What are Growth Stocks?

Although legendary investor like Warren Buffet has reckoned that ‘Growth and Value Investing are joined at the hip’, the market obsession with the divergences in the market multiples across businesses continues to ignite Growth and Value debate.

Thomas Rowe Price Jr is called the father of Growth Investing. Initially a chemist at DuPont, he later opted to work at a brokerage. He set up T. Rowe Price Associates, an investment advisory firm in 1937 and T. Rowe Price Growth Stock Fund was incorporated in 1950.

- Rowe Price Associates is now T. Rowe Price Group, Inc. – a publicly listed global investment management firm. And the T. Rowe Price Growth Stock Fund is still operating.

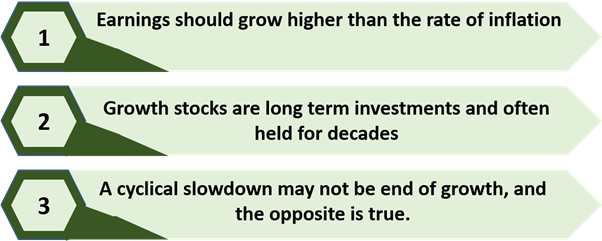

According to Mr Price, a growth stock should be able to retain growth in purchasing power terms, meaning that earnings of the enterprise should increase at a rate more than the existing level of inflation.

He stressed that a cyclical upside in the earnings of an enterprise should not be perceived as the growth of the firm, and the opposite is true when earnings of an enterprise are under strain during a cyclical slowdown.

Mr Price often held stocks for decades and noted that Growth Stocks should be held until the growth in the enterprise is exhausted, or the enterprise is no longer a Growth Stock. He published a list of stocks that were owned by him in the 1930s and 1940s, delivering outstanding returns. These stocks were Black & Decker, 3M, Scott Paper, IBM, Pfizer, DuPont, and Merck & Co.

Investors chase Growth Stock to realise long-term capital appreciation from the investments, which are expected to deliver better-than-average growth in the share price. Growing companies carry the potential to outperform income stocks since growing companies reinvest their profits instead of distributions to exhibit further growth.

Must Read: How To Identify A Growth Stock?

What are the features of Growth Stocks?

High earnings multiple: As a result of high expectations from the market participants, Growth Stocks usually trade at a high earnings multiples. Not all growing companies pay dividends, the potential returns from growth investments are likely to be realised through capital appreciation.

But investors may also feel that the stock is overvalued given its high multiple. Another legendary Growth Investor – Philip Fisher, noted that sometimes high price-to-earnings multiple indicates the intrinsic value of a company rather than discounting for expected growth. Stocks of businesses with long growth run way tend to sustain high multiples as time is in favour of the business. Many growth stocks across the world have traded at high multiples in the era of ultra-low interest rate.

Read: Popular Names Under Growth Versus Value Scanner: TLS, XRO, LLC, SPT, PBH

Target market: Growing enterprises often have a large target market, allowing the business to grow since there are a large number of customers. It is important that the target market is growing because a slowly-growing target market would also impact the growth of the company. Usually, growth companies are found lead the market be it in terms of scale, industry leading margins, over all market share, etc.

A new entrant in the industry: A business could be a growth business when it is a relatively new player in the industry that is challenging other players to gain market share. Since the business is new to the industry, the level of the growth realised by the business could be better-than-average. On account of scale.

A small cap company growing strong: Baby Bunting Delivers Strong Profitability Growth

New product development & innovation: It is crucial for growing enterprises to continuously develop new products driven by innovation, which would require investments in research and development. A disruptive new product in any industry developed by a business has the potential to gain market share due to its value to the customers.

High reinvestment rate: A successful growth enterprise would need to continuously improve its processes and products to deliver a better return on invested capital with sustainable debt. Growth Stocks generally exhibit a high growth rate due to their high reinvestment, which is applied to new product development, enhancement of standard business practices or enter new markets and geographies, especially with high growth potential.

A growth stock raising capital: Afterpay to raise 1 billion in Fresh Capital

Sound management: Management of a business is responsible for the many important decisions in a firm, whether it is purchasing new machinery or acquiring a business. Investors also study the past projections and compare those to realised results by the firm, allowing investors to form a view on management skills.

Qualities of a good management read: 5 Traits of a Good Management Team

It also becomes imperative for investors to evaluate how the business has performed in times of distress like an economic slowdown, and how the management of the business has been able to navigate the business out of the crisis.

Investors also prefer leadership that has delivered results consistently and has a reputation for thinking out-of-box. Studying management style of leadership would enable the investor to know the risks associated with the decision-making.

Moreover, the management team is responsible for capital allocation decision and prudent use of capital that is deployed in the pursuit of growth.

What are the risks associated with Growth Stocks?

Capital allocation: Capital allocation is a crucial exercise undertaken by the management, and investors carefully evaluate these decisions by management. Since Capital Expenditure would deliver benefits in the future, there always remains a risk of underachievement by the business.

It is also important for investors to question the funding sources and the rationale behind those sources. Businesses could take up a huge debt to fund the growth plans, but when the expected outcomes are not realised – the return on capital will deplete.

More on return on invested capital: What Is Return On Invested Capital (ROIC)?

Growing competition: A new entrant in a market with disruptive products remains a major threat to all existing companies in the industry. As competition grows, the management needs to be proactive and responsive to the underlying change in the industry.

Moreover, it is equally important for management to know what their peers are developing and launching in the market. When a business is not paying attention to how its competition is evolving, it could well trigger a crisis for the business.

Small & growing enterprises: In most of the cases, a growing enterprise would be a small business seeking to expand and grow due to its relatively small penetration in the target market. Since small businesses have less diversified revenue streams, new business model and lack of experience in the market, these factors could impact the businesses when growth in the target market slows down, especially during times of cyclical slowdown.

How to select growth stocks?

Growth businesses tend to be leader in a particular category as discusses above. Investors can look for businesses that have shown consistent growth in revenue, margin, market share- if not growth at least sustain market share and show growth in other parameters. These stocks tend to be in good momentum; thus stock price is usually seen trading near or at 52- highs. Growth stocks typically do not provide dividend as they reinvest capital back into the business. Look for good management pedigree as they are the stewards of the business.

The management of a growth stock in the 21st century is expected to build a business that is not just robust but also antifragile.

To know more on antifragility read here: Developing Antifragility was Essential Pre Covid-19; Now It Is A Must- Taleb Your Go to Guru

Please wait processing your request...

Please wait processing your request...