0R15 8520.0 0.0% 0R1E 8203.0 0.0% 0M69 21090.0 67.5139% 0R2V 226.02 9878.8079% 0QYR None None% 0QYP 412.97 -2.8306% 0RUK 2652.0 -9.2402% 0RYA 1554.0 -0.7029% 0RIH 174.55 -1.3563% 0RIH 165.15 -5.3853% 0R1O 198.5 9800.2494% 0R1O None None% 0QFP None None% 0M2Z 267.777 -0.1763% 0VSO 32.05 -9.9846% 0R1I None None% 0QZI 559.0 0.7207% 0QZ0 220.0 0.0% 0NZF None None% 0YXG 165.7358 2.7149%

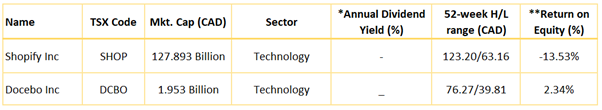

Shopify Inc

Section 1: Company Overview

Shopify Inc. (TSX: SHOP) offers an e-commerce platform primarily to small and midsize businesses. The firm has two segments: subscription solutions and merchant solutions. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores. This Report covers the Investment Highlights, Key Financial Metrics, Risks, Technical Analysis along with the Valuation, Target Price, and Recommendation on the stock.

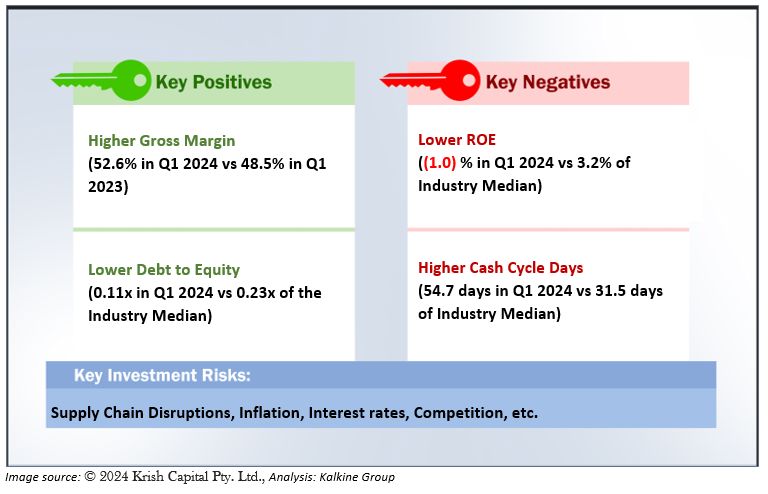

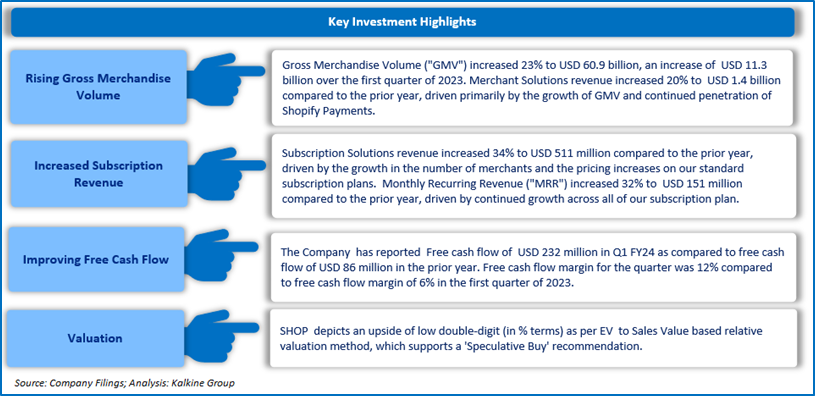

1.1 The Key Positives, Negatives, Investment Highlights, and Risks

Section2: Financial Highlights

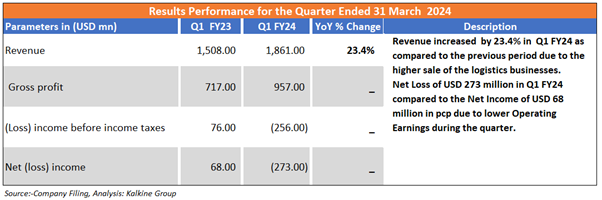

2.1 Key Financial Highlights

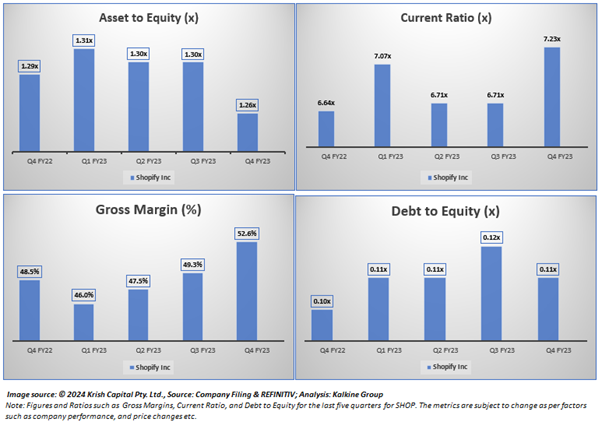

Section 3: Key Metrics

Below charts depict the change in Debt to Equity, Current Ratio and Gross margins ratios of the Company for the last one year.

Section 4: Stock Recommendation Summary

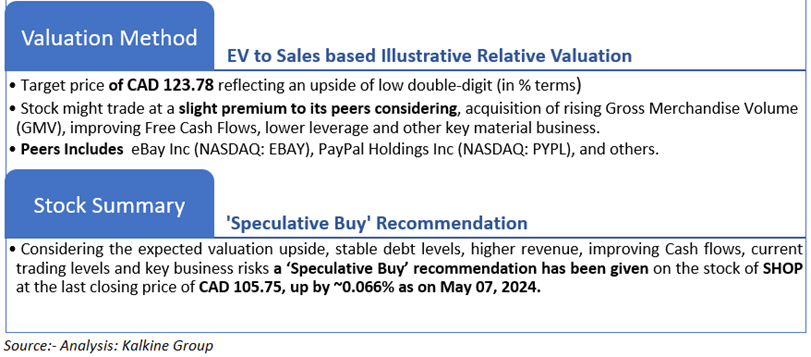

4.1 Valuation Methodology Illustrative EV to Sales Based

4.2 Price Performance and Stock Recommendation

The stock has witnessed an upside of ~16.81% in 1 month and of ~7.68% over the last 3 months. Moreover, the stock is trading above the average of 52-week high price of CAD 123.20 and 52-week low price of CAD 63.16 providing an opportunity to ride the trend.

4.3 One-Year Technical Price Chart

One-Year Technical Price Chart (as of May 07, 2024). Source: REFINITIV, Analysis: Kalkine Group

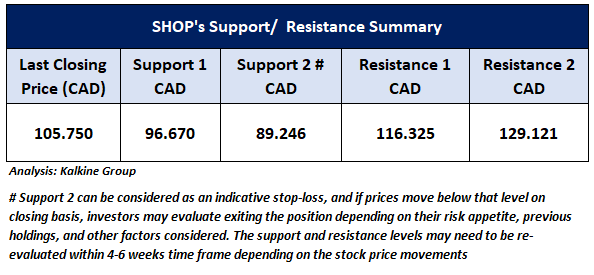

4.4 Technical Summary

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is May 07, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and the uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock prices.

Docebo Inc

Section 1: Company Overview

Docebo Inc (TSX: DCBO) offers cloud-based learning platform for both internal and external enterprise learning with real time tracking of training results, optimizing time, and reducing costs associated with traditional learning methods. Geographically, it holds presence in five offices around the world, including locations in Europe, Asia and North America. This Report covers the Investment Highlights, Key Financial Metrics, Risks, Technical Analysis along with the Valuation, Target Price, and Recommendation on the stock.

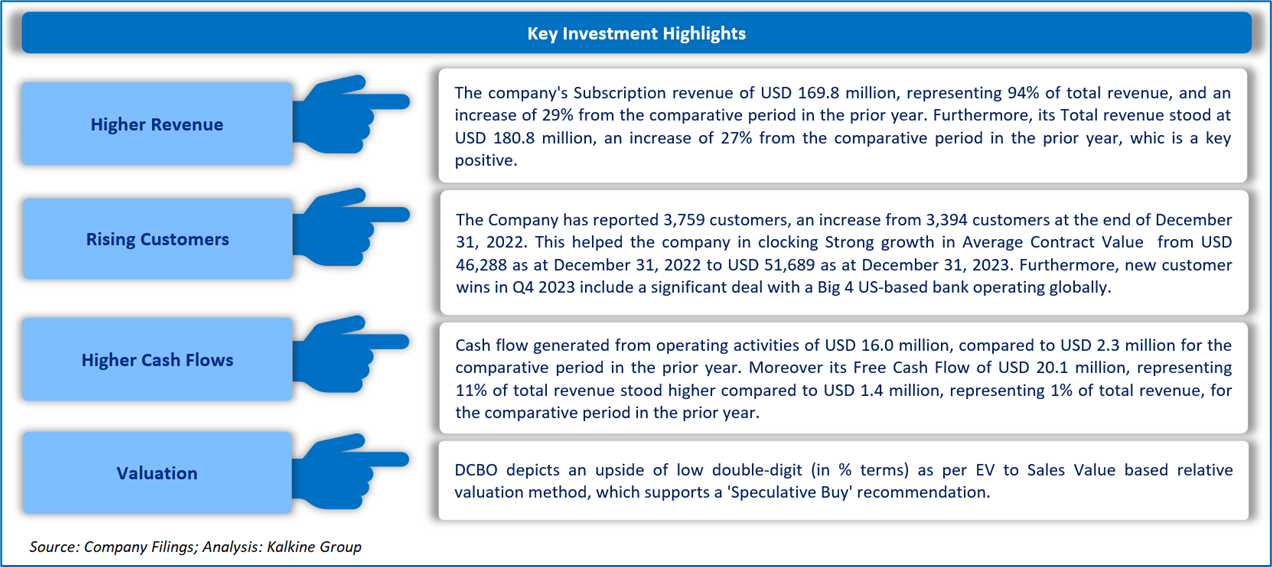

1.1 The Key Positives, Negatives, Investment Highlights, and Risks

Section2: Financial Highlights

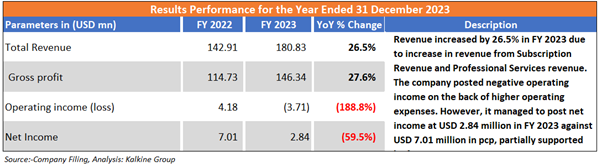

2.1 Key Financial Highlights

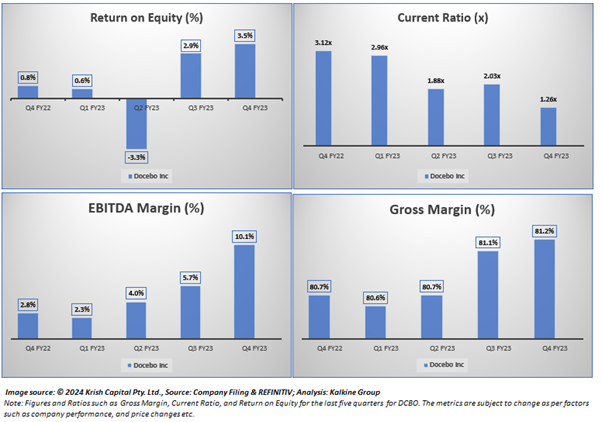

Section 3: Key Metrics

Below charts depict the change in Gross Margin, EBITDA Margin, Current Ratio and ROE ratios of the Company for the last one year.

Section 4: Stock Recommendation Summary

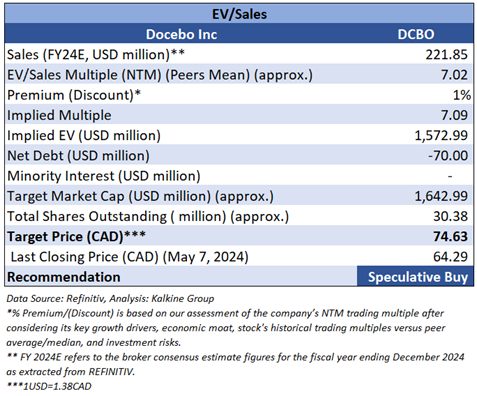

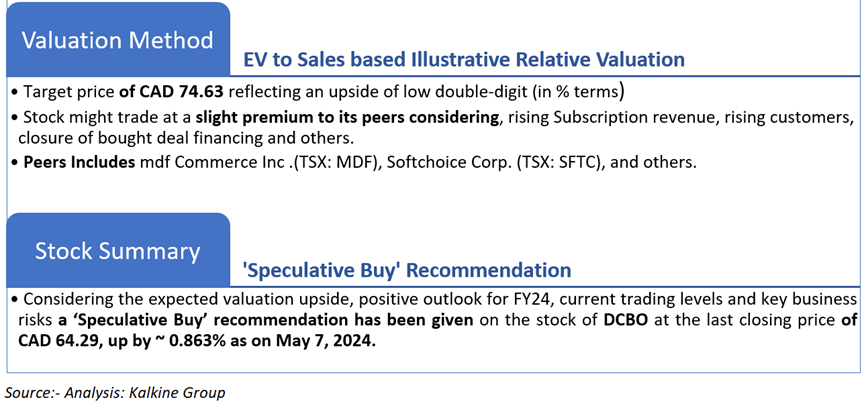

4.1 Valuation Methodology

Valuation Methodology (Illustrative): EV/ Sales based

4.2 Price Performance and Stock Recommendation

The stock has witnessed an upside of ~4.46% in 1 week and a downside of ~1.09% over the last 1 month. Moreover, the stock is trading above the average 52-week high price of CAD 76.27 and 52-week low price of CAD 39.81 providing an opportunity to ride the trend.

4.3 One-Year Technical Price Chart

One-Year Technical Price Chart (as of May 7, 2024). Source: REFINITIV, Analysis: Kalkine Group

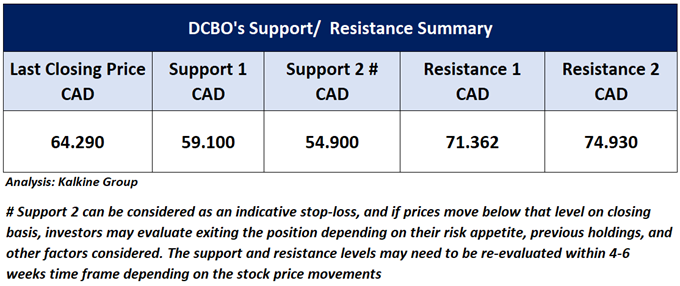

4.4 Technical Summary

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels as on May 7, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and the uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock prices.

This report has been issued by Kalkine Limited (Company number 07903332), a private limited company, incorporated in England and Wales ("Kalkine”). Kalkine.co.uk and associated pages are published by Kalkine. Kalkine is authorised and regulated by the Financial Conduct Authority under reference number 579414.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain non personalized recommendations to invest in securities and other financial products.

Kalkine does not offer financial advice based upon your personal financial situation or goals, and we shall not be held liable for any investment or trading losses you may incur by using the opinions expressed in our reports, publications, market updates, news alerts and corporate profiles. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation. Kalkine’s non-personalised advice does not in any way endorse or recommend individuals, investment products or services for your personal financial situation. You should discuss your portfolios and the risk tolerance level appropriate for your personal financial situation, with a professional authorised financial planner and adviser. You should be aware that the value of any investment and the income from it can go down as well as up and you may not get back the amount invested.

Please also read our Terms & Conditions for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Limited, an affiliate of Kalkine, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this report.