0R15 9025.0 0.0% 0R1E 9410.0 0.0% 0M69 None None% 0R2V 247.99 9682.643% 0QYR 1567.5 0.0% 0QYP 439.3701 -2.9016% 0RUK None None% 0RYA 1597.0 1.2682% 0RIH 195.55 0.0% 0RIH 191.4 -2.1222% 0R1O 225.5 9683.0803% 0R1O None None% 0QFP 10475.8496 107.8542% 0M2Z 252.573 0.2373% 0VSO 33.0 -7.3164% 0R1I None None% 0QZI 622.0 0.0% 0QZ0 220.0 0.0% 0NZF None None% 0YXG 222.05 -4.1318%

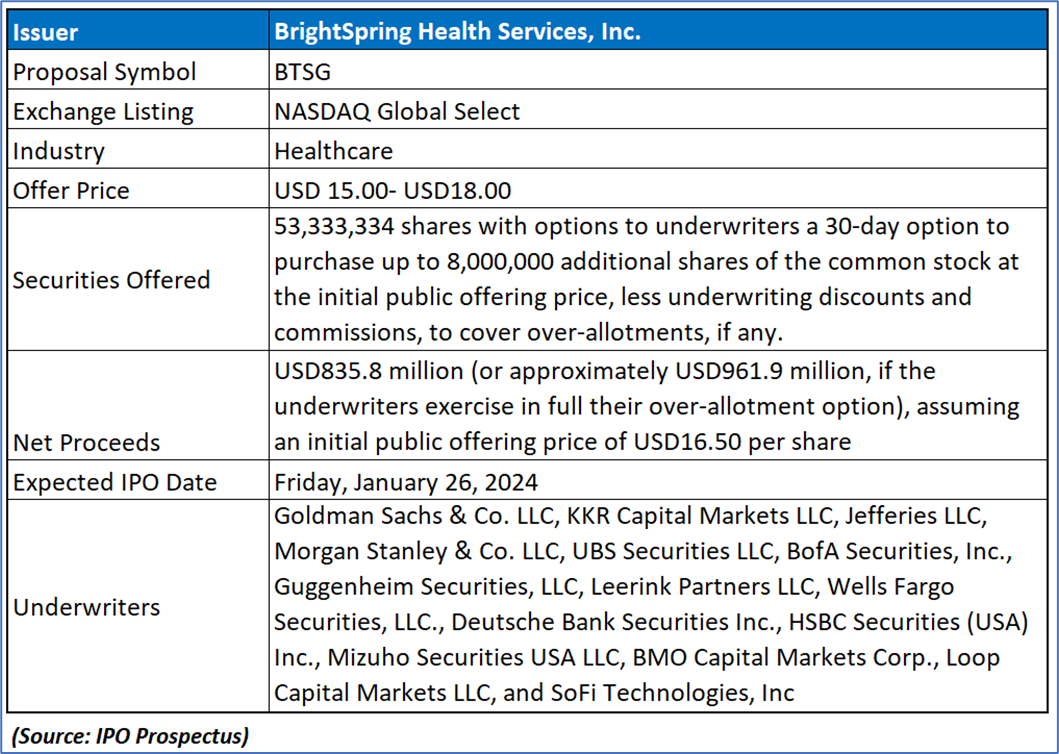

The Offer

Company Overview

BTSG is a leading home and community-based healthcare platform, providing integrated pharmacy and provider services to over 400,000 patients across all 50 states. Focused on high-need and high-cost Senior and Specialty patients, the platform addresses chronic conditions, aiming to improve patient outcomes, enhance quality, and reduce overall healthcare costs through its comprehensive and coordinated care model.

Key Highlights

Primary Offering:

BTSG is offering 53,333,334 shares of common stock, with an option granted to the underwriters to purchase an additional 8,000,000 shares within a 30-day period from the prospectus date. Following the offering, the estimated total outstanding common stock will be 171,190,389 shares (or 179,190,389 shares if the over-allotment option is fully exercised by the underwriters). The anticipated net proceeds from the offering are approximately USD835.8 million (or approximately USD961.9 million if the over-allotment option is exercised in full), based on an assumed initial public offering price of USD16.50 per share.

Use of proceeds:

BTSG anticipates net proceeds of approximately USD 835.8 million (or approximately USD 961.9 million with the full exercise of the over-allotment option) from its common stock offering, assuming an initial public offering price of USD 16.50 per share, after deducting underwriting discounts, commissions, and estimated expenses. Changes in shares or offering price would proportionally affect the net proceeds. The concurrent offering of Units is estimated to generate approximately USD 388.9 million (or USD 447.3 million with full option exercise), contributing to the repayment of outstanding indebtedness under various facilities and covering termination fees related to the Monitoring Agreement. The remaining funds will be allocated for general corporate purposes. As of September 30, 2023, BTSG had outstanding principal amounts under the Second Lien Facility (USD 450.0 million), Revolving Credit Facility (USD 173.1 million), and First Lien Facility (USD 2,916.9 million). The proposed use of proceeds aligns with debt repayment and corporate needs, as outlined in the prospectus.

Dividend policy:

BTSG currently does not intend to distribute dividends on its common stock. The decision to declare and distribute dividends in the future will be solely at the discretion of the board of directors, considering factors such as financial performance, cash needs, legal and regulatory constraints, and other relevant considerations outlined in our indebtedness agreements.

Industry and Market Analysis

Financial Highlights (Expressed in USD):

Revenue Growth Overview: For the nine months ending September 30, 2023, total revenue reached USD 6,451.6 million, marking a notable increase from the USD 5,749.9 million recorded during the same period in 2022—a substantial uptick of USD 701.7 million or 12.2%. This growth was primarily fueled by the robust performance in Pharmacy Solutions, which experienced a significant uptrend with a USD 851.7 million increase, translating to a remarkable 14.8% growth in consolidated revenue for the specified nine months. Furthermore, Provider Services also contributed to the positive trajectory, registering a USD 97.4 million hike or a 1.7% expansion in consolidated revenue for the same period. However, the overall positive trend was partially offset by a decline of USD 247.4 million or a 4.3% decrease in consolidated revenue for the nine months ending September 30, 2022, attributed to the divestiture of a single business within the other segment.

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “BTSG” is exposed to a variety of risks such as:

Intense Competition: The company operates in a highly competitive industry, facing competition in both the Pharmacy Solutions and Provider Services segments. The competition is based on factors such as personnel availability, service quality, expertise, and, in some cases, pricing. Competitors may have greater financial resources, technical capabilities, and market presence. The non-exclusivity of contracts with payors and the potential for competitors to establish strategic relationships could lead to a decline in market share, business, financial condition, and results of operations.

Dependency on Relationships with Referral Sources: The success of the business heavily relies on referrals from various sources, including physicians, hospitals, long-term care facilities, and other healthcare providers. If the company fails to maintain good relationships with these referral sources, it could adversely impact its ability to generate referrals. Factors such as failure to meet quality metrics, negative publicity, and issues related to staffing, training, and facility conditions may affect the company's reputation. Losing existing relationships or failing to establish new ones could result in a decline in patient volumes, the quality of patient mix, and, consequently, revenue and profitability.

Regulatory and Payment Risks in Government Healthcare Programs: The company derives a substantial portion of its revenue from government healthcare programs, primarily Medicare and Medicaid. Changes in federal legislation, regulations, administrative rulings, and interpretations regarding patient eligibility requirements, funding levels, and payment methods for Medicare and Medicaid can significantly impact the company's reimbursement rates. Government budgetary shortfalls and the possibility of spending cuts, especially within the Medicare program, pose a risk of decreased reimbursement, limiting access to services, and potentially leading to a decline in revenues and profitability. The need to modify internal billing processes in response to these changes can also result in significant time and expense for the company.

Conclusion

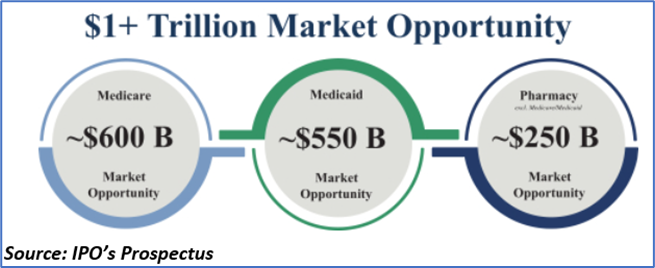

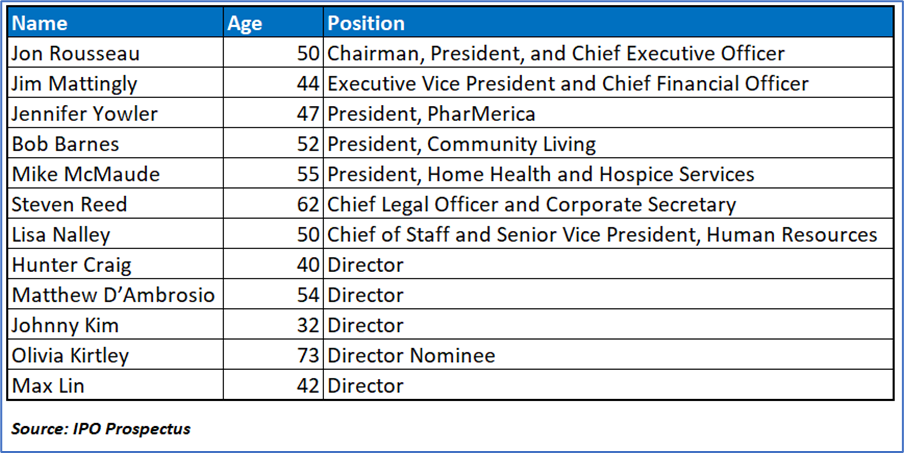

BTSG, a prominent and diversified independent provider of home and community-based healthcare services in the United States, operates on a national scale with a presence in all 50 states. The organization, distinguished by its commitment to quality and compliance, maintains longer-term customer relationships and boasts a successful track record in mergers and acquisitions. With a seasoned management team, BTSG provides integrated pharmacy and provider services to address the diverse needs of complex Senior and Specialty patients. The focus on clinical and operational excellence results in improved outcomes in lower-cost settings, garnering high satisfaction among stakeholders. The organization's value proposition extends to clients, patients, families, customers, partners, payors, employees, and investors. Positioned in a market with a combined opportunity exceeding USD 1.0 trillion and positive industry trends, BTSG sees growth potential through organic expansion, integrated care synergies, value-based care payment models, and strategic acquisitions. Despite a net income decrease to USD (54.2) million in 2022, BTSG achieved substantial revenue growth of USD 1.0 billion (15.3%), reaching USD 7.7 billion, and increased Adjusted EBITDA by USD 29.4 million (6.0%) to USD 522.5 million. Overall, BTSG's comprehensive services at a significant scale create economies of scale, stability, and compelling commercial opportunities that align with societal needs.

Overall, while there are growth prospects, BTSG's performance shows a mix of positive and negative financial trends. Hence, given the financial performance of the company, consistent revenue, decreased net income, industry analysis, use of proceeds, and associated risks “BrightSpring Health Services, Inc. (BTSG)” IPO seems “Neutral" at the IPO price.

References to ‘Kalkine’, ‘we’, ‘our’ and ‘us’ refer to Kalkine Limited.

This website is a service of Kalkine Limited. Kalkine Limited is a private limited company, incorporated in England and Wales with registration number 07903332. Kalkine Limited is authorised and regulated by the Financial Conduct Authority under reference number 579414.

The article has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. No advice or information, whether oral or written, obtained by you from Kalkine or through or from the service shall create any warranty not expressly stated. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation.

Kalkine does not offer financial advice based upon your personal financial situation or goals, and we shall NOT be held liable for any investment or trading losses you may incur by using the opinions expressed in our publications, market updates, news alerts and corporate profiles. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation. Kalkine’s non-personalised advice does not in any way endorse or recommend individuals, investment products or services for your personal financial situation. You should discuss your portfolios and the risk tolerance level appropriate for your personal financial situation, with a professional authorised financial planner and adviser. You should be aware that the value of any investment and the income from it can go down as well as up and you may not get back the amount invested.

Kalkine Media Limited, an affiliate of Kalkine Limited, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.