0R15 8520.0 0.0% 0R1E 8203.0 0.0% 0M69 21090.0 67.5139% 0R2V 226.02 9878.8079% 0QYR None None% 0QYP 412.97 -2.8306% 0RUK 2652.0 -9.2402% 0RYA 1554.0 -0.7029% 0RIH 174.55 -1.3563% 0RIH 165.15 -5.3853% 0R1O 198.5 9800.2494% 0R1O None None% 0QFP None None% 0M2Z 267.777 -0.1763% 0VSO 32.05 -9.9846% 0R1I None None% 0QZI 559.0 0.7207% 0QZ0 220.0 0.0% 0NZF None None% 0YXG 165.7358 2.7149%

GoPro Inc

GoPro, Inc. (NASDAQ: GPRO) produces cameras, and mountable and wearable accessories. The Company offers a family of flagship cameras, including its cloud connected HERO12 Black, HERO11 Black, HERO11 Black Mini, HERO10 Black, HERO10 Black Bones, HERO9 Black, and MAX cameras.

Recent Financial and Business Updates:

Q4 2023 Financial Performance: A Mixed Bag: In the fourth quarter of 2023, GoPro faced revenue challenges with a year-over-year decrease of 8%, amounting to USD 295 million. However, a silver lining emerged as subscription and service revenue bucked the trend, experiencing a commendable 13% increase, reaching USD 25 million. Despite an overall decline, GoPro's subscriber count showed resilience, concluding the quarter at 2.5 million, signifying a robust 12% year-over-year growth.

Revenue Channels: Retail Shines, GoPro.com Sees Setback: The retail channel proved to be a stronghold for GoPro, contributing USD 228 million or 77% of total revenue, and displaying an impressive 18% year-over-year growth. Contrastingly, GoPro.com’s revenue, which includes subscription and service revenue, faced headwinds, totaling USD 67 million, constituting 23% of total revenue, and witnessing a notable 47% year-over-year decline.

Profit Dynamics: Margins, Earnings, and Adjusted EBITDA: Both GAAP and non-GAAP gross margins for Q4 2023 held strong at 34.2% and 34.4%, respectively. However, the company reported a GAAP net loss of USD 2 million (or USD 0.02 per share), a stark contrast from the net income of USD 3 million (or USD 0.02 per share) in the prior year period. Non-GAAP net income also took a hit, dropping to USD 2 million (or USD 0.02 per share), down from USD 21 million (or USD 0.12 per share) in the previous year. Adjusted EBITDA for Q4 2023 amounted to USD 3 million, a significant shift from the USD 22 million reported in the same quarter of the prior year.

2023: A Year of Financial Resilience and Challenges: For the full year 2023, GoPro's revenue tallied USD 1.0 billion, reflecting an 8% year-over-year decrease. Subscription and service revenue, however, defied the downturn, marking an 18% increase and reaching USD 97 million. The financial landscape showed a less favorable side as GAAP net loss for the year amounted to USD 53 million (or a USD 0.35 loss per share), compared to the net income of USD 29 million (or USD 0.18 per share) in the prior year. Non-GAAP net loss for the year was USD 31 million (or a USD 0.20 loss per share), a substantial drop from the non-GAAP net income of USD 81 million (or USD 0.47 per share) in the previous year. Both GAAP and non-GAAP gross margins for 2023 registered a decline at 32.2% and 32.4%, respectively. Notably, Adjusted EBITDA for 2023 reported a negative USD 27 million, representing a significant departure from the USD 95 million reported in the prior year period.

Business Highlights: Strategic Moves and Sponsorships: During the fourth quarter, GoPro strategically navigated capital allocations, repurchasing USD 50.0 million in aggregate principal amount of the 2025 Convertible Notes and USD 10.0 million in stock, contributing to a total repurchase of USD 40.0 million for 2023. In January 2024, GoPro unveiled plans to acquire Forcite Helmet Systems, an Australian tech-enabled motorcycle helmet manufacturer. Additionally, the company reaffirmed its presence in extreme sports by renewing sponsorships, becoming the official action camera for the X Games, Freeride World Tour, and Vans Pipe Masters surf contest. Recognition from Outside Magazine in November 2023 as one of the 50 Best Places to Work for the third consecutive year capped off a mix of financial challenges and strategic triumphs for GoPro.

Technical Observation (on the daily chart)

The Relative Strength Index (RSI), calculated over a 14-day span, stands at 28.33, currently in the over-sold zone, signifying the likelihood of either some consolidation or a trend reversal towards the upside from the current key support levels. Adding to this, the stock presently finds itself positioned below both the 21-day and 50-day Simple Moving Averages (SMA), which could function as a dynamic short-term resistance levels.

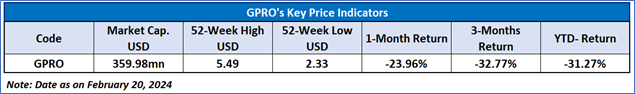

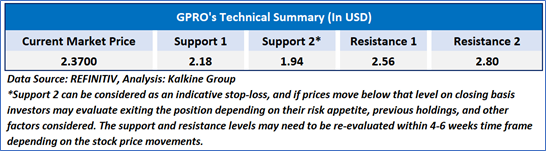

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Speculative Buy’ rating has been given to GoPro, Inc. (NASDAQ: GPRO) at the current market price of USD 2.37, as of February 20, 2024, at 07:15 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is February 20, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

References to ‘Kalkine’, ‘we’, ‘our’ and ‘us’ refer to Kalkine Limited.

This website is a service of Kalkine Limited. Kalkine Limited is a private limited company, incorporated in England and Wales with registration number 07903332. Kalkine Limited is authorised and regulated by the Financial Conduct Authority under reference number 579414.

The article has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. No advice or information, whether oral or written, obtained by you from Kalkine or through or from the service shall create any warranty not expressly stated. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation.

Kalkine does not offer financial advice based upon your personal financial situation or goals, and we shall NOT be held liable for any investment or trading losses you may incur by using the opinions expressed in our publications, market updates, news alerts and corporate profiles. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation. Kalkine’s non-personalised advice does not in any way endorse or recommend individuals, investment products or services for your personal financial situation. You should discuss your portfolios and the risk tolerance level appropriate for your personal financial situation, with a professional authorised financial planner and adviser. You should be aware that the value of any investment and the income from it can go down as well as up and you may not get back the amount invested.

Kalkine Media Limited, an affiliate of Kalkine Limited, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.