What is Sensex?

Sensex is Bombay Stock Exchange’s (BSE) benchmark index. The term was coined by a market analyst, Mr. Deepak Mohoni, and is made by combining two words- sensitive and index.

Source: © Kdrs32| Megapixl.com

Summary

- Stock market analyst Mr. Deepak Mohoni invented the term Sensex.

- The Sensex is a stock market index that tracks changes in the share market.

- It has 30 largest firms those are the most actively traded stocks on the BSE.

Frequently Asked Questions

What is BSE?

BSE, earlier known as the Bombay Stock Exchange, was established in 1875 and is located on Dalal Street in Mumbai, India. It is the Asia's first and fastest stock exchange with a speed of 6 microseconds and is the only first and fastest stock exchange in India.

In equity, derivatives, currencies, mutual funds, and debt instruments the BSE promotes trading with efficiency and transparency. It also offers investor education, risk management and clearing in addition to trading.

The BSE Sensex is most well-known equity index of BSE. It operates on EUREX as well as the stock markets of Russia, China, Brazil, and South Africa and is the most widely used and followed indexes out there.

What role does the Sensex play in the stock market?

The term Sensex refers to an index that represents the Bombay Stock Exchange, which was formed in 1875. The stock exchange did not have an official index until 1 January 1986, and when the Sensex launched, people used it to assess the success of the share market and economy.

The Sensex has 30 largest firms those are the most actively traded stocks on the BSE. Investors and analysts use the Sensex, India's oldest stock index, to monitor the country's economic cycles as well as the rise and fall of specific industries.

The index tracks the movement of the share market. If the Sensex rises, it indicates that the price of shares is rising, while if the Sensex falls, it indicates that the price of shares is falling.

The Sensex, India's oldest and most trusted index, is used to monitor the overall economic growth, progress, and twists and turns so that investors can evaluate the market and make better investment decisions.

Source: Pexels

What causes the Sensex to rise?

Since India's economy was opened in 1991, the BSE Sensex has grown tremendously. The most significant increases occurred in the twenty-first century, when it increased from about 5,000 in early 2000 to over 42,000 in January 2020. This is largely due to India's booming economy, which has been growing at one of the world's highest rates for years.

However, due to the global COVID-19 pandemic that began in early 2020, India's economic growth slowed, casting doubt on potential gains.

What is the Sensex calculation methodology?

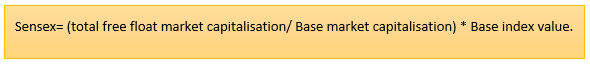

The Sensex is made up of 30 stocks, with market capitalisations and free float market capitalisations calculated for each of them.

The cumulative free float market capitalization of all 30 companies is calculated by adding their free float market capitalizations together.

So, here's the formula:

How does the Sensex differ from the Nifty?

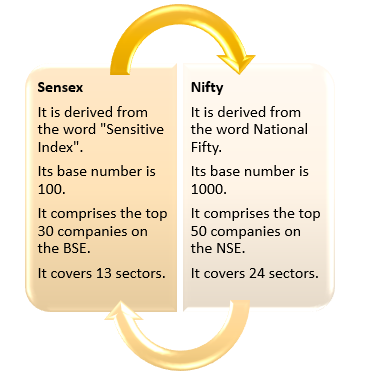

The stock market indexes Sensex and Nifty are used to show the strength of the stock market.

The movement of stocks may be impacted by a number of factors, and hence the index. For instance, when there is an election outcome, a trade war escalates, or a rate cut is announced, the Sensex and Nifty either spike or plunge.

The Sensex index, which is derived from the word "Sensitive Index," is comprised of 30 companies listed on the Bombay Stock Exchange (BSE).

Companies collect capital through an Initial Public Offering (IPO), after which they are listed on stock exchanges such as the BSE and NSE. This gives the general public a better chance to purchase these shares in order to achieve their short or long-term objectives.

The word "Nifty" comes from the term "National Stock Exchange Fifty," and it refers to a group of 50 companies that trade on the National Stock Exchange (NSE). It was first introduced in 1996 as the NSE's benchmark index.

Sensex's base index value is 100 while Nifty's base index value is 1000. The Nifty is a wider business index that includes 24 sectors, whereas the Sensex only includes 13 of them.

Source: Copyright © 2021 Kalkine Media

Which companies are listed on the Sensex?

The companies that are currently listed in this index are among the largest in the world, with the most actively traded stocks.

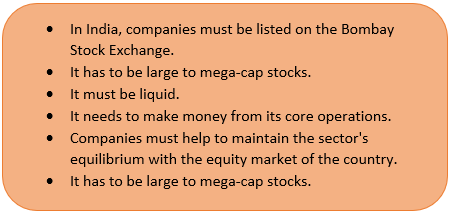

The S&P BSE Index Committee selects companies for inclusion based on the five factors below:

Source: Copyright © 2021 Kalkine Media

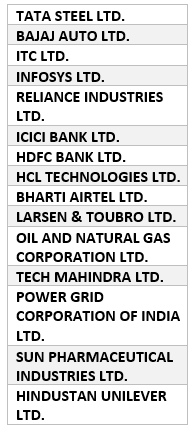

Sensex has 30 companies as of April 2021, a few of which are listed below:

Please wait processing your request...

Please wait processing your request...