What is statutory reserve?

A statutory reserve is a reserve of money set aside according to an institution's laws and regulations. It is often required to meet obligations with unknown risks of losses. It is seen on the face of the balance sheet in the form of easily convertible assets to cash. Organisations are required to hold these funds in reserve for a specific period as directed by law. The amount to be kept aside in a statutory reserve may vary according to the laws applicable, but it is a certain percentage of total liabilities. The goal is to ensure that the reserve can cover any obligations due in the near future.

One of the most important aims of any organisation is to be solvent and financially stable. Organisations can achieve this by maintaining enough liquid assets in a statutory reserve.

Highlights

- Statutory reserves are funds set aside as necessitated by-laws to hold liquidity for future obligations.

- The statutory reserves help organisations to remain solvent and financially stable even after paying obligations.

- Governing laws in a state decide the amount and type of assets allowed in the statutory reserves.

Frequently Asked Questions (FAQ)

What are the ways to compute balance in statutory reserves?

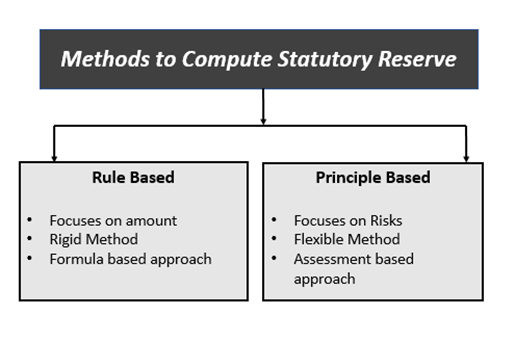

The amount to be kept in a statutory reserve is usually calculated using either of the two approaches—

Source: Copyright © 2021 Kalkine Media

- The rule-based system

In the rule-based system, an organisation focuses on the number of funds required to be kept as a statutory reserve. This is decided on the basis of standardised formulations and conventions. This approach's computation of statutory reserve amount depends on several aspects set out in the fixated formula. This method may not essentially capture the underlying risks completely. The approach is inflexible and does not allow any charge on the business. The computed amount is set aside as per the applicable laws which mandate an organisation to maintain it.

- The principle-based system

As per the principle-based system, flexibility is provided to the organisation. The principle-based approach is different because the focus is not on the amount to be maintained as a reserve but on the risk that an organisation is adept at bearing. The approach considers the organisations’ understanding of business, years of experience and capacity to predict and limit the impact of future risks.

The principal aim of maintaining a statutory reserve is the base of this method of computing reserves. It helps the firms maintain liquidity for providing safety to customer’s investments. This method is also beneficial for companies as it promotes their solvency.

Share an example of statutory reserve?

Insurance companies are required to hold a certain amount of funds in reserves to protect policyholders. The applicable laws may bind the insurance companies to hold a certain percentage of their liquid assets as statutory reserves. Such a reserve will allow the insurers to honour obligations punctually. The insurance companies in financial statements shall also report the statutory reserves as per the regulations of the regulatory laws.

What are the benefits of a statutory reserve?

Source: © Studiostoks | Megapixl.com

The main benefits accrued to an organisation that maintains a statutory reserve are:

- It enables the business to make payments for future obligations or claims on it.

- Maintaining the reserve backs an organisation in making payments even if the business is not any more profitable.

- Investors gain confidence in a firm’s repayment capacity by looking at the statutory reserves it maintains.

- If the organisation is consistent in maintaining the reserve as per law, it attracts more and more investors to the business.

- Customers can rest assured about the payments they may need in the organisation as the statutory reserve will help fulfil obligations even if an unforeseen event befalls.

What are the disadvantages of a statutory reserve?

Just like any other thing, maintaining statutory reserves also brings a few limitations to the organisation-

- It requires a mindful effort from the organisation’s side; this may shift its focus from profitability to reserve maintenance to avoid future penalties.

- As the reserve balance increases, the profits available are reduced.

- Statutory reserves are mandatory and need to be maintained even if there is a commercial loss.

- There is a lot of time and effort needed for maintaining such reserves as proper documentation of assets kept as reserve needs to be maintained.

- The governing law or regulatory body decides the amount of money or assets to be maintained as statutory reserves; there is no scope of flexibility here.

- Assets kept aside as statutory reserves are often marketable or liquid assets. The statutory reserves block their use in business.

What happens on failure to maintain statutory reserves?

If an organisation fails to maintain a statutory reserve-

Source: © Bradcalkins | Megapixl.com

- It may not be able to meet its future obligations.

- Things can go wrong tremendously for firms on which infrequent lump sum claims are made.

- Consequently, claim costs might increase, as seen in the case of insurance companies

- The risk of investors is increased as future insolvency is probable for the firm.

- Not maintaining statutory reserves will also attract fines and penalties as per governing laws.

- Profits of the firm may get eroded in case risks materialise.

- The operational efficiency of the firm will also be affected.

In which kind of business is statutory reserve generally maintained?

In most countries, insurance companies are mandated to maintain statutory reserves. Central banks command even banks to maintain a certain percentage of fund balances as statutory reserves. This is done to avoid the insolvency of the banks and insurance companies. People who deposit small and big savings in the bank are also protected from losses in future. In addition, insurance policyholders are ensured a certain amount of claim by the insurance company even in case of loss to the firm.

Any other kind of business, often a financial institution or other that involves many risks, is generally mandated by governing laws to maintain a statutory reserve.

Please wait processing your request...

Please wait processing your request...