What is Inventory Valuation?

Inventory valuation defines the practice of accounting which helps in performing the valuation of business inventories of a company. Inventory valuation refers to the amount of money required for the operations or production of a company including raw material, goods etc.

Summary

- Inventory valuation defines the practice of accounting which helps in performing the valuation of business inventories of a company.

- The inventory valuation is depends on the costs incurred in order to obtain inventory and in the process of production of goods.

- Inventory valuation is done at the end of every accounting year in order to determine the cost of goods sold (COGS) and the cost of unsold inventory.

Copyright © 2021 Kalkine Media

Understanding Inventory Valuation

Inventory valuation may refer to the calculation of total amount of money related with the production of a company during an accounting year. The inventory valuation depends on the costs incurred in order to obtain inventory and in the process of production of goods. Inventory is considered as the biggest current assets of a company. Through inventory valuation, financial managers of a company evaluate the Cost of Goods Sold of a company and, eventually, profitability of a company because inventory is also used to calculate the gross profit of a company. Gross profit can be calculated by subtracting the cost of goods sold from the revenue of a company at the end of an accounting year. There are various methods which are used for the valuation of inventories.

Inventory many include sale or unsold goods of a company. In the production of goods, inventory may include raw material, semi-finished and finished goods of a company. Inventory valuation is performed by a company at the end of every accounting year to determine the cost of goods sold (COGS) and the cost of unsold inventory.

The values of inventory can be determined by multiplying the total numbers of items with their unit price. According to the Generally Accepted Accounting Principles (GAAP), values of inventory are to be determined by using the lowest of the market price or cost to the company. Inventory valuation represents in the balance sheet of a company as current assets. Costs of inventory do not include any administrative or selling costs, it includes factory overhead, direct labor, handling, direct materials, import duties, freight in.

Frequently Asked Questions (FAQs)

What is the importance of Inventory Valuation?

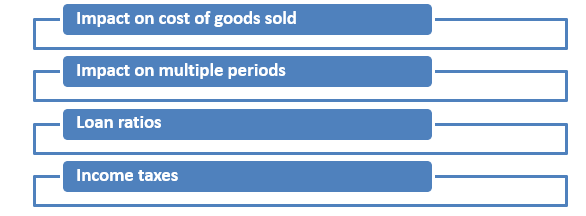

There are various reasons which tell the importance of Inventory Valuation includes:

Copyright © 2021 Kalkine Media

- Impact on cost of goods sold: Inventory valuation plays a vital role to know the impact on cost of goods sold. A higher valuation of ending inventory shows that not so much expense to be imposed to the COGS, and vice versa. So, inventory valuation has a vital effect on the recorded profit levels.

- Impact on multiple periods: Inventory valuation also has a great impact on the reports of multiple periods. If inventory valuation may get wrong, that will lead the recorded profits of two consecutive years to be inaccurate as the ending balance of first year will caries forward to the next year as the beginning inventory balance in the reports.

- Loan ratios: when a lender grants a loan to a company, the loan agreement may involve limitation on the permissible part of current assets of a company to its current liabilities. If a company fails in meeting the targeted ratio, the lender may call loan. Inventory is major component of the current ratio, and its valuation can be more critical.

- Income taxes: The amount that has to be paid as income taxes can be changed based on the cost-flow method. The method called LIFO is used by a company in the years of increasing prices in order to decrease the amount of income taxes paid.

What are the different methods of Inventory Valuation?

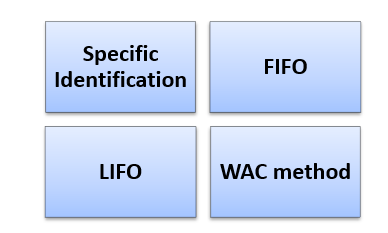

The methods of performing inventory valuation may include the following:

Copyright © 2021 Kalkine Media

- Specific Identification

Specification identification refers to the method, where every inventory item of a company is tracked based on their timing like when an item of an inventory is stocked to when the item is sold. This method is preferred by a company for the big items which are easily identified. Under this method, every item of inventory is tracked by a company through stamped receipt date, its a serial number, RFID tag.

- FIFO

The FIFO method is one of the most used method of inventory valuation. FIFO is First In, First Out. In this method, items of inventory are sold based on its purchasing date, the first item purchased has to be sold first. Or we can say, a company makes a sale of an item which is on the first number in the list of the product (depending on purchase date). The method is based on an assumption that is the older inventory is sold first while the new inventory remains in the warehouse.

At the time of inflation, the FIFO method provides high value of the ending inventory, which lowers the COGS, and results high gross profit. The method fails to give an accurate inventory valuation.

- LIFO

LIFO stands for Last in, first out (LIFO). This method is just opposite of First In, First Out (FIFO). Under this method, the last item purchased has to be sold first. This method is barely used by any company as the newer inventory has to be sold first and the older inventories lose their value because it’s hard to sell old inventories. The method is used by a company at the time of inflation and in order to reduce the taxes.

- WAC method

WAC stands for weighted average cost, in this method, the weighted average cost is used to calculate the amount of cost of goods sold and inventory of a company. The Weighted Average Cost per unit can be calculated by dividing the total Cost of Goods in Inventory with the total Units in Inventory.

Please wait processing your request...

Please wait processing your request...