What is Tax Bracket?

A tax bracket defines the income range and the income tax rate that will be charged against a specific income range. A progressive tax system is used in the tax bracket, that is, the tax rate increases with the increase in the income of the individual. The low income brackets are charged lower tax rates and higher income individuals fall in the category of higher tax rates.

Internal Revenue Services (IRS) is the agency that determines the tax bracket in the US. IRS employs a progressive tax system and there are 7 tax brackets and the tax range is different for each bracket, ranging from 10% - 37%. The dollar range is different for different filers, such as married joint filers, single filers, head of household filers, married filing separately. With the filers, there are presently 20 tax brackets in the US.

For ascertaining the personal tax bracket, the individual is first required to calculate taxable income. Taxable income is calculated by subtracting deductions and adjustments from the investment income and earned income.

Highlights

- A tax bracket defines the income range and the income tax rate that will be charged against the specific income range.

- A progressive tax system is used in the tax bracket, that is, the tax rate increases with the increase in the income of the individual.

- Internal Revenue Services (IRS) is the agency that determines the tax bracket in the US. IRS employs a progressive tax system and there are 7 tax brackets and the tax range is different for each bracket.

Frequently Asked Questions (FAQs)

How to locate a personal tax bracket?

There are numerous methodologies and techniques by which the personal tax bracket can be located. The IRS ensures that all the required information is available on site regarding the taxable income, income brackets, tax rates and detailed information about the tax filing status.

There are different websites that help in locating the tax bracket. These sites only ask for the taxable income and filing status. The tax bracket can change because of the change in income and inflation. Therefore, it is generally suggested to remain updated about the tax brackets.

What is the difference between the tax brackets and tax rates?

Quite often, the terms tax bracket and tax rate are used interchangeably, however, they do not have similar meanings. The tax rate stands for the percentage of tax that is charged on the income and the tax brackets have different tax rates. The tax rates are also known as marginal rates. The taxpayers who fall in the category of the lowest tax bracket are not subjected to different rates. Most of the taxpayer’s population is taxed progressively as they have to pay a range of tax rates, that is, they are not limited to a single tax rate. The tax bracket does not state the exact tax percentage that an individual is required to pay. The tax bracket does not define the effective tax rate.

What myths are associated with the tax bracket?

There is a general opinion among the people that higher earnings mean that they will be required to pay higher taxes. The higher taxes means that they will be left with less money for fulfilling personal needs, instead, it is better to earn less.

However, this is not true as the tax rate is charged on each dollar that is earned by the individual. The rate which is applied to the lower tax bracket does not change when the individual moves to the upper tax brackets. For instance, if an individual falls in the lowest tax bracket, then they pay only a single tax rate. If the individual moves to a higher tax bracket, say a 24% bracket, then they would have to make the tax payment in 4 different rates.

The tax brackets are created in such a manner that the more an individual earns, the more money he/she is left with after paying the taxes.

What pros and cons are associated with the tax bracket?

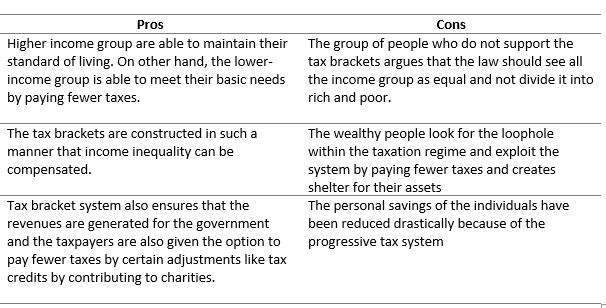

Pros – Tax brackets follow the progressive tax systems, as a result, the individual with lower income pays less tax and people with higher income pay higher taxes. Even by paying higher taxes, they are able to maintain their standard of living. On other hand, the lower-income group is able to meet their basic needs by paying fewer taxes.

The tax brackets are constructed in such a manner that income inequality can be compensated for as it is only fair that the wealthy are paying more taxes than the lower income groups. Therefore, the term progressive can be interpreted from two aspects. Firstly, the increase in the tax rate along with the tax brackets and lower-income groups are also given advantages.

This system also ensures that the revenues are generated for the government and the taxpayers are also given the option to pay fewer taxes by certain adjustments like tax credits by contributing to charities.

The amount of tax paid by the high-income group of taxpayers is invested in the growth of the economy.

Cons – The group of people who do not support the tax brackets argue that the law should see all income groups as equal and not divide them into rich and poor. They further supported their argument by stating that there is a difference between the amount paid and the government representatives that receive it. Some pointed out that people are given only one vote irrespective of their income slab.

In addition to this, the wealthy people look for the loophole within the taxation regime and exploit the system by paying fewer taxes and create a shelter for their assets. In effect, they pay fewer taxes, and the government does not receive the revenues.

Lastly, the personal savings of the individuals have been reduced drastically because of the progressive tax system.

Please wait processing your request...

Please wait processing your request...