe is a person from the low-income category who cannot pay taxes.

Excludability in consumption implies that those who do not pay cannot use the commodity and are thus excluded from receiving its benefits. An aircraft seat, a McDonald's burger, a Honda car are examples wherein the seller will give the goods only to those who pay for it. However, in the case of public goods, nobody is excluded from using them. For instance, a road or security from national defence forces is available to billionaires and beggars alike.

How is the free-rider problem a barrier to the private production of public goods?

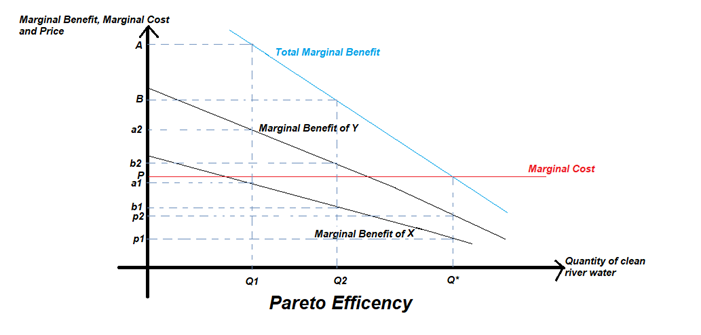

Pareto efficient production happens where the total marginal cost and marginal benefit are equal. For example, let us assume that the society comprises two individuals X and Y, and a river is to be cleaned in a locality by a private player. As seen in the diagram, for Q1 units of clean water, X is willing to pay a1 while Y is willing to pay a2. Similarly, for Q2 units, X would pay b1, and Y would pay b2. So by horizontal summation, the aggregate benefit from Q1 would stand valued at a1+a2= A and Q2 at B= b1+b2.

Copyright © 2021 Kalkine Media

The concerned private producer will have to incur the cost of man and materials to clean the river. Let the cost be P, and it is assumed to be constant throughout. Then, the marginal benefit and marginal cost are equal at level Q*- this is the level of Pareto efficient production.

Pareto efficient production is possible only if the consumers pay according to the marginal benefit they receive from a commodity, i.e. X should be willing to pay p1 and Y should be ready to pay p2. However, since everyone can use the clean water from the river regardless of who pays for it, nobody will pay to the full extent of their marginal benefit. Some may even choose not to pay at all. This problem of free ridership is why private players will not willingly come forward for the creation and distribution of public goods because they will fail to collect revenue and run into losses. Thus, we see that due to the free-rider problem, Pareto efficient production is not possible. Due to market inefficiency, public goods tend to be overproduced or underproduced.

How can the prisoner’s dilemma concept be used to understand the ills of the free rider problem?

The game of prisoner’s dilemma can be used to understand the free rider problem. The prisoner's dilemma is a decision-making paradox in which two people are involved- They are rational beings and will work to maximise their benefit. However, this may not generate the best possible outcome. Suppose there is an economy two people A and B and a flood control system is to be set up in their area (a flood control system is a public good)

Copyright © 2021 Kalkine Media

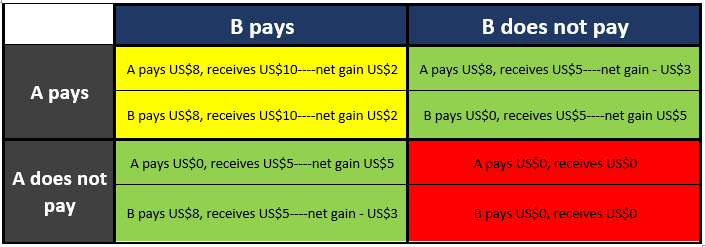

As seen in the yellow segment, when both of them contribute to it, their personal cost is $8 per head and the social benefit of their contribution is $20 in total. Here we can see that the total cost is US$16 while the total benefit stands at US$20 for the society i.e. the benefit exceeds the cost by US$4. Thus, the investment is in the best interest of the society.

However, each of them think that they can benefit even if they don’t pay for it while the other one does. As seen in the green segments, when only either one pays, the society receives only half the benefit (i.e. US$5+US$5=US$10). For any public good, everyone gets the total benefit in equal proportions. However, the person actually pays more than the benefit he/she receives.

As seen in the red segment, if neither of them pay for the public good, the costs and benefits of the public good are nil. In this case, the public good never materialises and there is no benefit to the society at all.

Please wait processing your request...

Please wait processing your request...