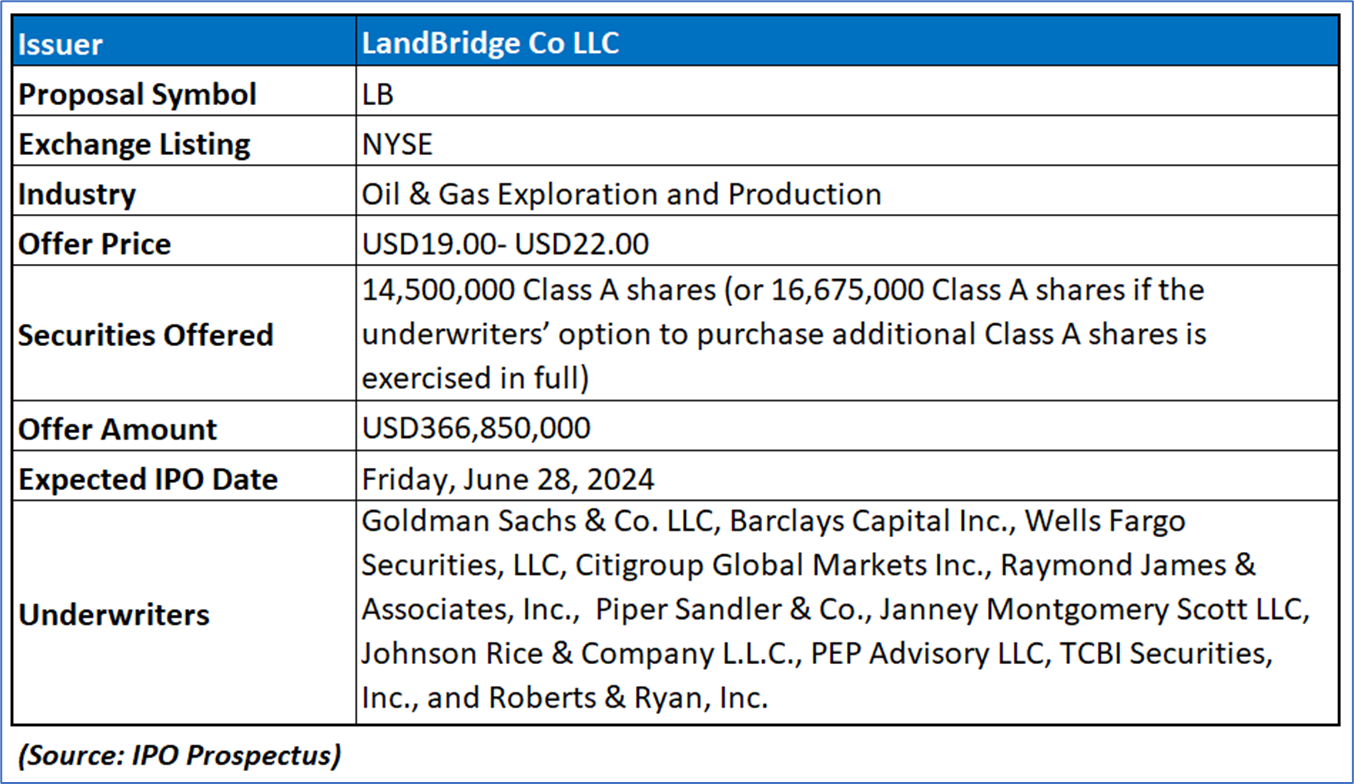

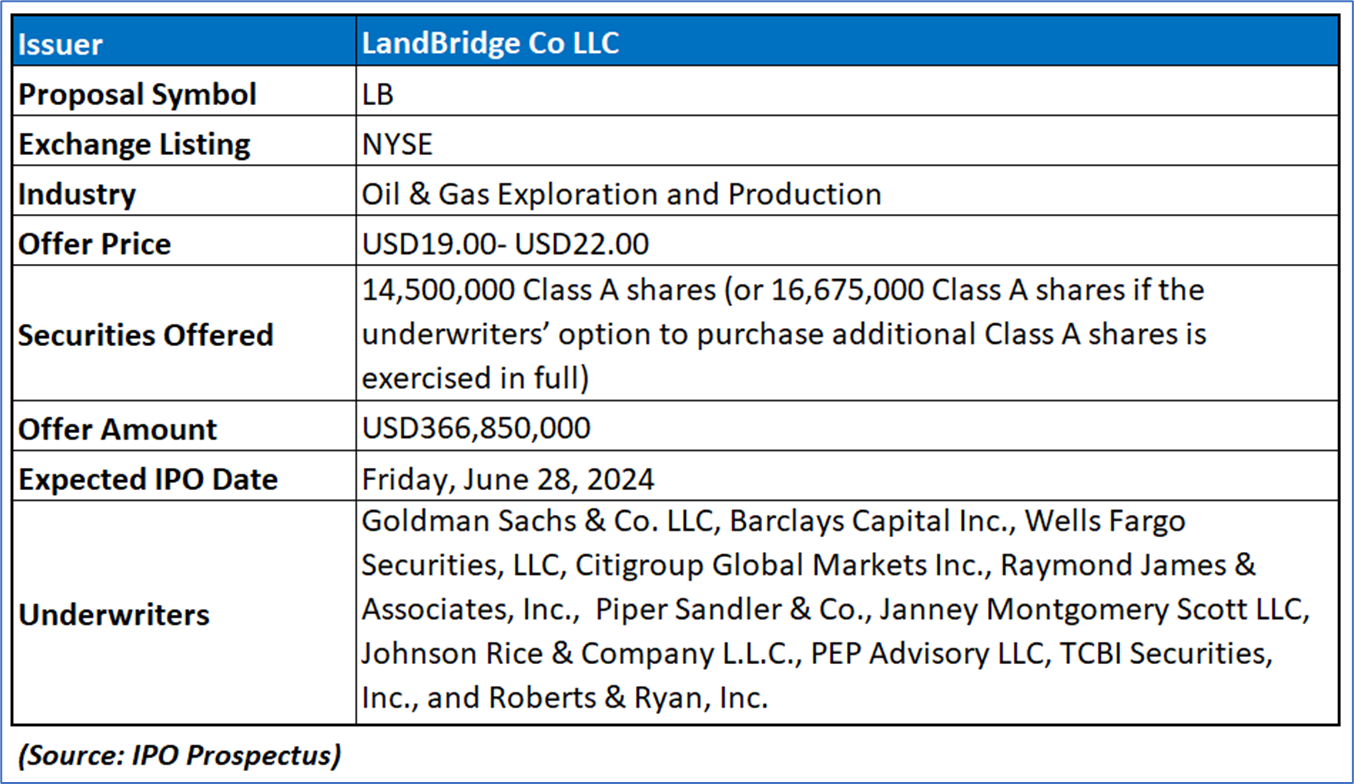

The Offer

Company Overview

Landbridge Co LLC owns approximately 220,000 surface acres in and around the Delaware sub-basin within the Permian Basin, the most active region for oil and natural gas exploration in the US. This extensive landholding supports various energy development activities including oil and gas production, solar power generation, storage facilities, data centers, and non-hazardous waste management. Located strategically along the Texas-New Mexico border, in the heart of the prolific Delaware Basin, the company aims to maximize revenue and Free Cash Flow by facilitating oil and gas development and other complementary land uses, benefiting shareholders amidst a robust industrial economy supporting energy infrastructure.

Key Highlights

Primary Offering:

LB’s anticipates issuing 14,500,000 Class A shares (or 16,675,000 Class A shares if the underwriters’ option to purchase additional Class A shares is exercised in full).

Use of proceeds:

LandBridge expects to receive proceeds totaling USD 271.2 million (USD 313.0 million if the underwriters fully exercise their option to purchase additional Class A shares) from this offering, calculated based on an assumed public offering price of USD 20.50 per Class A share, net of underwriting discounts and estimated offering expenses. The company plans to allocate all net proceeds to OpCo in exchange for newly issued OpCo Units at a corresponding per-unit price. OpCo intends to utilize these funds to repay approximately USD 100.0 million of outstanding borrowings under its credit facility and to distribute approximately USD 171.2 million to LandBridge Holdings. If the underwriters exercise their option in full, LandBridge anticipates an additional USD 41.8 million in net proceeds, to be similarly contributed to OpCo in exchange for additional OpCo Units, further augmenting distributions to LandBridge Holdings. Following these transactions, LandBridge will hold approximately 20.1% of outstanding OpCo Units (or approximately 23.2% if the underwriters fully exercise their option).

Dividend policy:

LandBridge intends to pay dividends on its Class A shares, with the specific amounts to be determined periodically by its board of directors. Despite this intention, the company has not established a formal written dividend policy tied to specific financial metrics and is not under any contractual obligation to pay dividends. Factors influencing dividend payments include general economic conditions, financial performance, cash flow from operations, capital requirements, legal and regulatory constraints, and potential acquisition opportunities. The discretion to declare and pay dividends rests solely with the board of directors, which may revise the dividend policy or suspend dividend payments at its discretion. As a holding company, LandBridge's ability to pay dividends depends on distributions from its subsidiaries, particularly OpCo, which in turn are subject to operational cash generation, financial needs, and regulatory restrictions. Dividends paid to Class A shareholders are expected to be impacted by taxes and other expenses, potentially resulting in lower per-share distributions compared to distributions received by OpCo Unitholders.

Industry Analysis:

- Strategic Location in the Delaware Basin: Located strategically in and around the Delaware Basin spanning Texas and New Mexico, which is recognized as the most active region for oil and natural gas production within the prolific Permian Basin, LandBridge's land holdings cover approximately 220,000 surface acres. This basin is renowned for its economic viability in extracting liquid-rich hydrocarbons, attracting large, publicly listed companies with substantial capital for drilling operations. As of April 30, 2024, there were 298 active rigs in the Permian Basin, representing 49% of total rigs in the United States, predominantly operated by well-capitalized and publicly listed firms.

- Impact of Sustained Drilling Activity: With sustained drilling activity in the region, oil production in the Permian Basin has grown at a compound annual growth rate (CAGR) of 16% from 2016 to 2023, accompanied by a 12% CAGR in water production over the same period, according to Enverus data. Specifically, within the Delaware Basin, oil production has surged at a CAGR of 24%, while water production has increased at a 22% CAGR during this timeframe. The Northern Delaware Basin is witnessing an increasing share of production activities, expected to reach approximately 12 million barrels per day in water production by 2025, necessitating significant infrastructure development and extensive surface acreage utilization.

- Critical Role of Surface Acreage in Energy Development: Access to expansive surface acreage is indispensable for various energy-related endeavors such as oil and natural gas development, solar power generation, power storage projects, and hydrogen development. Beyond facilitating energy asset installations, the availability of extensive land also supports a robust industrial ecosystem catering to energy development needs. The infrastructure established on LandBridge's acreage by customers further attracts ancillary developments, enhancing revenue generation through infrastructure use fees and facilitating diverse commercial opportunities.

- Hydrocarbon Value Chain and Resource Utilization: The predominant source of revenue for LandBridge derives from its hydrocarbon value chain activities on and around its land in the Delaware Basin. Customers leverage the infrastructure on LandBridge's acreage to support oil and gas development, utilizing critical resources such as brackish water, sand, and subsurface pore space for produced water injection. The identification of approximately 22,196 economically viable well locations within a 10-mile radius of LandBridge's surface acreage underscores its potential for sustained activity, with projections indicating decades of inventory life based on current economic conditions.

- Future Considerations and Produced Water Management: As hydrocarbon production continues to expand in the Delaware Basin, addressing the significant volumes of produced water remains crucial. From 2016 to 2023, produced water in the Delaware Basin escalated from approximately 2.6 million barrels per day to 10.7 million barrels per day, indicating a critical need for reliable separation, handling, recycling, or disposal solutions. This growing demand for water management services underscores the enduring requirement for customer access to and utilization of LandBridge's surface acreage throughout the energy development lifecycle.

Strategic Acquisitions: Expanding Land Holdings and Infrastructure

- On May 10, 2024, LB significantly expanded its land holdings with the acquisition of the East Stateline Ranch, encompassing approximately 103,000 surface acres, from a private third-party seller. This acquisition was complemented by WaterBridge's purchase of brackish and produced water handling infrastructure and related commercial contracts on the East Stateline Ranch Acreage. The purchase price for this acquisition was financed through a combination of equity contributions and borrowings under LB's credit facility. Both parties have no material post-closing obligations under the purchase agreement.

- Simultaneously, on May 10, 2024, LB acquired the Speed Ranch, consisting of approximately 34,000 surface acres, from the same private third-party seller. This acquisition was funded by cash on hand and borrowings under LB's credit facility.

- Earlier, on March 18, 2024, LB acquired the Lea County Ranches, which comprise approximately 11,000 surface acres, from another private third-party seller. The purchase price for this acquisition was similarly financed with cash on hand and borrowings under LB's credit facility.

- Through these strategic acquisitions, LB has secured approximately 150,000 surface acres along the Texas-New Mexico state border. These acquisitions enhance LB's exposure to operations conducted by large, well-capitalized producers and position LB to capitalize on expected growth in oil, natural gas, and other developments on and around its newly acquired lands.

Financial Highlights (Results of Operations) (Expressed in USD)

- Revenue Growth and Composition: In the first quarter of 2024, total revenues increased by USD 3.1 million, representing a 20% rise to reach USD 19.0 million compared to USD 15.9 million in the same period of 2023. This growth was driven by several factors: a USD 3.1 million increase from easements and other surface-related activities, USD 1.9 million from surface use royalties, USD 0.6 million from oil and gas royalties, and USD 0.4 million from resource royalties. However, these gains were offset by a USD 2.9 million decrease in revenues from resource sales. The increase in revenues underscores diversified income streams, with significant contributions from surface-related activities and royalties.

- Oil and Gas Royalties Performance: Oil and gas royalties increased by USD 0.6 million, marking a 17% rise to USD 4.2 million for Q1 2024 compared to USD 3.6 million in Q1 2023. This growth primarily stemmed from higher royalty income, partially offset by reduced mineral lease income due to decreased leasing activities during the current period. The increase in oil and gas royalties reflects ongoing profitability from existing production activities despite reduced leasing activity impacting mineral lease income.

- Decline in Resource Sales: Resource sales declined by USD 2.9 million, a significant 45% decrease to USD 3.5 million for Q1 2024 from USD 6.4 million in Q1 2023. This decline was driven by a 25% reduction in brackish water sales volume and lower unit prices per barrel sold, influenced by contract terms favoring lower rates during the reporting period. The decline in resource sales highlights volatility in sales volume and pricing dynamics affecting revenue performance.

- Financing and Cash Flow Activities: Net cash provided by operating activities increased by USD 5.3 million to USD 17.2 million for Q1 2024 from USD 11.9 million in Q1 2023, driven by higher net income adjusted for non-cash items and increased working capital. Meanwhile, net cash used in investing activities expanded significantly to USD 55.2 million, mainly due to acquisition-related expenditures. Net cash provided by financing activities rose to USD 9.0 million, primarily from debt borrowings related to acquisitions, indicating strategic financial maneuvers to support growth initiatives.

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “LB” is exposed to a variety of risks such as:

- Commodity Price Risks: LB's major market risk exposure is tied to the fluctuating prices of oil and natural gas, which directly impact the revenues from their land and its resources. The volatility in oil and gas prices influences drilling, completion, and production activities, affecting LB's customers in the exploration and production and oilfield services sectors. Over the past five years, prices have shown significant fluctuations, with natural gas ranging from USD 1.25 to USD 23.86 per MMBtu, and WTI crude oil prices swinging from negative USD 36.98 to USD 123.64 per barrel. As of December 31, 2023, natural gas was priced at USD 2.58 per MMBtu and oil at USD 71.89 per barrel. Such volatility can reduce LB's revenues and the economic viability of their customers' production. Despite recognizing these risks, LB currently does not hedge against them but may consider derivative instruments in the future to partially mitigate their impact.

- Market Risks: The demand for LB's land and resources is heavily influenced by the activity levels in the energy industry, particularly in the Permian Basin. These levels are affected by numerous uncontrollable factors including oil and gas supply and demand, price expectations, production and delivery costs, weather conditions, economic conditions, political stability, environmental regulations, and technological advancements. The volatility in U.S. energy production and a decline in oil and natural gas prices or Permian Basin activity levels could significantly impact LB's operations, cash flows, and financial position. Factors such as the transition to a low-carbon economy and advancements in alternative energy also play a role in determining the demand for LB's resources.

- Interest Rate Risks: LB's borrowing capacity and the interest rates they receive are influenced by the credit markets and their credit profile. LB has substantial outstanding borrowings, which accrue interest based on either the Term SOFR or the base rate, plus an applicable margin, exposing them to interest rate risk. As of March 31, 2024, LB had USD 140.0 million in outstanding borrowings, with weighted average interest rates of 8.59% for revolving credit and 8.45% for term loans. A 1.0% fluctuation in the interest rate could impact LB's interest expense by USD 1.4 million annually. Currently, LB does not employ any derivative hedge contracts to guard against interest rate changes, leaving them exposed to potential fluctuations.

Conclusion

LB has its strategic landholdings of approximately 220,000 surface acres in the Delaware sub-basin of the Permian Basin, a prime region for oil and natural gas production in the US. The company benefits from diversified revenue streams, including oil and gas production, solar power generation, and various energy infrastructure activities, ensuring a robust financial performance with a notable 20% revenue increase in the first quarter of 2024. LB's recent strategic acquisitions of 150,000 additional surface acres further strengthen its position, enabling significant growth potential and enhancing its exposure to well-capitalized producers. The proceeds from the IPO will be used to reduce debt and support further expansion, promising financial stability and growth. Despite market volatility and interest rate risks, LB's extensive land assets, strategic location, and diversified operations underscore its fundamental strength, positioning it for long-term success.

Hence, given the financial performance of the company, use of proceeds, and associated risks “LandBridge Co LLC (LB)” IPO seems “Attractive" at the IPO price.

Disclaimer-

This report has been issued by Kalkine Limited (Company number 07903332), a private limited company, incorporated in England and Wales ("Kalkine”). Kalkine.co.uk and associated pages are published by Kalkine. Kalkine is authorised and regulated by the Financial Conduct Authority under reference number 579414.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain non personalized recommendations to invest in securities and other financial products.

Kalkine does not offer financial advice based upon your personal financial situation or goals, and we shall not be held liable for any investment or trading losses you may incur by using the opinions expressed in our reports, publications, market updates, news alerts and corporate profiles. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation. Kalkine’s non-personalised advice does not in any way endorse or recommend individuals, investment products or services for your personal financial situation. You should discuss your portfolios and the risk tolerance level appropriate for your personal financial situation, with a professional authorised financial planner and adviser. You should be aware that the value of any investment and the income from it can go down as well as up and you may not get back the amount invested.

Please also read our Terms & Conditions for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Limited, an affiliate of Kalkine, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this report.