What is an operating expense?

An operating expense is the cost a company encounters while running its core business operations. This cost is not in direct relation to the manufacture of its products or services, which is why the cost of goods sold (COGS) is not considered a part of operating expense.

Theseexpenses include advertising and marketing expense, office supplies, maintenance and repairs, salaries and wages, etc., mentioned in the company's income statement.

Operating expenses can also be termed as OPEX and operating expenditure.

An operational activity of the company is the crucial function of the company associated with producing and providing the goods and services to the market. The operating expense reflects the cost incurred in performing the operational activity and may vary for every industry.

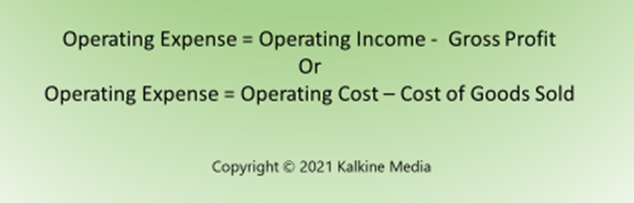

Formula to calculate operating expense:

The company can alter the operating expenses by:

- Automating small business operations like marketing, payroll, etc.

- Outsourcing certain business activities via specialists and experts.

- Paying invoices on time as, at times, vendors do provide discounts.

- Encouraging the workers or employees to look for the inefficiencies.

- Identification of the services that are not in use can help in reducing the variable cost.

- Making the office premises environment friendly.

Summary

- An operating expense is the cost a company encounters while running its commercial business operations.

- COGS is not part of an operating expense.

- Businesses should always encourage to lower operating costs.

- Operating expense is part of calculating the operating cost of the company. Operating cost includes COGS and OPEX.

Frequently Asked Questions (FAQs)

- What is an operating cost?

Operating cost is the expense an enterprise encounters while running a business on a daily basis. It is calculated by adding COGS and total operating expenses.

Operating Cost = COGS + Operating Expense

- What is the importance of operating expense?

Operating expense underlines how much cost a company should bear to generate revenue, which is the primary goal of the business. OPEX helps in managing the stock efficiently and in evaluating the overall cost borne by the company.

It is an essential financial metric used to assess a firm’s present performance to that of its past. However, it is suggested that OPEX is used as a percentage of revenue generated from sales to compare the efficiency among the competitors, called an operating ratio.

For instance, if company A operates at a higher operating ratio, it means it is less efficient in generating revenue from sales when compared to company B.

The management’s agenda is to increase the net income of the company or the bottom line. Therefore, the management is always keen to look at OPEX numbers. To increase operating profit, the company focuses on expanding its sales and reducing operating expenses. By doing this, the company can have the edge over its competitors.

- What is the difference between capital expenditure and operating expenditure?

A business has to bear a variety of expenses, and two of them are capital expenditure (or CAPEX) and operating expense (or OPEX).

CAPEX is the expense taken up by the company to purchase and upgrade the technology and the significant tangible assets like property, machinery, plant, equipment, etc. On the contrary, OPEX is the expense required to keep the day-to-day business activities operational.

CAPEX lasts for longer than one year, and OPEX is deducted from the taxes for the given fiscal year. The return on OPEX is realized in a shorter period (an employee is working daily to earn the monthly salary), and capex takes a longer time span (machinery installed for the upcoming project).

- Are property tax and interest payments part of operating expense?

Operating expenses include only those items that are contributing to the production of the goods and services the enterprise offers. The taxes charged on the net income is not part of the operating expense, but property tax on production facilities is an OPEX. The production facility facilitates the production process.

Similarly, the interest paid is charged on the loans or debt taken up by the company. Interest payments are not directly linked to the manufacture of goods and services.

- Is depreciation an operating expense?

In an accounting period, depreciation is the cost of the fixed and tangible asset that has been used up. The total depreciation cost of the asset is divided throughout its life span. It is a non-cash operating expense.

The depreciating asset (for instance, machinery) contributes to the production of the goods and services, therefore, considered as an operating expense. Charging depreciation on intangible assets is known as amortization.

Adding depreciation and amortization in the calculation of an OPEX helps the company to reduce its taxable income. If the companies fail to do so, it can negatively impact the firm’s profits.

- What is the importance of operating expense in analyzing the operating profit margin ratio?

Reviewing operating profit margin is an important feature while analyzing the stock options. It helps to evaluate the profitability of the company by assessing the management’s role in reducing operating cost and operating expense.

Operating Profit Margin = Operating Revenue / Revenue from Operations

The higher the operating profit margin better the company is performing, keeping other things equal. Operating revenue can be increased if the company is able to reduce the operating expenses leading to an increase in the operating profit margin.

- What is operating expense ratio (OER)?

Operating expense ratio compares the operating expense directly with the revenues. The lower the ratio, the better efficacy rate of the business operations in the given period.

OER = Operating Expense (or Cost) / Revenues

Please wait processing your request...

Please wait processing your request...