0R15 8520.0 0.0% 0R1E 8203.0 0.0% 0M69 21090.0 67.5139% 0R2V 226.02 9878.8079% 0QYR None None% 0QYP 412.97 -2.8306% 0RUK 2652.0 -9.2402% 0RYA 1554.0 -0.7029% 0RIH 174.55 -1.3563% 0RIH 165.15 -5.3853% 0R1O 198.5 9800.2494% 0R1O None None% 0QFP None None% 0M2Z 267.777 -0.1763% 0VSO 32.05 -9.9846% 0R1I None None% 0QZI 559.0 0.7207% 0QZ0 220.0 0.0% 0NZF None None% 0YXG 165.7358 2.7149%

Harbour Energy PLC

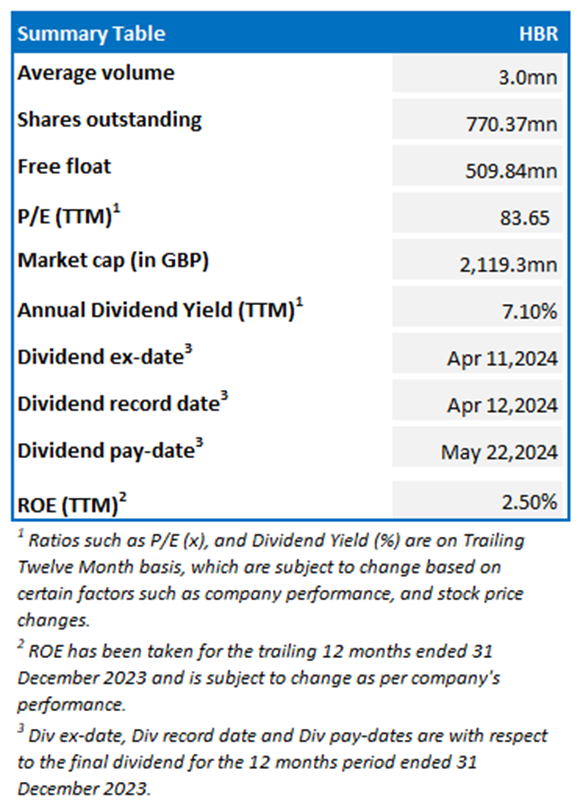

Harbour Energy PLC (LSE: HBR) is an FTSE 250 listed entity that came into existence after an all-share merger between Premier Oil and Chrysaor.

FY23 Results (Released on 07 March 2024)

Share Price Chart

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Harbour Energy PLC (LSE: HBR) was trading at the closing market price of GBX 275.10 (as of 25 March 2024)

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is 25 March 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: ‘Kalkine reports are prepared based on the stock prices captured either from the London Stock Exchange (LSE) and or REFINITIV. Typically, both sources (LSE and or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Note 4: Dividend Yield may vary as per the stock price movement.

References to ‘Kalkine’, ‘we’, ‘our’ and ‘us’ refer to Kalkine Limited.

This website is a service of Kalkine Limited. Kalkine Limited is a private limited company, incorporated in England and Wales with registration number 07903332. Kalkine Limited is authorised and regulated by the Financial Conduct Authority under reference number 579414.

The article has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. No advice or information, whether oral or written, obtained by you from Kalkine or through or from the service shall create any warranty not expressly stated. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation.

Kalkine does not offer financial advice based upon your personal financial situation or goals, and we shall NOT be held liable for any investment or trading losses you may incur by using the opinions expressed in our publications, market updates, news alerts and corporate profiles. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation. Kalkine’s non-personalised advice does not in any way endorse or recommend individuals, investment products or services for your personal financial situation. You should discuss your portfolios and the risk tolerance level appropriate for your personal financial situation, with a professional authorised financial planner and adviser. You should be aware that the value of any investment and the income from it can go down as well as up and you may not get back the amount invested.

Kalkine Media Limited, an affiliate of Kalkine Limited, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.