0R15 8520.0 0.0% 0R1E 8203.0 0.0% 0M69 21090.0 67.5139% 0R2V 226.02 9878.8079% 0QYR None None% 0QYP 412.97 -2.8306% 0RUK 2652.0 -9.2402% 0RYA 1554.0 -0.7029% 0RIH 174.55 -1.3563% 0RIH 165.15 -5.3853% 0R1O 198.5 9800.2494% 0R1O None None% 0QFP None None% 0M2Z 267.777 -0.1763% 0VSO 32.05 -9.9846% 0R1I None None% 0QZI 559.0 0.7207% 0QZ0 220.0 0.0% 0NZF None None% 0YXG 165.7358 2.7149%

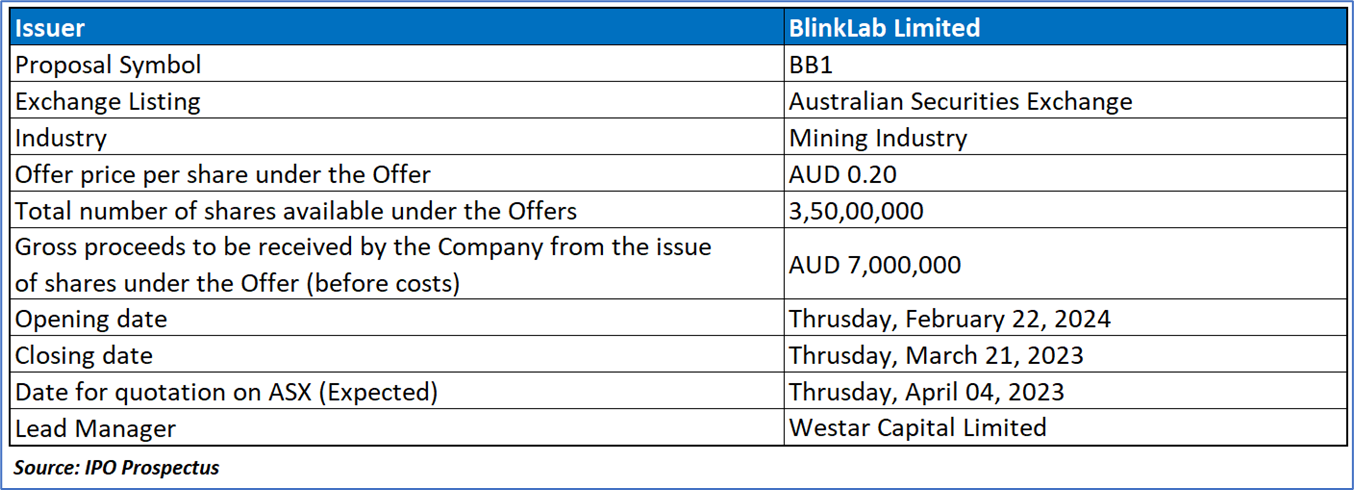

The Offer

Company Overview

BlinkLab, established on August 17, 2021, aims to expedite the development and commercialization of intellectual property (Licenced IP) from Princeton University. The company holds an exclusive global license for the Licenced IP, focusing on smartphone-neurobehavioral testing. BlinkLab has created a medical device, the BlinkLab Device, in the form of a smartphone application with an e-platform. This device conducts neurometric tests aiding in the diagnosis of conditions like autism spectrum disorder (ASD), attention deficit hyperactivity disorder (ADHD), schizophrenia, and other neurodevelopmental disorders. The BlinkLab Tests, including eyeblink conditioning, prepulse inhibition of acoustic startle, and habituation of eye blink response, serve as biomarkers for neurological and psychiatric disorders. Results from these tests are recorded on smartphones and analyzed using machine learning on BlinkLab's confidential and secure online platform. BlinkLab's immediate focus is to complete regulatory clinical studies and secure FDA approval in the US and CE Mark in Europe. The ultimate goal is to introduce the BlinkLab Device to the market initially as a diagnostic tool for ASD.

Key Highlights

Primary Offering:

The Public Offer entails the offering of 35,000,000 Shares at a price of AUD0.20 per Share, with the objective of generating AUD7,000,000 in funds (pre-expenses).

Use of proceeds:

Industry Overview:

Dividend policy:

The Company foresees substantial expenditures for the assessment and advancement of its business, with a predominant focus expected over the next two years from the date of this Prospectus. Consequently, the Company does not anticipate declaring any dividends during this period. The decision to pay dividends in the future rests with the discretion of the Directors and will hinge on factors such as the availability of distributable earnings, operating results, the financial condition of the Company, future capital requirements, and other relevant business considerations. The Company cannot provide assurance regarding the payment of dividends or the availability of franking credits, as these decisions will depend on various factors as evaluated by the Directors.

Financial Highlights (Expressed in AUD):

Key Management Highlights

Risk Associated (High)

Conclusion

BlinkLab Limited, an emerging player in smartphone-neurobehavioral testing, has proposed an initial public offering (IPO) to generate AUD7,000,000. Established in August 2021, the company holds exclusive global rights to intellectual property from Princeton University, focusing on neurobehavioral testing for conditions like ASD, ADHD, and schizophrenia. The BlinkLab Device, a smartphone application, conducts neurometric tests aiding diagnosis, with regulatory studies underway for FDA approval. The industry overview emphasizes the growing market for neurodevelopmental disorder diagnostics and BlinkLab's innovative contributions. However, financial highlights reveal a pre-revenue status, and potential investors should consider the high associated risks, including dependence on the Princeton Licence Agreement, government interest and rights, jurisdictional patent requirements, and trade secret vulnerabilities. The company anticipates significant expenses, postponing dividends for the next two years, with future decisions subject to various business factors.

Hence, given the financial performance of the company, incurred net losses, company’s product, and associated risks “BlinkLab (BB1)” IPO seems “Neutral" at the IPO price.

References to ‘Kalkine’, ‘we’, ‘our’ and ‘us’ refer to Kalkine Limited.

This website is a service of Kalkine Limited. Kalkine Limited is a private limited company, incorporated in England and Wales with registration number 07903332. Kalkine Limited is authorised and regulated by the Financial Conduct Authority under reference number 579414.

The article has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. No advice or information, whether oral or written, obtained by you from Kalkine or through or from the service shall create any warranty not expressly stated. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation.

Kalkine does not offer financial advice based upon your personal financial situation or goals, and we shall NOT be held liable for any investment or trading losses you may incur by using the opinions expressed in our publications, market updates, news alerts and corporate profiles. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation. Kalkine’s non-personalised advice does not in any way endorse or recommend individuals, investment products or services for your personal financial situation. You should discuss your portfolios and the risk tolerance level appropriate for your personal financial situation, with a professional authorised financial planner and adviser. You should be aware that the value of any investment and the income from it can go down as well as up and you may not get back the amount invested.

Kalkine Media Limited, an affiliate of Kalkine Limited, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.