What is a Yankee bond?

Yankee bonds are issued by foreign institutions such as foreign financial institutions and foreign banks. These bonds are issued and traded in the US dollar in the United States. The Yankee bonds are governed under the security Act of 1933. A lot of documentation is required to get the bonds registered. The credit rating of the Yankee bonds is done by the agencies such as S&P, Moody’s.

A trader can also trade in reverse Yankee bonds. The reverse Yankee bonds are issued and traded outside the United States in the currency of the respective country.

What is the Yankee market?

The Yankee market is located inside the United States where foreign securities such as Yankee bonds are bought and sold.

Summary

- Yankee bonds are issued by foreign institutions such as foreign financial institutions and foreign banks and are available in the United States for trading in USD only.

- A lot of documentation is required to get the bonds registered.

- The credit rating of the Yankee bonds is done by the agencies such as S&P, Moody’s.

- A trader can also trade in reverse Yankee bonds, which are issued and traded outside the United States in the currency of the respective country.

Frequently Asked Questions (FAQs)

How do yanked bonds work?

Let us assume that a company has a headquarter in Morocco. When the company issues a bond that is denominated in the US dollar in the United States, then the bonds will be termed as the Yankee bonds.

Yankee bonds are similar to bonds, that is, the borrower is obligated to pay the principal amount and certain amount of interest rate in accordance with the terms of indenture. The yanked bonds need to be registered with the SEC and the registration process might take months.

What is the difference between the yanked bonds and the Eurobonds?

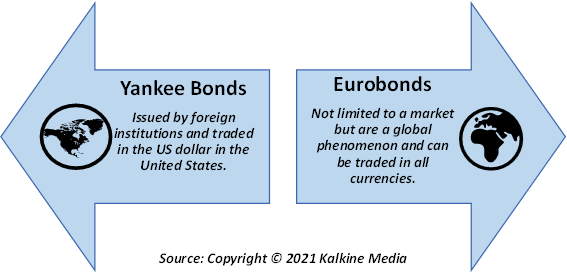

Generally, Yankee bonds and Eurobonds are seen as similar by the investors and confusion is created. However, there is a significant fundamental difference between Yankee bonds and Eurobonds.

Yankee bonds are the US market bonds, on other hand, the Eurobonds are not limited to a market but are a global phenomenon.

There is a misconception that Eurobonds can only be traded in Euros. The misconception arises from the name. However, the Eurobonds can be issued and traded in all currencies. In Eurobond, the bond can be issued in any currency except the country’s currency in which the bond is issued. To illustrate- a company in a European country issues a Eurosterling bond for borrowing sterling, but the bond cannot be issued in sterling. Another example can be an American MNC issuing a Eurodollar bond to raise the US dollar in Britain.

What is the significance of yanked bonds?

Yankee bonds can extend a significant amount of advantage to the issuers in case they make borrowings inexpensive. The issuer of the Yankee bonds benefits from the favourable lending conditions and regulatory requirements of the US. Moreover, the issuer can take advantage of the large bond market of the US.

Yankee bonds are liked by the investors because they offer the facilities of currency diversification and geographic diversification as well. Tax advantages are also adjoint with the Yankee bonds. The income stream is in the dollar, which can be used by the investors to pay off the dollar-denominated obligations.

However, the investors are exposed to the risks above the standard interest rate risk and credit risks. A dramatic and quick change can be observed in the exchange rates, and it can drastically affect the returns of the foreign investors (non-US investors).

What are the advantages of yanked bonds?

- Portfolio diversification – The investors can diversify their portfolios as entities outside the US issue Yankee bonds in the US market. The investor will be able to make an investment in a range of emerging economies.

- Limited currency risk – The currency risk is negligible as the bonds are issued in the US dollar currency and the repayment (either interest or principal amount) is also done in the US dollar only. Therefore, investors are protected from currency risk.

- Liquidity – The Yankee bonds are traded actively in the Debt market of the US. Therefore, the investors are provided with highly liquid bonds.

- Economic risk is limited - The bond’s prices are not affected dramatically by the economic and the political factors which are prevailing in the home country.

- Access to the US bond market – After completion of the SEC requirements for issuing Yankee bonds, the issuers gain access to the US market.

- Fund’s availability – The tenure of the Yankee bonds is long; therefore, the issuer has the access to the fund for a longer duration.

- Lower cost – The funds can be accessed in the market at a lower cost in comparison to the cost in other markets.

- High yield – The yield on the investment is higher in the Yankee bonds in comparison to the other investment portfolios of America.

What are the disadvantages of yanked Bonds?

- High risk – the risk in the Yankee bonds is high along with high rewards. Hence, only those investors should invest in the Yankee bonds who have high risk appetite.

- Converted to the junk bonds – The Yankee bonds can be converted into junk bonds when the financial performance of the issuers is not satisfactory. Moreover, the performance of the issuing company is affected by the nation’s law, therefore, any amendment in the law can significantly affect the performance of the company.

- Mismatch in the currency – In case of the foreign companies, currency mismatch may take place. For example, the borrowing is done in the US dollar; however, the earning is not in the US dollars. In case, the home currency depreciates against the US dollar, then the company must take actions to pay the bondholders and mitigate the risk.

- Registration procedure – The procedure for registering with the SEC is complicated and can take months, and every issuer must go through the complicated procedure.

- Relation with the US interest rate – Yankee bonds have gained popularity among American investors in comparison to domestic bonds because of the high yield after the sub-prime crisis. When the interest is low in the US market, the Yankee bonds are sold off.

Is yanked bond a good investment?

The high yield of the Yankee bonds might attract many investors, however, the risk associated with the bonds should not be ignored. The risk includes the impact of the home country’s economy on the bonds. In case the country of the issuing company is shaky and is not promising, then the returns will be affected. The investor should choose the Yankee bonds carefully and considering the country of the issuers.

The Yankee bonds eliminate the currency risks’ direct impact on the bonds; however, it is crucial to acknowledge that they are affected by the indirect currency risk. When the issuing company is making borrowings in the US dollar and their earnings are in home currency. Any depreciation in the home currency against the US dollar will have an effect on the value of the Yankee bonds.

Please wait processing your request...

Please wait processing your request...