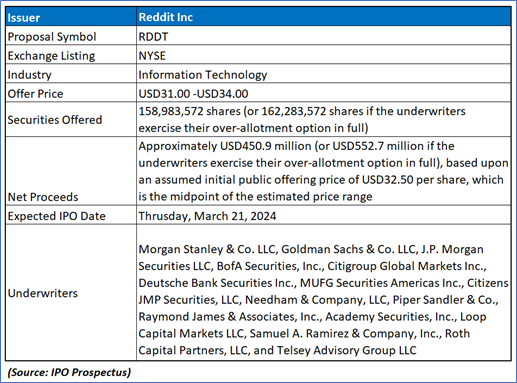

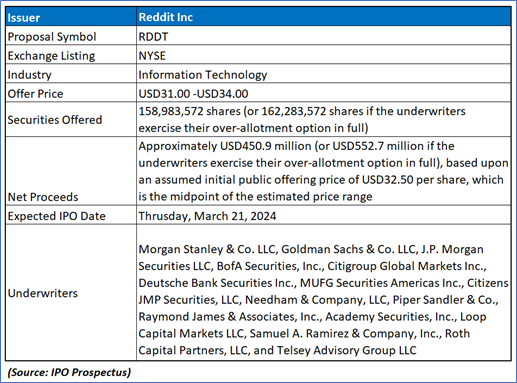

The Offer

Company Overview

Reddit serves as a global digital city where individuals worldwide can connect, learn, and engage in a multitude of activities within diverse communities. Like citizens in a physical city, Reddit users participate in various subreddits based on their interests, fostering meaningful discussions and sharing experiences through posts, comments, and media uploads. With over 500 million visitors and an average of 73.1 million daily active uniques as of December 2023, Reddit acts as a dynamic archive of human knowledge and interaction, enabling users to seek advice, share discoveries, and build relationships.

Key Highlights

Primary Offering:

RDDT anticipates issuing 158,983,572 shares (or 162,283,572 shares if the underwriters exercise their over-allotment option in full), with expected net proceeds totaling approximately USD450.9 million (or USD552.7 million if the underwriters exercise their over-allotment option in full), assuming an initial public offering price of USD32.50 per share, representing the midpoint of the estimated price range.

Use of proceeds:

RDDT estimates that it will receive net proceeds of USD450.9 million (or approximately USD552.7 million if the underwriters' over-allotment option is exercised in full) from its offering, assuming an initial public offering price of USD32.50 per share of Class A common stock. Each USD1.00 increase (decrease) in the offering price would affect the net proceeds accordingly. The company intends to utilize the funds for general corporate purposes, including working capital, operating expenses, and capital expenditures, as well as potentially for in-licensing, acquiring, or investing in complementary technologies, assets, or intellectual property. Additionally, a portion of the proceeds will be used to satisfy tax withholding and remittance obligations related to the Restricted Stock Units (RSUs) and Performance-based Restricted Stock Units (PRSUs) held by executives, including CEO Steven Huffman.

Dividend policy:

RDDT has never issued cash dividends on its capital stock and currently plans to retain all available funds and future earnings for business development and expansion, with no expectation of paying dividends in the foreseeable future. The terms of its revolving credit facility and potential future credit agreements or borrowing arrangements may further restrict its ability to declare dividends. Any decisions regarding dividends will be made by the board of directors based on various factors, including financial condition, operating results, contractual obligations, and general business conditions.

Market Opportunity

- Unveiling RDDT's Market Potential: RDDT's legacy of adapting to internet evolution continues as it explores new market avenues. The focus remains on advertising solutions fueled by user engagement. Projections indicate a global advertising market, excluding China and Russia, reaching a staggering USD 1.4 trillion by 2027. This encompasses diverse formats like desktop and mobile web, display, video, social direct response ads, and search advertising. Leveraging data from S&P Global Market Intelligence, RDDT estimates the current market size at USD 1.0 trillion, with a projected CAGR of 8% to attain USD 1.4 trillion in 2027. The strategic expansion into search capabilities aims to tap into the anticipated USD 750 billion opportunity in search advertising by 2027.

- Navigating the Data Licensing Frontier: Recognizing the burgeoning potential in data licensing, RDDT eyes significant opportunities. With RDDT's data proving instrumental in sentiment analysis and trend identification, the platform foresees a pivotal role in emerging analytics and AI platforms. Projections from the International Data Corporation (IDC) foresee the AI market, excluding China and Russia, growing at an impressive CAGR of 20% to reach USD 1.0 trillion by 2027. RDDT's positioning in data analytics positions it as a key player in this burgeoning market, promising substantial growth potential.

- Empowering the User Economy: Commerce stands as a cornerstone of RDDT's vibrant communities, laying the foundation for economic growth. Informal exchanges of digital goods, services, and physical products already thrive within RDDT's ecosystem. As RDDT introduces innovative features empowering community developers, further economic advancements, including gaming integration, are anticipated. Drawing insights from IDC's Consumer Market Model, RDDT estimates the current user economy at USD 1.3 trillion, poised to surge to USD 2.1 trillion by 2027 with a projected CAGR of 12%. RDDT's vision encompasses revenue generation through facilitated commerce transactions, underscoring its commitment to nurturing a dynamic user-centric economy.

Financial Highlights (Expressed in USD):

- Global DAUq Growth: A Testament to RDDT's Expansion: In the three months ending December 31, 2023, RDDT witnessed a remarkable 27% surge in global daily active users (DAUq) compared to the same period in the previous year. This substantial growth was chiefly fueled by a 34% increase in DAUq within the United States and a commendable 21% uptick in the rest of the world. Moreover, global DAUq saw an impressive 11% expansion compared to the prior quarter, with the United States registering a robust 14% rise and the rest of the world demonstrating an 8% increase. The upward trajectory in DAUq persisted, culminating in a global monthly average DAUq of 76.0 million by December 2023, indicating significant traction, particularly among logged-out users, as the quarter drew to a close, with RDDT continuing to onboard users well into February 2024.

- Navigating Fluctuating User Activity: RDDT's Adaptive Approach: Despite consistent growth, RDDT acknowledges the fluctuating nature of user activity, subject to various internal and external factors. For instance, the three-month period ending March 31, 2022, witnessed a notable 7% quarter-over-quarter growth, attributed in part to heightened user engagement surrounding specific communities like r/EldenRing and other gaming-related platforms, alongside ongoing global events such as the Russia-Ukraine conflict. Conversely, a downturn in global DAUq occurred during the three months ending June 30, 2022, as the absence of significant worldwide events and cultural trends impacted quarterly DAUq growth. RDDT remains proactive in enhancing its user activity identification and management methods, implementing advanced techniques to detect and address automated agents like web crawlers and scrapers, with prospective removal from DAUq counts and immaterial recalculations for prior periods.

- Monetization Metrics: Unlocking Revenue Potential: RDDT's revenue generation primarily revolves around advertising on its mobile applications and website, with revenue reaching USD 804.0 million for the year ended December 31, 2023, reflecting a commendable 21% increase compared to the previous year. During the same period, average revenue per user (ARPU) stood at USD 3.42, registering a modest 2% decline year-over-year. Notably, United States ARPU declined to USD 5.51 from USD 5.92 in the prior year, while rest-of-world ARPU witnessed a slight rise to USD 1.34 from USD 1.30 in the prior year. The decline in global ARPU compared to the previous year was primarily attributed to heightened DAUq growth, particularly among logged-out users, presenting a lower monetization opportunity. Conversely, the increase in global ARPU compared to the prior quarter was fueled by a surge in impressions delivered.

- Driving Revenue Growth: RDDT's Strategic Advancements: Furthermore, revenue soared by USD 137.3 million, or 21%, compared to the previous year, largely attributable to an increase in impressions delivered stemming from robust DAUq growth, which outpaced the growth in pricing during the same period. Meanwhile, Free Cash Flow for the years ended December 31, 2022, and 2023, amounted to USD (100.3) million and USD (84.8) million, respectively. This metric, encompassing net cash provided by operating activities adjusted for non-cash items and changes in working capital, along with property and equipment purchases totaling USD 6.2 million and USD 9.7 million for the respective years, witnessed an improvement compared to the previous year primarily due to a decrease in cash used in operating activities.

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “RDDT” is exposed to a variety of risks such as:

- User Base and Engagement Concerns: The inability of RDDT to expand or retain its user base, particularly daily active uniques (DAUq), or a decline in user engagement poses a significant threat to RDDT's business, financial performance, and prospects. RDDT's reliance on user growth and engagement as key determinants of financial success underscores the criticality of these metrics. While RDDT's strategies aim to convert monthly users into more active daily users, fluctuations in DAUq, influenced by external events and evolving user preferences, present inherent risks. Factors such as shifts in user behavior, competition from alternative platforms, or cultural trends impacting user engagement could impede RDDT's ability to sustainably grow its user base.

- Content Quality and Redditor Engagement: The vitality of RDDT's platform hinges on the continued contribution of valuable and engaging content by Redditors. A decline in content quality, user contributions, or Redditor engagement could precipitate a drop-in user activity and engagement levels, adversely affecting RDDT's business operations and financial performance. Challenges such as the dissemination of abusive or harmful content, the departure of prolific Redditors, or inadequacies in content moderation could erode user trust and diminish RDDT's platform's appeal, thereby deterring advertisers and tarnishing RDDT's reputation.

- Brand Reputation and Media Scrutiny: Maintaining and enhancing the reputation of the RDDT brand is paramount for sustaining user and advertiser loyalty. Negative publicity, regulatory scrutiny, or controversies surrounding RDDT's platform's practices, content moderation, or user privacy could inflict substantial damage to RDDT's brand image and reputation. Adverse media coverage, legislative actions, or regulatory investigations may undermine user confidence and advertiser trust, hindering RDDT's ability to attract and retain users and advertisers alike. Moreover, any failure to address Redditor or advertiser needs effectively may further exacerbate brand erosion, jeopardizing RDDT's long-term viability and financial health.

Conclusion

RDDT, the global digital city connecting individuals worldwide through diverse communities, presents a compelling investment opportunity in its upcoming IPO. With over 500 million visitors and an average of 73.1 million daily active uniques as of December 2023, RDDT serves as a dynamic hub of human knowledge and interaction. The company's strategic focus on advertising solutions, data licensing, and empowering the user economy underscores its potential for substantial growth. RDDT's robust financial performance, highlighted by a 27% surge in global DAUq and a commendable revenue increase of 21%, reflects its resilience and adaptability. Moreover, RDDT's proactive approach to address fluctuating user activity and its commitment to maintaining its brand reputation further bolster confidence in its long-term prospects. While investment in RDDT is not without risks, including concerns regarding user engagement and brand reputation, the company's innovative strategies and solid financial foundation position it as an attractive proposition to the burgeoning digital landscape.

Hence, given the financial performance of the company, increased global DAUq and revenue, market opportunity of RDDT, use of proceeds, and associated risks “Reddit Inc (RDDT)” IPO seems “Attractive" at the IPO price.

Disclaimer-

References to ‘Kalkine’, ‘we’, ‘our’ and ‘us’ refer to Kalkine Limited.

This website is a service of Kalkine Limited. Kalkine Limited is a private limited company, incorporated in England and Wales with registration number 07903332. Kalkine Limited is authorised and regulated by the Financial Conduct Authority under reference number 579414.

The article has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. No advice or information, whether oral or written, obtained by you from Kalkine or through or from the service shall create any warranty not expressly stated. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation.

Kalkine does not offer financial advice based upon your personal financial situation or goals, and we shall NOT be held liable for any investment or trading losses you may incur by using the opinions expressed in our publications, market updates, news alerts and corporate profiles. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation. Kalkine’s non-personalised advice does not in any way endorse or recommend individuals, investment products or services for your personal financial situation. You should discuss your portfolios and the risk tolerance level appropriate for your personal financial situation, with a professional authorised financial planner and adviser. You should be aware that the value of any investment and the income from it can go down as well as up and you may not get back the amount invested.

Kalkine Media Limited, an affiliate of Kalkine Limited, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.