What is the J curve effect?

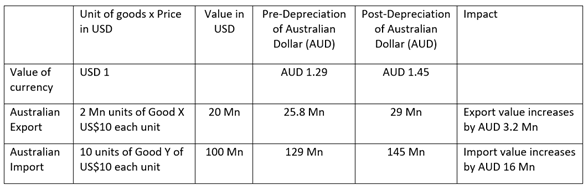

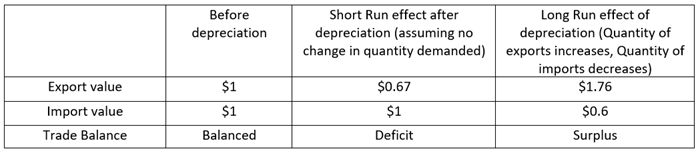

J Curve effect studies the effect of currency depreciation on trade surplus and deficit. By the simple look of it, a decline in currency value will boost exports and decrease imports due to the higher price to be paid as shown in the table below

Copyright © 2021 Kalkine Media Pty Ltd

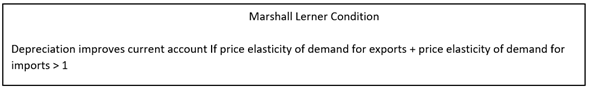

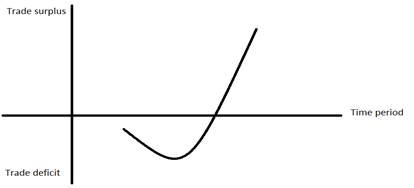

However, it is a more complex process. Initially when a currency depreciates, the current account deteriorates and then improves. This deterioration and the subsequent improvement is represented by a J curve and can be explained with the help of Marshall Lerner condition.

Copyright © 2021 Kalkine Media Pty Ltd

Summary

- J Curve effect studies the effect of currency depreciation on its trade surplus and deficit.

- Decline in currency value will boost exports and cause a decline in imports due to the higher price to be paid as shown in the table below-

- Current account of the balance of payments is impacted not just by currency depreciation but also by factors like consumption patterns in the economy, GDP growth rate and inflation levels too

Frequently Asked Questions (FAQs)

What is J curve?

J curve is a graphical representation of data which shows a period of unfavourable effect on dependent variables followed by improvements at a gradual rate. J curve is used in areas of economics, political science, medical sciences, finance etc.

In the field of medicine, when blood pressure falls below a certain level or rises above it, the risk of cardiovascular diseases is high and thus the J curve. In economics, J curve is used to explain the J curve effect brought about by currency depreciation. In private equity, J Curve demonstrates firms generating negligible cash flows to gradual improvement.

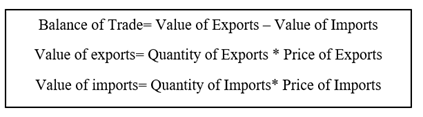

What is the Balance of Trade?

The Balance of trade is a part of the current account of a country’s Balance of Payments. It measures the exports and imports of goods and services. All the receipts and payments for raw materials and manufactured goods are recorded in the current account called visible trade and those for services is called invisible trade. When value of exports exceeds that of imports, it is a situation of trade surplus. If value of imports is more it is called trade deficit.

Copyright © 2021 Kalkine Media Pty Ltd

Price effect and Quantity effect of currency depreciation

It may be noted that when depreciation happens, price effect and quantity effect come into play. In the above example, when Australians have to pay more for the same quantity of Good Y, it is the price effect. But this increased price to be paid will bring down the quantity demanded, and this is the quantity effect. The final effect of devaluation depends on which of the two - quantity effect or price effect - is larger. This is dependent on the price elasticity of demand of the imports and exports. If the extent of change in quantity demanded is greater than that of change in price, then demand is said to be elastic.

Copyright © 2021 Kalkine Media Pty Ltd

How can the J shape of the curve be explained?

Initially, when devaluation occurs, there are pre-existing contracts of the importers and exporters, which may specify the quantity of trade. As a result, in the short run, the importers and exporters may not be able to leverage the change in exchange rate to their benefit.

Also, demand tends to be relatively inelastic because consumers are used to a certain consumption pattern and varying it may take time. As a result, in the short run, the price elasticity of demand for exports and imports is relatively inelastic. Thus, what happens is that the value of imports is higher than the value of imports. This explains the downward segment of the J curve wherein, as shown in the table below, there is a deficit because at the pre-existing consumption levels, the import value exceeds the export value.

Copyright © 2021 Kalkine Media Pty Ltd

However, in the long run, there is an increased consumers’ responsiveness to the price change caused by exchange rate fluctuation. As a result, demand becomes more price elastic and thus as seen in the hypothetical example of Good X and Good Y, the demand for the former increases to 5 units, while the latter sees decline in demand to 6 units. This results in the export value exceeding the import value, leading to a trade surplus explained by the upward sloping segment of the J curve.

Will currency depreciation alone impact the current account?

Current account of the balance of payments is impacted not just by currency depreciation but also by factors like consumption patterns in the economy, GDP growth rate and inflation levels -- all these can impact the competitiveness of the exports. Sometime imports too, may be affected by shocks in the economy. For example, Japanese Yen had been weakening since 2012 and thus exports did see a spike but simultaneously import bills also shot up because there was a domestic demand and supply gap for oil and gas caused due to the shutdown of nuclear plants following the Fukushima crisis in 2011.

Please wait processing your request...

Please wait processing your request...