0R15 8520.0 0.0% 0R1E 8203.0 0.0% 0M69 21090.0 67.5139% 0R2V 226.02 9878.8079% 0QYR None None% 0QYP 412.97 -2.8306% 0RUK 2652.0 -9.2402% 0RYA 1554.0 -0.7029% 0RIH 174.55 -1.3563% 0RIH 165.15 -5.3853% 0R1O 198.5 9800.2494% 0R1O None None% 0QFP None None% 0M2Z 267.777 -0.1763% 0VSO 32.05 -9.9846% 0R1I None None% 0QZI 559.0 0.7207% 0QZ0 220.0 0.0% 0NZF None None% 0YXG 165.7358 2.7149%

Cheetah Net Supply Chain Service Inc

Cheetah Net Supply Chain Service Inc. (NASDAQ: CTNT) is a supplier of parallel-import vehicles sourced in the United States to be sold in the People’s Republic of China (PRC) market. The Company and its subsidiaries are primarily engaged in the parallel-import vehicle dealership business. In the PRC, parallel-import vehicles refer to those purchased by dealers directly from overseas markets and imported for sale through channels other than brand manufacturer’s official distribution systems.

Recent Business and Financial Updates

Technical Observation (on the daily chart):

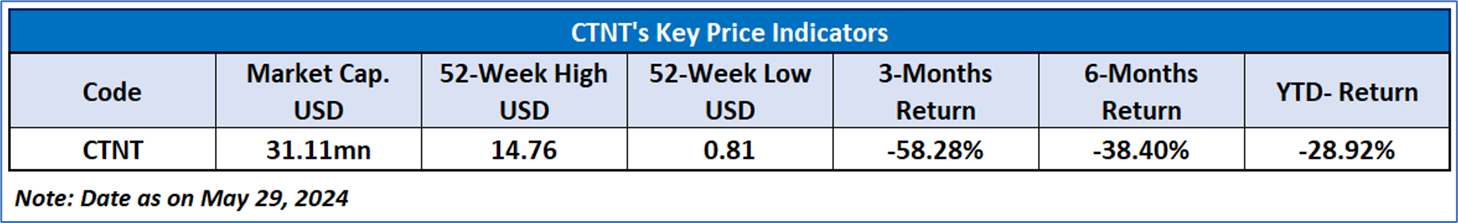

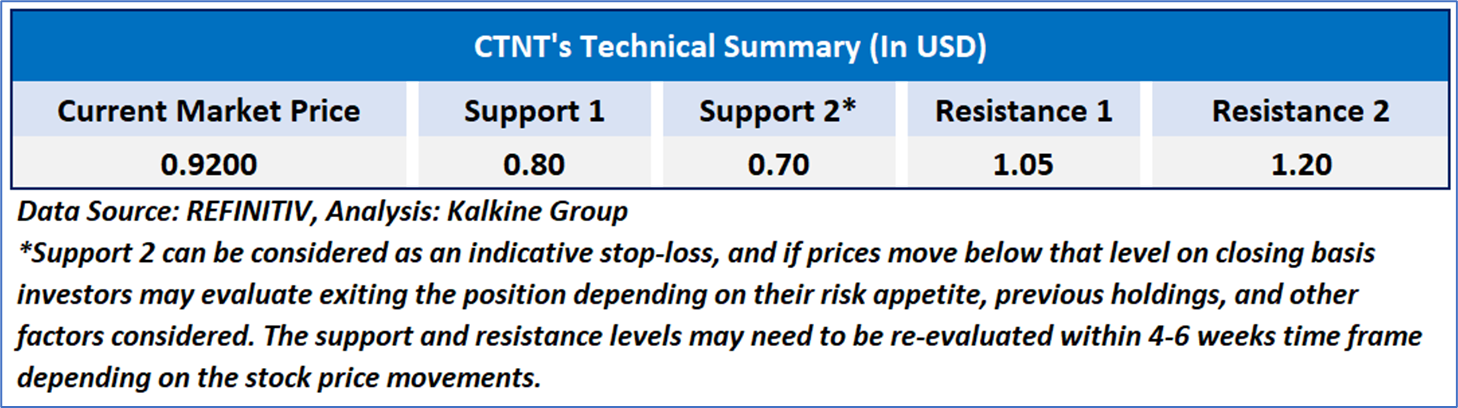

The Relative Strength Index (RSI) over a 14-day period stands upward trending with value of 44.05, with expectations of a consolidation. Additionally, the stock's current positioning is below both the 21-period SMA and 50-period SMA, which may serve as dynamic short to medium-term resistance levels.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is May 29, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

This report has been issued by Kalkine Limited (Company number 07903332), a private limited company, incorporated in England and Wales ("Kalkine”). Kalkine.co.uk and associated pages are published by Kalkine. Kalkine is authorised and regulated by the Financial Conduct Authority under reference number 579414.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain non personalized recommendations to invest in securities and other financial products.

Kalkine does not offer financial advice based upon your personal financial situation or goals, and we shall not be held liable for any investment or trading losses you may incur by using the opinions expressed in our reports, publications, market updates, news alerts and corporate profiles. Kalkine does not intend to exclude any liability which it is not permitted to exclude under applicable law or regulation. Kalkine’s non-personalised advice does not in any way endorse or recommend individuals, investment products or services for your personal financial situation. You should discuss your portfolios and the risk tolerance level appropriate for your personal financial situation, with a professional authorised financial planner and adviser. You should be aware that the value of any investment and the income from it can go down as well as up and you may not get back the amount invested.

Please also read our Terms & Conditions for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Limited, an affiliate of Kalkine, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this report.