0R15 8884.0068 1.4156% 0R1E 9171.0 0.4381% 0M69 None None% 0R2V 254.3746 5.7691% 0QYR 1619.0 1.9521% 0QYP 436.689 -0.8652% 0RUK None None% 0RYA 1604.02 0.4396% 0RIH 190.8 0.0% 0RIH 198.5 4.0356% 0R1O 225.0 9877.8271% 0R1O None None% 0QFP None None% 0M2Z 255.4879 -0.0829% 0VSO 33.09 -7.0636% 0R1I None None% 0QZI 599.0 0.0% 0QZ0 220.0 0.0% 0NZF None None% 0YXG 225.74 -0.2871%

Section 1: Company Overview and Fundamental Insights

1.1 Company Overview:

Nichols PLC (LSE: NICL) is an FTSE AIM UK-50 index-listed, international soft drinks company. The Company is engaged in the supply of soft drinks to the retail, wholesale, catering, licensed, and leisure industries. It has sales in over 73 countries, selling products in both the Still and Carbonate categories. Kalkine’s Penny Report covers the Investment Highlights, Key Financial Metrics, Risks, and Recent Business Updates along with the Valuation, Target Price, and Recommendation on the stock.

1.2 The Key Positives, Negatives, Highlights and Risks

1.3 Top 10 Shareholders:

The top 10 shareholders collectively form ~47.23% of the total shareholdings. Octopus Investments Limited holds the maximum number of shares with ~8.04% shareholding, followed by Harper (Susan Jane) with ~7.33% shareholding, as depicted in the chart below:

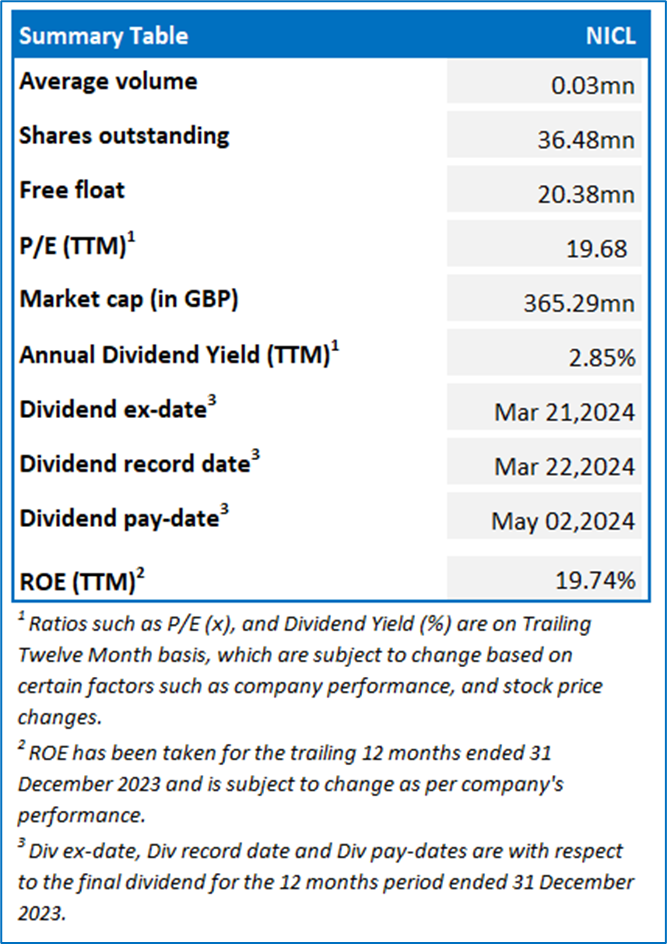

1.4 Key Metrics:

Section 2: Business Updates and Financial Highlights

2.1 Recent Business Updates

2.2 Financial Highlights:

Section 3: Key Risks and Outlook

Section 4: Stock Recommendation Summary

4.1 Price Performance and Technical Summary:

The stock has witnessed a rise of ~9.75% in the six months. The stock has a 52-week high and 52-week low of GBX 1,520.00 and GBX 882.00, respectively, and is currently trading below the average of 52-week high-low average.

4.2 Fundamental Valuation

Valuation Methodology: Price/Earnings Approach

Please note markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is 10 April 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: Kalkine reports are prepared based on the stock prices captured either from the London Stock Exchange (LSE) and or REFINITIV. Typically, both sources (LSE and or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Note 6: Dividend Yield may vary as per the stock price movement.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.