What do you mean by Gold Exchange Traded Funds (Gold ETFs)?

Gold Exchange Traded Fund is a special mutual fund scheme that invests in pure physical gold. It is an open-ended exchange-traded fund that invests in traditional gold. Gold ETFs are traded on exchanges just like a share, and money can be withdrawn from the scheme anytime. In addition, one can buy Gold ETF through a Demat or trading account.

Gold ETFs are traded in terms of units, and these units are stored in the Demat account. It is the electronic form of gold storage. This scheme allows an investor to invest in gold but not store it in the locker. Demat account means that the gold held by an investor is stored in an electronic form. Investing in Gold ETF does not mean physical possession of gold. One unit of the gold exchange-traded fund is equivalent to one gram of gold.

It should be noted that gold is inversely related to the stock market; as such, there is an increase in the gold market and the price of gold whenever stock market is turbulent. That’s why gold is the go-to investment when high volatility in the stock market has increased the worries for the investors. Gold ETF’s value increases or decreases in proportion to the price of physical gold.

Gold ETF is a good option for investors who want to diversify their portfolios with exposure to the gold market. Over the last few years, Gold ETFs have outperformed benchmark indices and are thus considered a low-risk investment best suited to the needs of conservative investors. The investors' money goes towards standard gold bullion of 99.5% purity in gold exchange-traded funds. In addition, the brokerage charge for Gold ETFs is between 0.5% to 1%, which helps investors save the commission charges.

Summary

- Gold Exchange Traded Fund is a special mutual fund scheme that invests in pure physical gold.

- It is an open-ended exchange-traded fund investing in traditional gold bullion (gold with 99.5% purity).

- Gold ETFs are traded on exchanges just like a share. One can buy a gold exchange-traded fund through a Demat account.

- Gold is inversely related to the stock market. As such, whenever stock market is turbulent, there is an increase in the price of gold.

What are the features of gold ETFs?

Flexibility

One can buy GETF through a Demat or trading account. Gold exchange-traded funds are traded on a stock exchange by an asset management company (AMC). In Gold ETFs, expense ratios are considerably low as compared to mutual funds.

Liquidity is high

Gold exchange-traded funds are more liquid because they can be traded in the stock exchange during a trading session at the existing price. Besides, the transactional expenses (this includes the broker fees and the government duty) are comparatively low compared to that of physical gold.

Image Source: © Indiaphotos | Megapixl.com

Exposure to the gold market

Gold exchange-traded funds provide the investors with more diversity in their portfolios. In addition, these instruments help investors gain more exposure to the gold market through smaller investment positions, something which was unachievable via physical investment. Since gold can be traded instantly without any hassle, GETFs offer high liquidity.

Safe and Secure

Since GETFs are stored in a demat account, they are considered safer, where investors need not worry about the safety of their gold holdings.

Taxation on Gold exchange-traded funds:

If Gold ETFs are sold before the completion of 36 months, they are taxed as per the income tax slab. However, if sold after 36 months and the holder generates long term capital gains (LTCGs), then the gains are taxed at 20.8% with indexation. Therefore, these funds do not attract VAT.

What do you mean by exchange traded funds?

An exchange-traded fund (ETF) is an investment fund that tracks or imitates market indexes such as the S&P 500, Nasdaq, and Dow Jones and is traded on the stock exchange as a regular stock. They have the characteristic of both a share and a mutual fund. ETFs considerably have a lower expense ratio than a comparable mutual fund. Various types of ETFs include- Stock ETFs, Bond ETFs, Commodity ETFs, Index ETFs, Currency ETFs, Real Estate ETFs, leveraged ETFs, etc. ETFs are more liquid as compared to comparable mutual funds. Exchange-traded funds can also be termed marketable securities because they carry an associated price that makes their sale and purchase easy. The first ETF to track the price of gold was introduced in the US in the year 2004. However, the first gold exchange-traded fund was launched in Australia in the year 2003.

What do we mean by gold funds?

Gold fund is a form of investment fund which invests in different forms of gold, predominantly in gold bullion. The two most popular gold funds are i) Gold bullion and ii) gold mining companies. A gold fund can be defined as a mutual fund or exchange-traded fund. One can make investments in gold funds through a Systematic Investment Plan (SIP). Gold ETFs are traded on exchanges just like a share, whereas financial institutions like commercial banks can access gold funds. To invest in gold funds, one does not need to open a demat account. Just like other mutual funds, gold funds can be purchased from a respective fund house.

Image Source: © Maxxyustas | Megapixl.com

Example of gold funds:

SPDR Gold Trust (GLD) is a popular example of a gold fund; wherein investors invest directly in gold futures contracts. Similarly, VanEck Vectors Gold Miners ETF (GDX) is another popular alternative for those willing to invest in gold mining companies. Thus, investments into gold funds help investors diversify their investment portfolio.

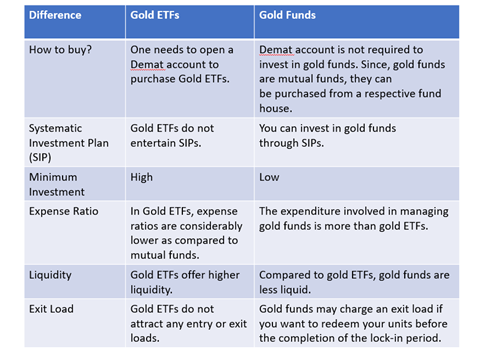

What are the differences between gold funds and gold ETFs?

What are the advantages of investing in Gold ETFs?

- Simple and transparent trading – The process of trading gold ETFs is the same as any other equity-based fund. This makes the entire process smooth and more accessible for an investor as well as ETF funds manager. The process also ensures transparency since gold prices are available to the public in the stock exchange.

- No entry or exit loads – There are no entry or exit loads on trading Gold ETFs, which makes them more cost-effective.

- Low expense ratio: The expense ratio on Gold ETFs is comparatively low as compared to other funds. Investors only have to pay 0.5% to 1% brokerage on transactions.

- Can be used as collateral – Gold ETFs can be used as collateral to secure loans from financial institutions.

- Tax benefits: Wealth tax is not levied on Gold ETFs.

Please wait processing your request...

Please wait processing your request...