0R15 9025.0 0.0% 0R1E 9410.0 0.0% 0M69 None None% 0R2V 247.99 9682.643% 0QYR 1567.5 0.0% 0QYP 439.3701 -2.9016% 0RUK None None% 0RYA 1597.0 1.2682% 0RIH 195.55 0.0% 0RIH 191.4 -2.1222% 0R1O 225.5 9683.0803% 0R1O None None% 0QFP 10475.8496 107.8542% 0M2Z 252.573 0.2373% 0VSO 33.0 -7.3164% 0R1I None None% 0QZI 622.0 0.0% 0QZ0 220.0 0.0% 0NZF None None% 0YXG 222.05 -4.1318%

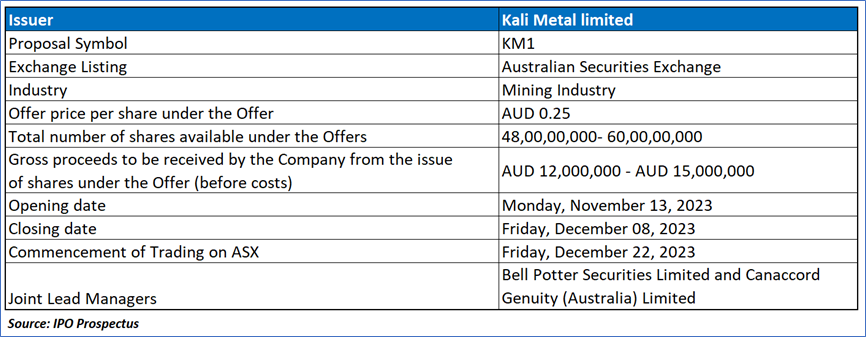

The Offer

Company Overview

Kali Metals Limited (ACN 653 279 371), an unlisted Australian public company incorporated on August 31, 2021, in Western Australia, is actively engaged in mineral exploration, particularly focusing on lithium. The company holds various projects, including the DOM’s Hill Project, Marble Bar Project (subject to completing the Tenement Sale Agreement with Kalamazoo), Pear Creek Project, and the Higginsville Lithium Rights at the Higginsville Project tenements (subject to finalizing the Share Sale Agreement and Mineral Rights Agreements with the Karora Group). Additionally, Kali Metals possesses the Jingellic Project and Tallangatta Project in southern New South Wales and north-eastern Victoria, with the option to earn a 100% interest in the MEG Lithium Rights at EL8958 held by MEG. This comprehensive portfolio reflects the company's strategic presence in key lithium exploration regions in Western Australia and eastern Australia.

Key Highlights

Primary Offering:

The offering document outlines the proposition of issuing a minimum of 48 million shares at an offer price of AUD 0.25, with the intention of raising at least AUD 12 million. Alternatively, the offering could encompass up to 60 million shares at an offer price of AUD 0.25, aiming to raise a maximum of AUD 15 million.

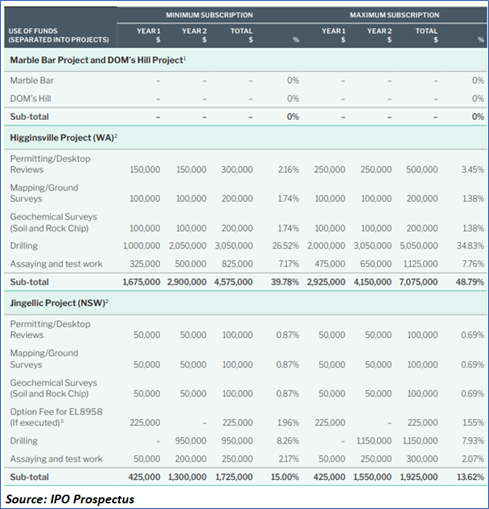

Use of proceeds:

Project Highlights:

Pilbara Projects: DOM’s Hill, Marble Bar, and Pear Creek Projects exhibit lithium prospectivity in the Pilbara Craton, with significant exploration activities planned.

Higginsville Project: In Eastern Yilgarn, Western Australia, Kali Metals plans exploration for lithium-bearing pegmatites, leveraging the region's known pegmatite occurrences.

New South Wales and Victoria Projects: The Jingellic and Tallangatta Projects in the Lachlan Fold Belt region are early-stage exploration plays for LCT pegmatites. Kali Metals aims to explore areas with historical tin and tantalum occurrences for lithium potential.

Lithium Market:

Lithium's Role in Batteries: Lithium is a crucial element in modern battery technology, and its demand has significantly risen due to the ongoing development and adoption of electric and hybrid vehicles, aligned with the global shift towards renewable energy sources.

Growing Demand from Electric Vehicles: The increasing commitment of over 20 countries and 70 city governments to achieve 100% zero-emission vehicle targets or phase out internal combustion engine vehicles by 2050 is expected to drive the demand for lithium. It is projected that more than 70% of the total lithium demand by 2030 will be fueled by the expanding electric vehicle market.

Concentration of Lithium Resources and Market Control: Lithium resources are concentrated in a limited number of countries, primarily Australia, Chile, China, and Argentina. The global lithium market is dominated by the five largest producers, including SQM, with only a handful of companies controlling the majority of mine output.

Diversity in Lithium Production Sources: Lithium is extracted from either brines or hard-rock sources, and each producing country, except China, specializes in one of these sources. South American countries like Argentina, Chile, and Bolivia focus on brine production, while Australia specializes in hard-rock lithium extraction.

Anticipated Growth in Lithium Demand: The demand for lithium is expected to surge from around 0.72 million metric tonnes of lithium carbonate equivalent (LCE) in 2023 to over 3 million metric tonnes of LCE in 2030. Depending on the success of exploration and project development, Kali Metals has the potential to play a vital role in ensuring the long-term lithium supply to support the global transition to clean energy.

Dividend policy:

The company anticipates refraining from dividend payments in the foreseeable future, emphasizing the prioritization of utilizing cash reserves for exploration and development endeavors across its projects. Any decision regarding dividends will solely rest with the Directors and will be contingent upon factors such as the availability of distributable earnings, the company's operating results and financial condition, future capital requirements, and other pertinent business considerations, particularly when progressing to development and production at the projects. It is important to note that the company cannot provide assurance regarding the payment of dividends or the presence of franking credits, and no dividend reinvestment plan is currently in place.

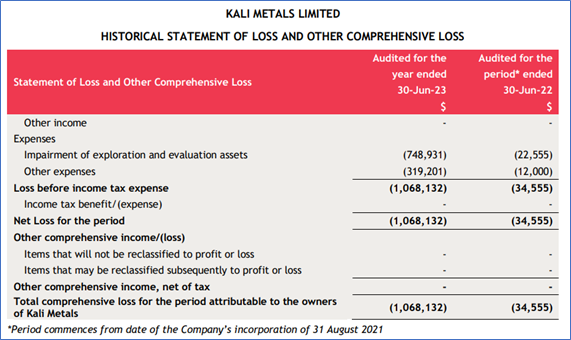

Financial Highlights (Expressed in AUD):

Key Management Highlights

Risk Associated (High)

Key Risks and Mitigation in Tolu Project:

Conclusion

Kali Metals strategically positions itself to capitalize on the increasing demand for lithium, driven by the surge in electric vehicle adoption and renewable energy initiatives globally. The company's project portfolio, especially in lithium-rich regions like the Pilbara, reflects a proactive approach to securing a foothold in key exploration areas. Additionally, the anticipated growth in lithium demand from approximately 0.72 million metric tonnes of lithium carbonate equivalent (LCE) in 2023 to over 3 million metric tonnes of LCE in 2030 presents a significant market opportunity for Kali Metals. The IPO's structure, with an offer price of AUD 0.25 and a targeted fundraising range of AUD 12-15 million, aligns with the company's financing needs for exploration and development.

Despite the promising market conditions, the investment in Kali Metals comes with inherent risks. The company, having been incorporated in August 2021, has a limited operating history, making the achievement of commercial viability uncertain. Moreover, the absence of operational revenue and reliance on future equity capital or debt funding introduce financial uncertainties. The nature of mineral exploration involves significant expenditures with no guaranteed revenue, and external factors beyond the company's control may impede operations. Complex agreements with the Karora Group and potential operational challenges add further layers of risk. Kali Metals' operational efficiency and financial performance are susceptible to challenges in exploration, technical complications, and environmental incidents.

Hence, given the financial performance of the company, incurred net losses, lithium market, company’s projects, and associated risks “Kali Metals Limited (KM1)” IPO seems “Neutral" at the IPO price.

References to ‘Kalkine’, ‘we’, ‘our’ and ‘us’ refer to Kalkine Limited.

This website is a service of Kalkine Limited. Kalkine Limited is a private limited company, incorporated in England and Wales with registration number 07903332. Kalkine Limited is authorised and regulated by the Financial Conduct Authority under reference number 579414.

The article has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. No advice or information, whether oral or written, obtained by you from Kalkine or through or from the service shall create any warranty not expressly stated. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation.

Kalkine does not offer financial advice based upon your personal financial situation or goals, and we shall NOT be held liable for any investment or trading losses you may incur by using the opinions expressed in our publications, market updates, news alerts and corporate profiles. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation. Kalkine’s non-personalised advice does not in any way endorse or recommend individuals, investment products or services for your personal financial situation. You should discuss your portfolios and the risk tolerance level appropriate for your personal financial situation, with a professional authorised financial planner and adviser. You should be aware that the value of any investment and the income from it can go down as well as up and you may not get back the amount invested.

Kalkine Media Limited, an affiliate of Kalkine Limited, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.