What is the S&P 500?

The S&P 500 is the market index including 500 largest publicly traded American companies. S&P stands for Standards and Poors. The index uses market capitalisation as the weights of the various companies, however, there are certain other criteria included in the index setting it apart from other indexes.

© Panteleev83 | Megapixl.com

The S&P 500 is regarded as one of the best indicators of trends in large cap US equities. The index reports the risks and returns associated with these 500 companies, which include some of the biggest players in the market.

The index is used as a benchmark of overall market performance. The companies included in the index range over various sectors and provide a good representation of the overall market trend.

How is the index calculated?

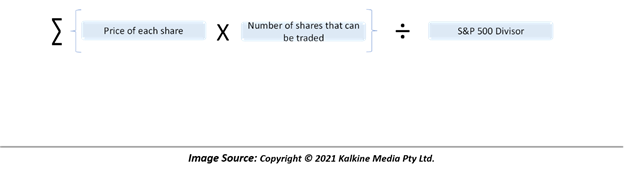

The index can be calculated by taking the price of each individual share times the number of shares that can be traded in the open market, which is known as float. The float-adjusted market cap is thus derived from this step.

The next step is taking the average of all these float-adjusted market caps. This can be done simply by adding the value of all the market caps derived for each company and dividing them by the S&P 500’s divisor. This divisor accounts for all changes in the different stocks listed in the index. These include stock splits as well as entry and exit of companies in the index.

Additionally, the total market cap held by all 500 companies listed in the ASX 500 index amounts to trillions of dollars. Thus, the divisor must also reduce this figure down to a more comprehensive and easy-to-work with figure.

What are the criteria that companies must fulfil before they can be a part of S&P 500 index?

The companies must fulfil the following criteria for them to be included in the index:

- Market Capitalization: First and foremost, companies must have a market capitalization of at least USD 8.2 billion. Market capitalization refers to the total value of the company’s outstanding shares.

- Geography: The companies must be based out of the United States. At least 50% of the company’s fixed assets as well as revenues should lie within the US.

- Listed on US exchanges: The stock cannot be listed on pink sheets or traded over the counter (OTC). Only stocks listed publicly on New York Stock Exchange, Nasdaq, Investors Exchange, or BATS Global Markets are permissible to be a part of the index.

© Breakers | Megapixl.com

- Earnings: The total earnings for the previous 4 quarters should be positive for the company, in addition to having positive reported earnings over the most recent quarter.

- Stock price: The stock price should be at least USD 1 per share. This means than micro cap stocks are left out of the index.

These criteria greatly reduce the number of companies that can be included in the index.

How did the Index come into picture?

The index first came into being in 1923, when it consisted of only 233 companies. The jump to 500 component firms came in 1957 when more companies were added to provide diversity to the index. At the time 425 companies belonged to the industrial sector alone, while 25 companies belonged to the railroads sector and 50 to utility sector.

However, with time, the sectoral composition of the index has seen various changes along with greater diversity. The index reflects the prevailing trends in the market. The current index primarily sees a dominance of technology-based stocks. These account for more than a quarter of the total companies in the index.

Which companies are currently a part of the index?

Following are the top 10 companies included in the index based on their weightage.

- Apple Inc. (AAPL)

- Microsoft Corp. (MSFT)

- com (AMZN)

- Facebook Inc. (FB)

- Alphabet Inc. Class A Shares (GOOGL)

- Alphabet Inc. Class C Shares (GOOG)

- Tesla Inc. (TSLA)

- Berkshire Hathaway Inc. (BRK.B)

- JP Morgan Chase & Co. (JPM)

- Johnson & Johnson (JNJ)

© Winnietam | Megapixl.com

One of the newest entrants into the index is Tesla which has quickly gained pace in the market. The company was added to the index on the 21st of December 2020 in place of Apartment Investment and Management Co. Despite being a newcomer, the company became the 5th largest stock in the entire index.

Why is the index important?

The index holds high importance as it consists of a broad range of stocks without many small companies. Most of these stocks are reputable and are widely owned by investors. This greatly puts the interests of investors into the index.

The top 500 companies make up for roughly 80% of the total value of stocks in the US stock market. This is one of the reasons why it is regarded as a strong benchmark for the stock market performance.

How can one invest in the index?

It is possible for investors to put their money in the index itself rather than in the companies included in the index. This is made possible by buying shares in an index that tracks the S&P 500.

Some of the more popular index funds tracking the index include: Vanguard 500 Index Investor Shares, Fidelity 500 Index, Schwab S&P 500 Index 500 Fund.

© Eamesbot | Megapixl.com

Many investors prefer putting their money in a SPDR (Spider) fund. This is an exchange traded fund tracking the S&P 500. The ETF has low expense ratio and can be easily bought or sold in the open market.

Please wait processing your request...

Please wait processing your request...