A value fund is a type of mutual fund which aims to invest in stocks that are fundamentally strong but are undervalued. The fund managers’ investment strategy is that the share prices will rise once the market realises such stocks' potential. The value fund investors thus earn profits from this increase. Often, the stocks chosen for a Value fund’s portfolio are from trustworthy firms offering dividend payments to investors. Value funds are focused on the intrinsic value of a stock and chose stocks after proper due diligence. The allocations in these funds are for long-term investment and grow steadily over time. As a result, the funds benefit from inherent inefficiencies of markets.

Highlights

- Value funds aim to invest in stocks that are fundamentally strong but are undervalued.

- Value fund’s portfolio consists of assets from trustworthy firms offering dividend payments to investors.

- Often knowledgeable Investors who understand the vitality of fundamentals go for value funds. These investors want their investments to grow steadily with minimal unexpected gains.

Frequently Asked Questions (FAQ)-

What are the key features of a Value Fund?

- Value funds display the following identifiable features-

- The portfolio is made of out-of-favour and discounted stocks of well-established businesses.

- The stocks held by value funds often pay regular discounts.

- Earnings to investors are from the rise in prices of portfolio stocks when they start beating market inefficiencies.

- It follows the value investment strategy in contrast to growth investing, focusing on high growth from emerging businesses.

- Stocks are selected based on the intrinsic value they have.

- Allocations by value funds are for long-term investments expected to grow continuously over time.

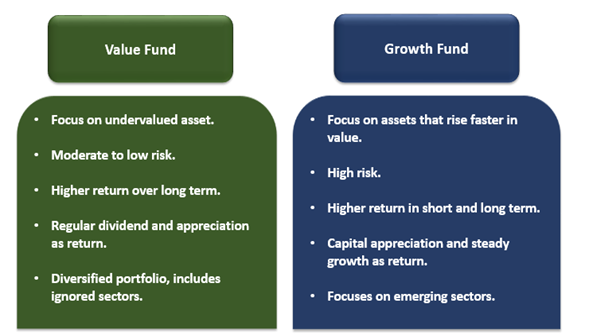

How are Value Funds different from Growth Funds?

Source: Copyright © 2021 Kalkine Media

- The growth fund portfolio registers higher earnings than a value fund portfolio that offers higher dividends to cover slow gains.

- Value funds have a lower cost and are cheaper to buy for investors than a growth fund.

- Value funds offer investors steady returns for a more extended period of time, whereas growth funds provide higher returns in the short and long term.

- Value funds are known to have performed better during a recession and stay afloat longer than growth funds.

- Value funds have regular dividend payouts. However, in growth funds, investors often sell or redeem investments to book profit.

- Growth funds are a higher risk option for investing as compared to value funds. The growth funds are significantly correlated to market movements and thus prone to fluctuations.

- Taxation differences may exist in various countries depending on the type of fund.

Which type of investors prefer Value funds?

- Often knowledgeable Investors who understand the importance of fundamentals well go for value funds.

- Those investors want their investments to grow steadily with minimal unexpected gains.

- Patience is essential in investors who park their money in value funds.

- Investors of a value fund are prepared for moderate to high losses, even when the market is performing well.

- Most Investors in such funds have a common purpose of earning income or yield.

- It is preferred by retired individuals because of the fund managers' due diligence while choosing stocks and the almost regular dividends stocks pay.

- The value fund investors are often reinvesting the dividends received to buy more shares of the fund.

What are Benefits of investing in Value Funds?

Image Source: 5 © Rawpixelimages | Megapixl.com

- Value funds offer exposure to a well-diversified portfolio of stocks.

- The investment strategy brings out less vulnerable, undervalued stocks that an individual investor cannot quickly identify.

- Value funds search for assets across economic sectors and include sectors often overlooked or not so popular.

- Value funds boost the market confidence in the underperforming stocks which they have identified after due diligence.

- Value funds generate profits without getting influenced by market productivity. They often outperform growth funds.

- Value funds bring out high-value companies for their investors.

- The value funds do not go with the Mob mentality and find value when everyone else ignores it.

- The funds invest in shares, mutual funds, Exchange Traded Funds and other assets.

- They provide investors with the benefits of investment portfolios carefully curated by expert advisors and fund managers.

- Value funds offer investors a reliable, consistent income in the form of dividend payments received.

- These funds provide excellent capital gains opportunities.

- Value funds adopt a low-risk, high-rewarding investment strategy.

- Investors in value funds get benefits of long-term financial stability provided by the fund portfolio.

What are some myths linked to Value Funds?

Please wait processing your request...

Please wait processing your request...