What is a Global Bond?

A global bond is a bond that can be purchased and sold both within the country where it is issued and the European markets. This bond is traded outside the country where the currency of the bond is denominated. These bonds are high in credit ratings and are traded by a non-European country in any European or foreign country. The maturities for global bonds range from one to thirty years. Large multinational corporations or sovereign entities issue these bonds.

Image source: © Larryhw | Megapixl.com

Summary

- Global bonds are available in various maturities and credit ratings.

- Global bonds are sometimes considered Eurobond; however, the difference is that the former can also be issued in the domestic market, which is not the case with Eurobonds. Moreover, Eurobond’s are traded and denominated in a currency different from the currency of the countries in which they are sold.

- Global bonds are issued in different countries in the currency of the country where they are issued.

Frequently Asked Questions (FAQs)

Are Global Bonds Safe?

Global Bonds are considered a safe mode of international investing. This is because they are registered with the Securities and Exchange Commission. Besides, credit ratings are allotted to global bonds by S&P and Moody’s Investor Service.

What are the advantage and disadvantage of global bonds?

Advantages

- Diversification and foreign market exposure – By investing in global bonds, the investors get exposure to different countries.

- High Yield – Global Bonds offer high returns, and it can become a good opportunity for investors who look for high returns by taking a high risk.

- Hedging – Investing in these bonds give an investor exposure to exchange rate risk. This helps in the formulation of a better risk management strategy for future investments.

Disadvantages

- Currency Volatility – This is due to the involvement of the currency exchange rate in International Bonds.

- Transaction costs are high – The transaction costs are relatively higher.

- Liquidity often Low – Since many people are not interested in investing in Global bonds; therefore, liquidity is often low compared to domestic bonds.

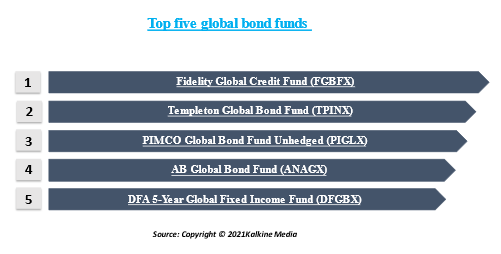

Which are the Top five global bond funds?

- Fidelity Global Credit Fund (FGBFX)

FGBFX invests in corporate bonds issued across the globe. Around 80% of the fund's assets are in debt securities of all categories. FGBFX’s top five allocation weightings by country (as of Nov. 30, 2020) are as mentioned below:

- United States: 43.44%

- Germany: 20.58%

- France: 6.15%

- United Kingdom: 6.03%

- Switzerland: 4.15%

- Templeton Global Bond Fund (TPINX)

The Templeton Global Bond Fund invests over 80% of assets in governmental and agency bonds around the world. The portfolio managers of Franklin Templeton Investments have an eye for investment opportunities across currencies and interest rates for reasonable returns.

It is to be noted that funds with higher expense ratios can cut performance over time. The Templeton Global Bond Fund has an average weighted maturity of 2.42 years. The top five allocation weightings by nation (as on 30 November 2020) are given below:

- United States: 24.30%

- Mexico: 17.33%

- Japan: 12.25%

- Indonesia: 10.52%

- South Korea: 7.78%

- PIMCO Global Bond Fund Unhedged (PIGLX)

PIGLX invests in high-quality, developed countries around the world.

The fund aims to provide exposure to multiple economies, including developing countries denominated in global currencies. The top five allocation weightings by country (as of Nov. 30, 2020) are as mentioned below:

- Italy: 19.24%

- Australia: 15.70%

- United States: 15.67%

- Spain: 13.19%

- Denmark: 9.42%

- AB Global Bond Fund (ANAGX)

The fund invests in fixed-income securities from developed and emerging markets. The weightage is as follows:

- United States: 37.40%

- Japan: 15.33%

- China: 8.75%

- United Kingdom: 6.36%

- Australia: 5.45%

- DFA 5-Year Global Fixed Income Fund (DFGBX)

DFA 5-Year Global Fixed Income Fund invests in the US and foreign debt securities with maturities of not more than five years. The percentage-wise weightage of DFGBX is:

- Canada: 20.32%

- Supranational countries: 18.77% (such as the European Union)

- France: 9.68%

- Netherlands: 8.78%

- Germany: 7.36%

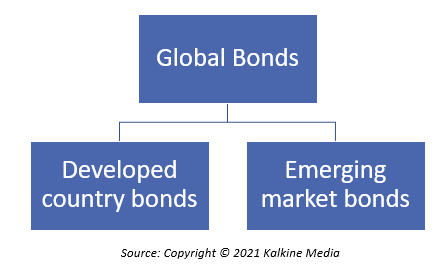

What the two groups in which Global Bonds are divided?

Global Bonds can be divided into two groups:

- Developed country bonds

- Emerging market bonds

Multinational corporations and governments from developed countries issue bonds with a different range of maturities and credit values. Most of the bonds are denominated in the currencies of the country of their origin. On the other hand, emerging market bonds are issued by the sovereign government only. Emerging market bonds are mostly dollar-denominated and offer higher interest rates. When these bonds are issued by countries that have unstable economic growth, they are considered riskier by the investors.

Both these two categories of global bonds are issued when both the corporations and the corporations aim to raise capital through the issuance of global bonds.

Is it wise to invest in Global Bonds?

Though investing in global bonds can help you earn interest income in multiple currencies. However, a second thought before purchasing global bonds is necessary, keeping in view the risks associated with this plan. First, it is a bit difficult for a Japanese investor sitting in Japan with the idea of buying, say, a Canadian bond since a native of a country better understands the financial condition of his country than a foreigner does. So, this can be a big challenge. Second, we are living in an age where international sanctions, wars, recession are quite common. If such things happen, then the investor who has purchased bonds from a country where fresh sanctions have been imposed due to some reason might bear economic losses on this account.

Image source: © Denisismagilov | Megapixl.com

Investing in global bonds can also pose you with an unforeseeable risk. If the bonds go into default, then the path for the investor who is also a foreigner becomes more difficult to recover his losses. Whereas, if the investor purchases bonds issued in his own home country, he has specific legal recourse in the event of default. Therefore, one should invest in Global bonds only after careful analysis on the same. This includes a study about the trading entity involved in the issuance of the bonds, its credit rating by different agencies, fluctuations in the market, the country's economic situation to which the issuer of the bonds belongs, and the legal options available if the bonds go into default.

What are the main countries involved in the issuance of Global Bonds?

In the wake of the Coronavirus pandemic, it is highly expected that there will be an elevation in the market volatility. Thus, it would be a wise decision to treat fixed income allocation as “equities light.” According to data compiled by Bloomberg, Bonds from UK and Austrian issuers were some of the biggest losers this year, with Austrian notes losing more than 3%.

Other than the US, global bonds are also issued by the other governments and corporations of Canada, England, France, Italy, Germany, Sweden, Japan, Switzerland, and many other countries. The main currencies in which these bonds are traded are - Yen, US dollar, Euro and Pound Sterling.

Please wait processing your request...

Please wait processing your request...