What is Value Investing?

Value investing is an investment strategy seeking to target business that is selling at a level below their perceived intrinsic value. The investment philosophy was developed by Benjamin Graham and David Dodd, and it was elaborated in the book Security Analysis.

Value-driven opportunities are found by evaluating companies according to book value or tangible book value. It is understood that value stocks are those trading at a discount to their book value or tangible book value or intrinsic value.

A lesson in investing strategies: Types of Investment Strategy in Equity Market

What are value stocks?

Earlier in the last century, the markets used to pay more attention to annual dividend yield, which was an important metric. Also, the tangible asset backing in the company is also assessed by the investors.

The price-to-earnings ratio (P/E ratio) grew popular in the US during the late 1920s. It also reflected that earnings could grow higher than the dividends. While dividends yields, P/E ratio and asset-backing were the main things to be assessed, the retained earnings of the business were also evaluated.

Although the P/E ratio remains popular, the essence of price-to-book ratio (P/B ratio) grew in evaluating value stocks. Evidently during the times of stock market bubble, the P/E ratio for companies with high expectations has reached to extraordinary levels.

Value stocks are traded at prices well below their perceived intrinsic value, typically due to some sort of headwinds that the business or the sector is undergoing. The intention is to buy stocks that are underestimated by the market at given price levels. It is also understood that market prices of stocks should reflect intrinsic value over time.

Value investing is a long-term strategy seeking to buy such stocks. But not all quantitatively cheap stocks reflect value, therefore the focus on quality of businesses increased as quantitatively cheap stocks could sometimes reflect true value rather relatively lower multiples than peers.

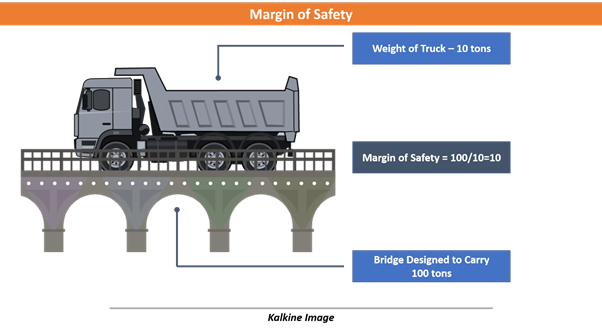

Benjamin Graham called this difference between intrinsic value and market price as the margin of safety. Value stocks should provide a sufficient margin of safety to be determined as a value stock. This margin of safety exists due to the inefficiency of markets to price stock accurately.

The disparity between the intrinsic value and market price of the stock can extend to years; it is the reason why value investing is a long-term approach. Over the years, value investing has been championed by great investors like Warren Buffet, Peter Lynch, Seth Klarman, Templeton etc.

Good read: Should you follow Templeton's investment mantra in today's scenario?

Modern considerations in Value Investing

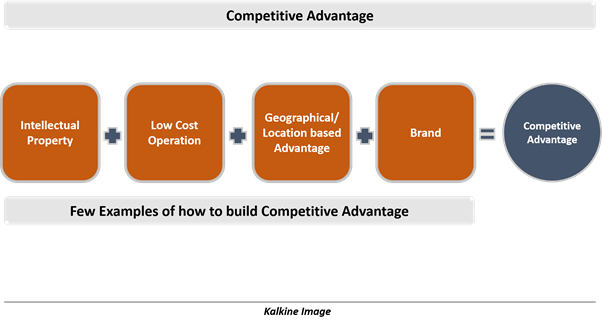

Competitive advantages: A firm can be better off rival firms through developing competitive advantages over its rival firms. Competitive advantages are strategies for operating a business that gives an edge over the firms.

Companies can develop competitive advantages by investing in intellectual property, know-how, improving labour productivity, geographical presence, manufacturing at relatively lower costs, developing brand image and awareness.

Competitive advantages enable a business to generate better margin than peers, therefor generating value for the business and owners. At the same time, they must be hard to replicate to avoid competition.

Cash flows and applications: Investors prefer cash-generating companies, and companies tend to strive for high cash generation to achieve better profits and scale. Cash flows are crucial to pay-off obligations and investments.

Free cash flow is a widely used metric in corporate finance to evaluate the business’ capability to pay off its obligations after incurring cash outflow on capital expenditure. It reflects the cash generated by a business operationally after capex.

Value investors look for businesses that can reinvest net cash from operations into the business to increase the enterprise value of the firm. Capital expenditure and investments of the business should be deployed efficiently to expand the business.

Asset-backing: The investments undertaken by a firm mostly result in the addition of the assets or increase in the value of assets. Value investors prefer companies having assets that could generate long-term gains for the business.

Although they look for the asset base of the company, it becomes imperative to evaluate the return generated on those assets. Capital allocation is one of the key decisions undertaken by firms to grow assets, but capital allocation could sometimes prove to be detrimental as well.

Value investors evaluate the capital allocation decisions of the firm carefully to assess the potential impact on the business over the future. Investments undertaken by the management can either make or break the company’s future.

Barriers to entry: These are the obstacles faced by new competition while entering a new market where existing players have developed a barrier to entry to avoid competition. Barriers to entry can include technological challenges, intellectual property, high start-up costs, licensing, Government regulations etc.

Value investors have stressed on the need for barriers to entry as it allows the business to grow profits across cycles.

Read: Become A Millionaire By Investing In Value Stocks!

Balance sheet: It is a financial statement of the company which enumerates the assets and liabilities of the business as of business date. A balance sheet reflects the obligations of the company and assets, which can be used to settle obligations.

Value investors prefer looking at the balance sheet as it allows to assess near-term and long-term obligations of the business.

Read: Be A Smart Investor, Escape These Myths While Investing In Stocks

Value investing Vs Growth Investing

Value investing is usually applied to investing in companies that are profitable and established. Growth investing can include companies that are relatively new to the markets and are growing relatively better than their peers.

Even though legendary investors have avoided value and growth debacle, noting that both are same. The divergences in the expectations from the business also set two investing philosophies apart. Investors expectation are high for growth, translating into a higher premium in the share price, while expectations from value stocks are relatively lower.

Read: The battle of Investment Philosophies; Growth Vs Value Investing in Australia

Please wait processing your request...

Please wait processing your request...