What is stock-based compensation?

Stock-based compensation can be described as a technique of rewarding a company’s employees. Stock-based compensation is also known as Employee stock options (ESOP) and stock options. Stock options are distributed among the company’s employees to attract or retain them, and motivate them to align their interests with the interest of the company’s shareholders.

Summary

- Stock-based compensation can be described as a technique of rewarding a company’s employees.

- Stock-based compensation is also known as Employee stock options (ESOP) and stock options.

- Stock options are distributed among the company’s employees to attract or retain them, and motivate them to align their interests with the interest of the company’s shareholders.

Frequently Asked Questions (FAQs)

What is the working of stock compensation?

Generally, stock compensation is utilised by the start-ups as they do not have enough cash to provide cash incentives or pay competitive rates to the employees. By stock compensation, staff and executives share in the growth and profits of the company. However, the company cannot use stock compensation after a certain limit and must adhere to many compliances and laws such as tax treatment and deductibility, fiduciary duty, expense charges and registration issues.

In stock compensation, companies give the right to the employee to purchase a specified number of the company’s shares for a predetermined price. The vesting can vest for a specific time period or on a monthly or annual basis. The time is decided as per the achievement of performance targets by employees or company or as per some performance criteria. Generally, the vesting period begins after the one year of the employee with the company and the vesting period is generally 3 to 4 years. As soon employees enter the vesting period, they gain the right to exercise their option to purchase the company’s stock at a pre-determined price till the expiration of the stock option.

Image source: © Kiosea39 | Megapixl.com

What are the types of stock options?

Incentive stock options (ISOs) - ISOs are only issued to company employees and not to the company’s directors or consultants. These stock options extend tax advantage to the holder.

Non-qualified stock options (NSOs) – In non-qualified stock options, income tax is paid by the employees on the grant price adjusted with a price of an exercised option.

Phantom stocks – Phantom stocks pay cash bonuses on a future date and the value is equal to the value of predetermined shares.

Stock appreciation rights (SARs) - SARs are the rights extended to the employees, in which the value of shares is either paid in shares or cash.

Employee stock purchase plans (ESPPs) – ESPP stock option give the right to the employee to purchase shares of the company at discount.

Restricted Stocks – Restricted Stock Units (RSUs) are enjoyed by the company’s employees through reward, gift or purchase after the employee meets certain performance goals or the employee completes a specific duration with the company. Vesting period completion is a crucial part of restricted stocks. The vesting can be completed over a specific duration or any other alternative that is suggested by the management. RSUs can be interpreted as a promise by the company to pay shares based on the vesting schedule. Generally, the employee does not enjoy any benefit with RSUs as they do not get any ownership rights such as voting rights till the shares are issued by a company or earned by them.

Performance shares – Performance shares are awarded to the managers and executives only after they meet certain specific measures. Certain specific measures can be targeted EPS (Earnings Per Share), return on company stocks, or ROE (Return on Equity). Since the targets can only be achieved in long run, the time horizon of performance shares lasts for many years.

What are the impacts of stock compensation on financial statements?

Impact on Income statements:

Reduction in net income – The share based compensation are considered as the expense to the company and is recorded in the expense column of the income statement. As a result, the net income is reduced.

Earnings per share – EPS is affected when the stock option is exercised by the employee or option holders. When the option is exercised by the holder then the company is required to issue additional shares for compensating the investors or employees. This results in an increase in the number of outstanding shares and therefore the EPS of the company declines.

Impact on cash flow

There are two ways by which the employees can be compensated, namely, cash and by issuing shares. When a company compensates employees through cash then there is cash outflow in the cash flow statement from the financing activities. The impact will be recorded in the balance sheet as well, deductions are done in the cash column. When the company issues share for compensating employees then there is no effect on the cash flow statement as the transaction does not involve cash.

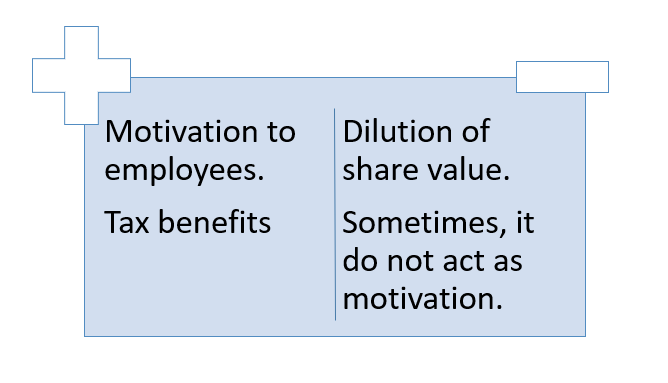

What are the advantages and disadvantages of stock compensation?

Following are the advantages of stock compensation

Stock compensation can be seen as an opportunity to share a company’s profits. Since employee’s earnings increase with the increase in the company’s profit, they have a feeling of being the shareholders. The ownership in the company acts as a motivation for the employees and as a result, the employees work harder to increase the company’s profit. Moreover, the stock compensation also extends tax benefits after the disposal or sale of the shares issued. Sometimes, it is also utilised as an exit strategy by the owners.

Following are the disadvantages of stock compensation

The major disadvantage that is associated with stock compensation is that the share value can be diluted which might not grab the experience of the shareholders from the long-run perspective. It can be a challenging task to value stock compensations and might result in higher compensation to the company’s executives. Lastly, stock options as incentives can become a difficult task for the employees as the output is dependent upon the whole team and management.

Please wait processing your request...

Please wait processing your request...