0R15 9025.0 0.0% 0R1E 9410.0 0.0% 0M69 None None% 0R2V 247.99 9682.643% 0QYR 1567.5 0.0% 0QYP 439.3701 -2.9016% 0RUK None None% 0RYA 1597.0 1.2682% 0RIH 195.55 0.0% 0RIH 191.4 -2.1222% 0R1O 225.5 9683.0803% 0R1O None None% 0QFP 10475.8496 107.8542% 0M2Z 252.573 0.2373% 0VSO 33.0 -7.3164% 0R1I None None% 0QZI 622.0 0.0% 0QZ0 220.0 0.0% 0NZF None None% 0YXG 222.05 -4.1318%

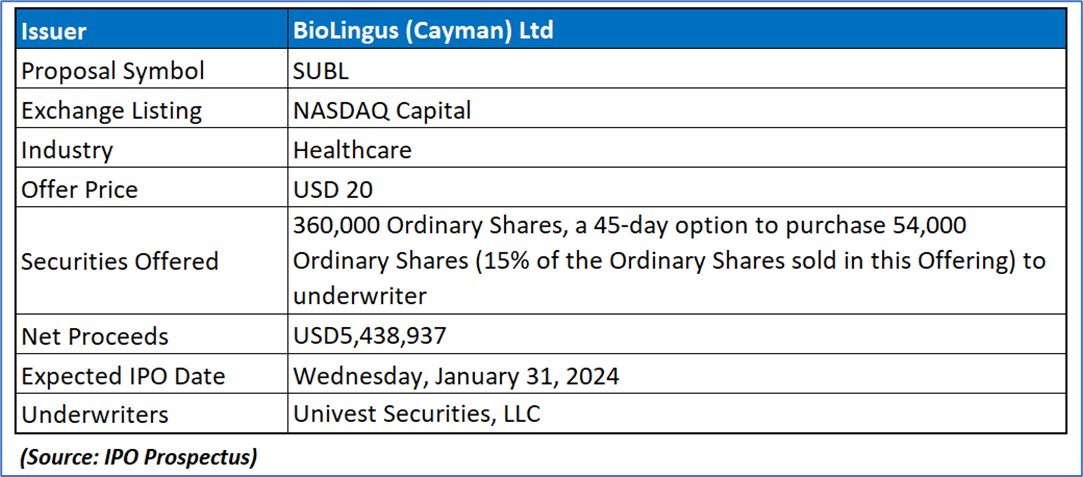

The Offer

Company Overview

SUBL is a limited liability exempted company incorporated in the Cayman Islands, with its primary business operations conducted through subsidiaries in Switzerland, Hong Kong SAR, the People’s Republic of China, and Australia. Each subsidiary operates independently with distinct yet complementary activities. As a pioneering biotechnology company, SUBL's focus lies in developing oral, specifically sublingual, delivery methods for peptides and proteins. The listing company, BioLingus (Cayman) Limited, functions as a holding company without material operations and was established on August 8, 2018. Serving as its parent entity, BioLingus (Cayman) Limited oversees BioLingus (BVI) Limited, also a holding company without material operations, incorporated in the British Virgin Islands on August 2, 2019. The Swiss wholly owned subsidiary, Biolingus IP GmbH, founded on July 25, 2014, by founders Yves Decadt, Thomas Ko, and Didier Coquoz, focuses on researching improved efficacy in sublingual/transmucosal delivery for metabolic diseases like diabetes and obesity. Following years of research, SUBL has identified two primary areas of application for its technology: Metabolics (primarily obesity and diabetes) and Immunology (mainly allergy and auto-immune disorders).

Key Highlights

Primary Offering:

Anticipates net proceeds amounting to USD 5,438,937 from the issuance of 360,000 Ordinary Shares priced at USD 20.00 per share. This calculation is derived by subtracting underwriting discounts of USD 504,000, an accountable expense allowance of USD 250,000, and estimated offering expenses payable by the company, totaling approximately USD 1,007,063, from the overall offering proceeds of USD 7,200,000.

Use of proceeds:

Based on the envisaged initial public offering price of USD20.00 per Ordinary Share, SUBL estimates that it will secure net proceeds of USD5.4 million from the Offering, considering anticipated underwriting discounts and offering expenses. The principal aims of this Offering encompass acquiring additional capital for business expansion, retaining skilled employees through equity incentives, and establishing a public market for Ordinary Shares. SUBL intends to allocate approximately 70% of the net proceeds to advance its Liraglutide Sublingual through Phase IIb studies and potential Phase III initiation. The remaining funds will be directed towards activities like repaying external borrowings, supporting working capital, and meeting general corporate needs. Emphasizing management's discretion in utilizing the net proceeds, SUBL acknowledges that decisions may be influenced by market conditions and emerging opportunities. Although the primary intention is to invest unused proceeds in short-term, interest-bearing instruments, unforeseen events or evolving business conditions may prompt alternative uses.

Dividend policy:

SUBL has never distributed dividends and plans to retain future earnings for business expansion, with no expectation of cash dividends in the foreseeable future. The board of directors holds discretionary authority over dividend distribution, adhering to Cayman Islands law restrictions. Dividends may only be paid out of profits or share premium, with the company avoiding any actions that could hinder debt payment in the ordinary course of business. Shareholders can declare a dividend by ordinary resolution, not exceeding the board's recommendation. The timing, amount, and form of potential dividends depend on various factors, including operational results, cash flow, capital requirements, surplus, subsidiary distributions, financial condition, and contractual restrictions. Any future dividends, if determined, rely on funds from operating subsidiaries in Switzerland, HK SAR, the PRC, and Australia. PRC regulations permit BioLingus Beijing to pay dividends to BioLingus (Hong Kong) Limited from accumulated profits, following Chinese accounting standards. However, BioLingus Beijing must allocate 10% of after-tax profits annually to a statutory reserve until reaching 50% of its registered capital, with such reserves not distributable as cash dividends unless during liquidation.

Industry and Market Analysis

Industry Overview:

Diabetes and Obesity:

Diabetes: Diabetes, a chronic condition, arises when the body cannot produce sufficient insulin or use it effectively, leading to elevated blood glucose levels. Hyperglycemia can result in severe organ damage, including cardiovascular diseases, nerve damage, kidney dysfunction, blindness, and circulation issues. Two major types exist: Type 1, where the body produces little or no insulin, and Type 2, involving insulin resistance. Symptoms range from excessive thirst to diabetic ketoacidosis. Treatment options include oral medications, GLP-1 agonists, insulin, and the recent FDA-approved semaglutide.

Overweight and Obesity: Overweight and obesity, defined by abnormal fat accumulation, pose significant health risks, with over 4 million annual deaths attributed to these conditions. Rates are escalating globally, affecting adults and children. Obesity, once considered a lifestyle issue, is now classified as a chronic disease, prompting research into next-generation medications. The obesity treatment market is poised to grow from USD 2.4 billion in 2022 to USD 54 billion by 2030. GLP-1 drugs, effective for weight loss, are potential treatments, emphasizing the need for non-invasive technologies.

Market:

Diabetes: According to the International Diabetes Federation, there were 537 million people with diabetes in 2021, projected to increase to 783 million by 2045. The disease's progressive nature requires tailored medications at different stages. Treatment paradigms include oral medicines, GLP-1 agonists, and insulin. Recent FDA approval for semaglutide as a first-line treatment for diabetes signals a shift in treatment strategies.

Obesity and Overweight Market: Obesity's reclassification as a chronic disease has spurred research into weight management medications. The obesity treatment market is set to become a top-12 global therapy, growing from USD 2.4 billion in 2022 to an estimated USD 54 billion by 2030. GLP-1 drugs, known for weight loss effects, could be crucial in treating obesity. The need for effective oral treatments in these indications is substantial.

The Need for Non-Invasive Technologies: Current peptide-based medications, including GLP-1 drugs and insulins, require injection, highlighting the demand for non-invasive alternatives. Several competitors, such as Emisphere Technologies, OraMed Pharmaceuticals, Diasome Pharm, Nugenerex Biotech, Merrion Pharm, and Biocon Limited, are exploring non-invasive diabetes treatments. Notably, Novo Nordisk's acquisition of Emisphere Technologies and the FDA's approval for oral semaglutide indicate advancements in this space. Eli Lilly's Fast Track designation for tirzepatide in obesity treatment further emphasizes the industry's focus on innovative and convenient administration methods. The pursuit of non-invasive treatment aims to enhance patient convenience, reduce manufacturing costs, and decrease dosing frequency, revolutionizing the diabetes and weight loss market.

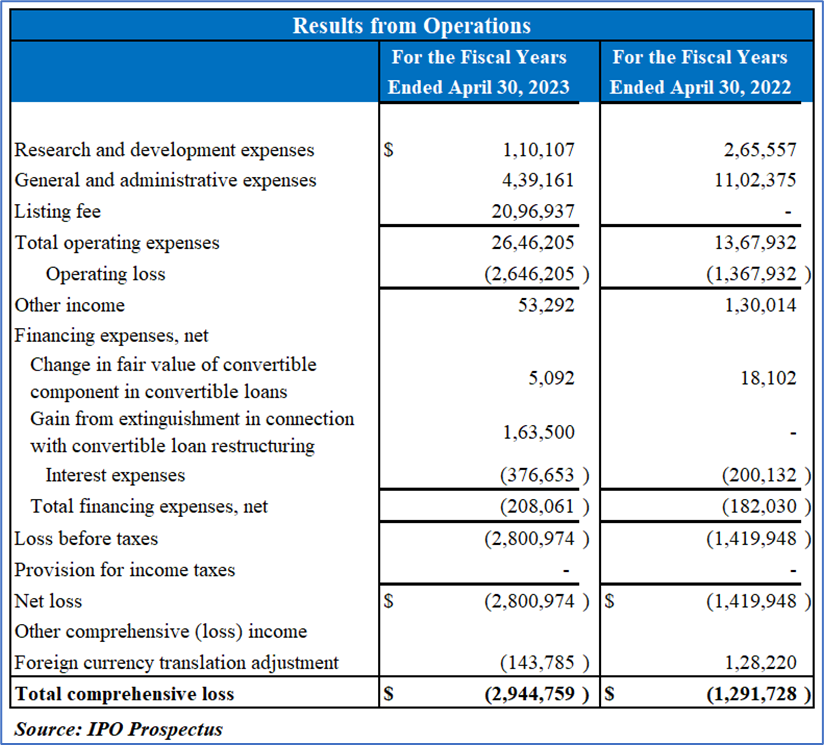

Financial Highlights (Expressed in USD):

Revenue and Development Expenses: As of the latest reporting period, SUBL has yet to generate revenue, contingent upon obtaining approval for core products or strategic collaborations. Research and development expenses primarily focus on advancing the BioLingus drug delivery platform. In the fiscal year ending April 30, 2023, these expenses decreased by 58.5%, with a notable reduction in clinical-related costs for Sublingual Liraglutide.

Administrative Costs and Financing: General and administrative expenses decreased by 60.2%, driven by factors like staff resignations and favorable exchange differences. Conversely, total financing expenses rose by 14.3%, primarily due to increased interest expenses on a new short-term loan. The financial performance revealed a 97.3% increase in loss before taxes, leading to a net loss of USD 2,800,974 for the fiscal year ending April 30, 2023.

Cash Flow Analysis: Operating activities resulted in a net cash outflow of USD 1,714,703 for the fiscal year ending April 30, 2023, primarily attributed to the net loss. Financing activities provided a net cash inflow of USD 1,668,966, emphasizing SUBL's reliance on securing funding for strategic initiatives. Overall, the financial overview underscores SUBL's current focus on product development, while cost-saving measures contributed to reduced administrative expenses.

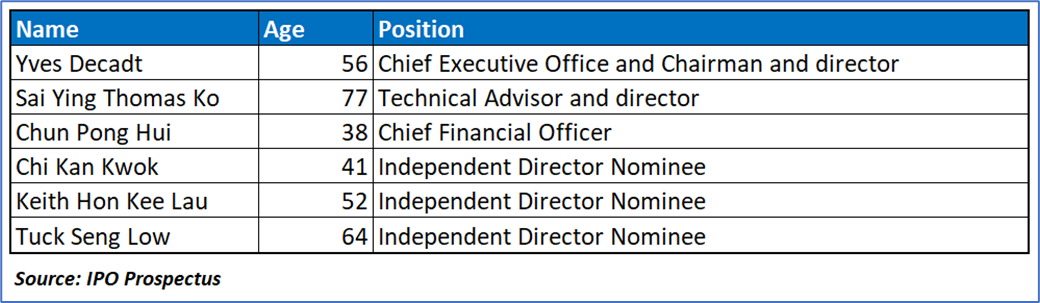

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “SUBL” is exposed to a variety of risks such as:

Financial Performance and Future Losses: SUBL, as a development stage company, has a limited operating history, incurring operating losses for the fiscal years ending April 30, 2023, and 2022. Projected significant losses for the foreseeable future raise uncertainty regarding future operating results. With no revenues from research and development activities, the company relies on strategic collaborations and licensing agreements, but the absence of approved core products poses challenges.

Product Development and Regulatory Approvals: SUBL faces obstacles in product development, with no current product revenues and an extended timeline to market. Success depends on navigating pre-clinical and clinical testing, obtaining FDA and EMA approvals, and securing international regulatory clearances. The absence of assurance regarding regulatory approvals and prolonged timelines may impact the ability to achieve revenue levels sufficient to sustain operations.

Clinical Trial Challenges and Delays: SUBL's limited experience in conducting clinical trials raises concerns about meeting regulatory requirements. Collaborations with CROs (Clinical Research Organizations) are pivotal, and any failure or delay in fulfilling obligations may lead to increased costs and trial delays. Challenges such as site selection, patient enrollment, and potential suspension or termination by regulatory agencies pose risks to the development of product candidates, potentially hindering regulatory approvals.

Commercialization and Market Acceptance: The success of SUBL depends significantly on the commercialization of its sublingual GLP-1 products, primarily sublingual liraglutide. Risks include potential clinical trial failures, manufacturing difficulties, regulatory challenges, market acceptance uncertainties, and competition from superior or cost-effective alternatives. Failure in any of these aspects may have severe consequences for the company's business.

Conclusion

SUBL, a biotechnology company focused on developing oral delivery methods for peptides and proteins, aims to raise net proceeds of approximately USD 5.4 million through the issuance of 360,000 Ordinary Shares priced at USD 20.00 per share. The funds raised are intended for business expansion, retaining skilled employees, and advancing the development of its sublingual GLP-1 products, particularly the Liraglutide Sublingual through Phase IIb studies and potential Phase III initiation. However, high associated risks include the company's limited operating history, incurred losses, and dependency on regulatory approvals for product commercialization. The absence of current revenues, reliance on strategic collaborations, and the challenges in navigating clinical trials pose uncertainties. Additionally, the success of SUBL is contingent on overcoming potential obstacles in product development, commercialization, and market acceptance, with the industry's focus on non-invasive technologies further emphasizing competitive challenges.

Overall, while there are growth prospects, SUBL's performance shows a mix of positive and negative financial trends. Hence, given the financial performance of the company, absence of revenue, increased net losses, industry analysis, use of proceeds, and associated risks “BioLingus (Cayman) Ltd (SUBL)” IPO seems “Neutral" at the IPO price.

Market Participants can subscribe BioLingus (Cayman) Ltd IPO through online stock brokers like Charles Schwab, Fidelity Investments, Robinhood, E-Trade, Interactive Brokers, Merrill Edge, Ally Invest, Tastytrade, WellsTrade and others .

References to ‘Kalkine’, ‘we’, ‘our’ and ‘us’ refer to Kalkine Limited.

This website is a service of Kalkine Limited. Kalkine Limited is a private limited company, incorporated in England and Wales with registration number 07903332. Kalkine Limited is authorised and regulated by the Financial Conduct Authority under reference number 579414.

The article has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. No advice or information, whether oral or written, obtained by you from Kalkine or through or from the service shall create any warranty not expressly stated. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation.

Kalkine does not offer financial advice based upon your personal financial situation or goals, and we shall NOT be held liable for any investment or trading losses you may incur by using the opinions expressed in our publications, market updates, news alerts and corporate profiles. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation. Kalkine’s non-personalised advice does not in any way endorse or recommend individuals, investment products or services for your personal financial situation. You should discuss your portfolios and the risk tolerance level appropriate for your personal financial situation, with a professional authorised financial planner and adviser. You should be aware that the value of any investment and the income from it can go down as well as up and you may not get back the amount invested.

Kalkine Media Limited, an affiliate of Kalkine Limited, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.