What is S&P/ ASX 200 index?

S&P/ ASX 200 is a stock market index comprising of stocks listed on the Australian Stock Exchange or ASX. 80% of Australia’s equity market capitalization is covered by S&P/ ASX 200 index. It was created by Standard and Poor’s (S&P) and is maintained by them. The value of 200 of the biggest public companies is tracked by this benchmark index based on their market capitalization.

S&P/ ASX 200 index is utilized as a barometer to examine the growth and performance of the Australian economy. It is commonly given the symbol ASJO or XJO.

Highly liquid securities which are listed on ASX index are termed as Australian or domestic for index purpose.

Summary

- S&P/ ASX 200 is a stock market index of Australia, tracking the value of 200 of the biggest public companies based on their market cap.

- S&P/ ASX 200 index is utilized as a barometer to examine the growth and performance of the Australian economy.

- All the ASX listed companies are eligible for inclusion in the index.

- S&P/ ASX 200 index is significantly skewed towards financial sector in comparison to the materials, industrials, and healthcare sectors.

Frequently asked questions (FAQs)

Why S&P/ ASX 200 was constructed?

The index was constructed to measure the performance of stocks listed on the ASX (Australian Stock Exchange) by employing float-adjusted market capitalization. The index constitutes of 200 largest eligible companies.

Which companies are eligible for inclusion in the S&P/ ASX 200 index?

All the ASX - listed companies are eligible for inclusion in the index. Presently, the 200 largest companies are included as per the market capitalization. However, stocks with fixed income (also known as hybrid stocks) are not included.

What S&P/ ASX index 200 select companies?

The selection of the companies is done by the committee of S&P and ASX. ASX listed companies are first ranked based on their market capitalisation. Listed investment companies and ETFs are not included in the selection procedure. Those companies are selected that fulfil investment and volume benchmarks.

The process is carried out quarterly (four times a year). In case, a significant event takes place such as a merger or an acquisition, the process may be undertaken intra-quarterly. Prior to commencing the process, two days’ notice is issued in the open market.

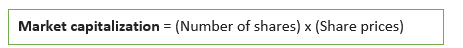

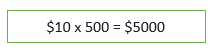

What calculations are undertaken by S&P/ ASX 200 index?

Companies are ranked based on their market capitalisation and the top 200 ranked companies are included.

To illustrate, if XYZ company has 500 shares at the price of $10 each, their market capitalization becomes:

Those companies with a larger capitalisation have a higher weightage attached to them.

What are the characteristics of the S&P/ ASX 200 index?

S&P/ ASX 200 index is significantly skewed towards the financial sector in comparison to the materials, industrials, and healthcare sectors.

The relatively lower number of companies, as compared to some other stocks, indicate that each company has a weight attached to it that is quite higher than the average.

What information does S&P/ ASX provides?

As the investors sell or buy shares of a company included in the index, it would reflect in the movement of the index, that is, the index will either move up or move down. The index allows investors to track the movement of the shares of the included companies daily by examining the change in share prices or percentage change.

ASX 200 had a value of 3,133.3 when it began in 2000, which was equal to the value of most indexes.

What is meant by an increase or decrease in S&P/ ASX 200 by 1 point?

In the stock market, one point is equal to one dollar. Points are generally employed for defining a short-term like day or a week.

Two different stocks can fall or rise by a similar point; however, percentage loss or gain can be different. Points can be used for both individual stock and equity indexes.

Therefore, when it is stated that a share has increased by one point, then it implies that stock has gained one dollar.

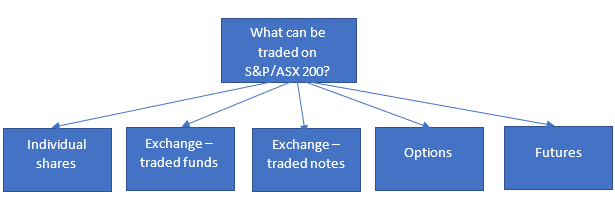

What can be traded on S&P/ ASX 200 index?

Source: Copyright © 2021 Kalkine Media

Shares of the individual companies which are listed on the S&P/ ASX 200 index can be bought or sold. In case, investors want to gain exposure to companies listed, it can be done by trading on an index or through EFTs (exchange - traded funds).

With changes to the value of the share and hence, the index, the value of an investment can decline and increase as well. Some amount of fee may also be applicable and these factors should be considered before making an investment decision.

Range of options and futures contracts are also available for trading on S&P/ ASX 200 index. The index publishes a list of the products where investment can be done on monthly basis.

The index publishes a report that provides information about the Australian market’s implied volatility over a 30-day period.

Please wait processing your request...

Please wait processing your request...